Semler Scientific Expands Its Bitcoin Holdings with $17 Million Purchase

In a bold move reflecting its confidence in cryptocurrency, Semler Scientific has announced a new purchase of $17 million in Bitcoin, significantly boosting its digital assets portfolio. This latest acquisition comes as part of the company’s ongoing strategy to solidify its position in both the healthcare and cryptocurrency sectors.

A Commitment to Cryptocurrency

Semler Scientific, a publicly traded company under the ticker SMLR, aims to raise an additional $150 million to further invest in Bitcoin. The CEO, Doug Murphy-Chutorian, stated, “Semler remains focused on our two strategies of expanding our healthcare business and acquiring and holding Bitcoin,” emphasizing the firm’s belief in Bitcoin as a valuable investment and a secure store of wealth.

Semler’s strategic approach towards Bitcoin acquisition

Semler’s strategic approach towards Bitcoin acquisition

With this latest purchase, Semler’s total Bitcoin stash rises to 828 BTC, acquired at an estimated cost of $57 million. According to current market data from CoinDesk Indices, this holding is now valued at approximately $59 million, demonstrating the dynamic nature of the cryptocurrency market and the asset’s potential growth.

