Semler Scientific’s Bitcoin Bet: A Bold Move or a Risky Gamble?

As the world of cryptocurrency continues to evolve, one company is making headlines with its bold move into the world of bitcoin. Semler Scientific, a healthcare business, has announced that it is buying $17 million more of the digital currency and is preparing to raise $150 million to purchase even more. But is this a savvy investment or a risky gamble?

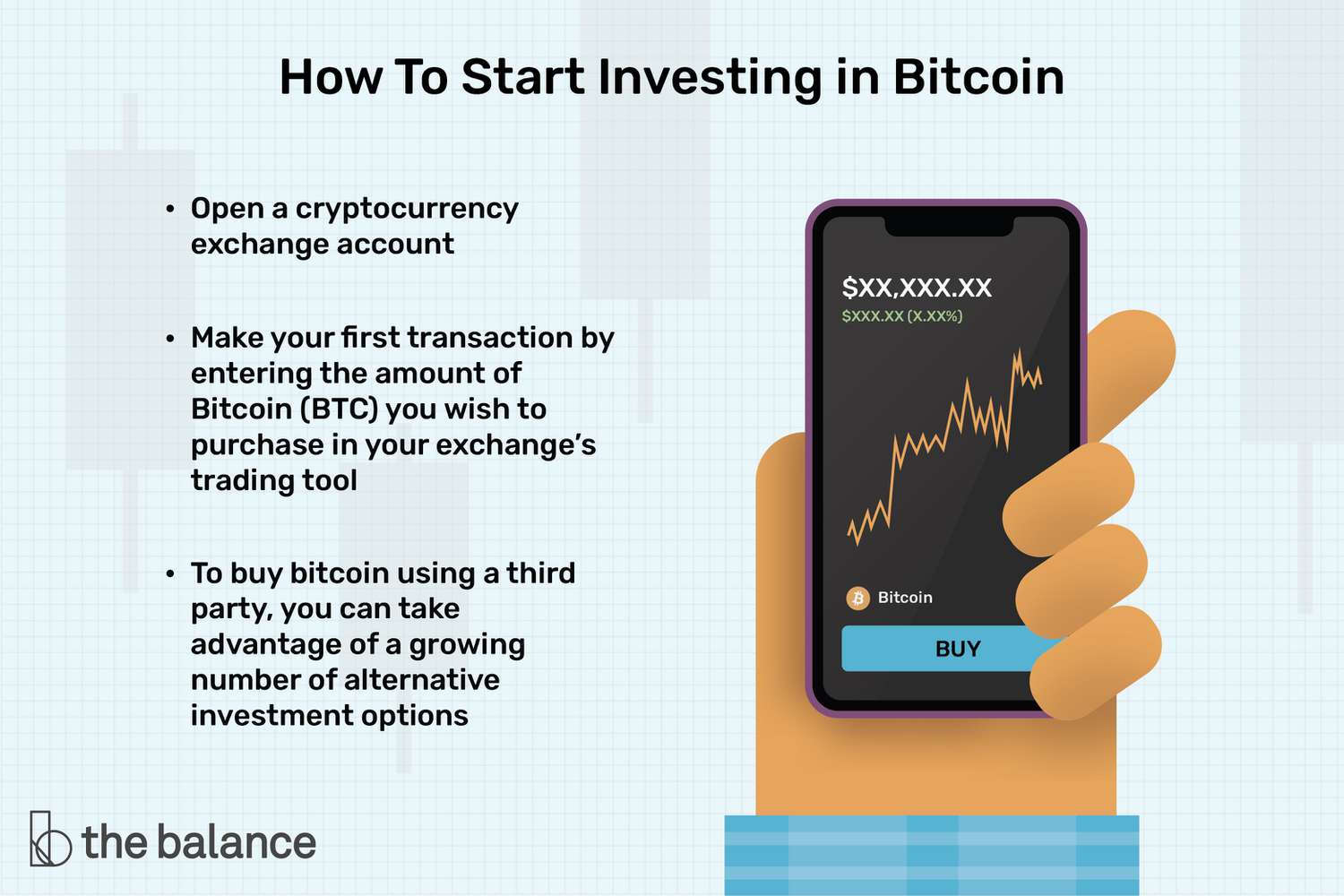

A visual representation of the rise of bitcoin

A visual representation of the rise of bitcoin

The company’s decision to invest in bitcoin is not new. In May, Semler Scientific announced that it was purchasing $40 million in bitcoin, which drove its stock up 25%. This latest move is a clear indication that the company is committed to its strategy of acquiring and holding bitcoin.

“Semler remains focused on our two strategies of expanding our healthcare business and acquiring and holding bitcoin,” said Doug Murphy-Chutorian, MD, Semler Scientific’s chief executive officer. “The company now holds 828 bitcoins, underscoring our view that bitcoin is a compelling investment and can serve as a reliable store of value. We will continue to pursue our strategy of purchasing bitcoins with cash.”

Semler Scientific’s bitcoin holdings

Semler Scientific’s 828 bitcoin were acquired for $57 million and are now worth $59 million, according to current market data from CoinDesk Indices. This is a significant investment, and one that has sparked interest in the cryptocurrency community.

Collectively, publicly listed companies hold 308,442 BTC worth approximately $21.8 billion on their balance sheets, according to bitcointreasuries.net. This trend is likely to continue as more companies explore the potential of bitcoin as a store of value.

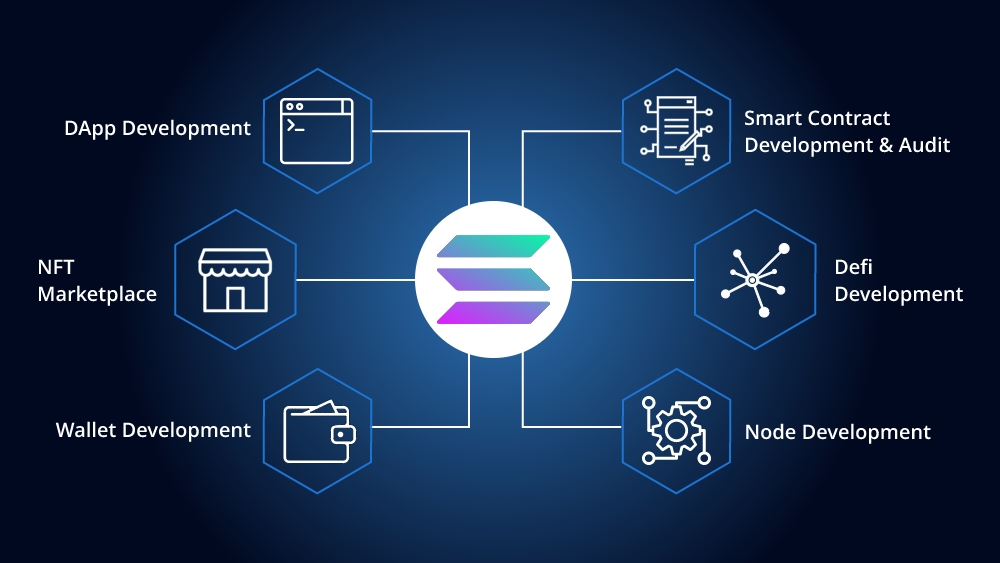

The growing trend of bitcoin adoption

The growing trend of bitcoin adoption

As I reflect on Semler Scientific’s bold move, I am reminded of the importance of diversification in any investment portfolio. While some may view this investment as risky, others see it as a shrewd move to hedge against inflation and market volatility. As the world of cryptocurrency continues to evolve, one thing is certain - the future of money is changing, and companies like Semler Scientific are at the forefront of this revolution.

The future of money is changing

The future of money is changing

In conclusion, Semler Scientific’s decision to invest in bitcoin is a bold move that is likely to spark debate in the investment community. While some may view this as a risky gamble, others see it as a savvy investment in the future of money. As the world of cryptocurrency continues to evolve, one thing is certain - the future of money is changing, and companies like Semler Scientific are leading the way.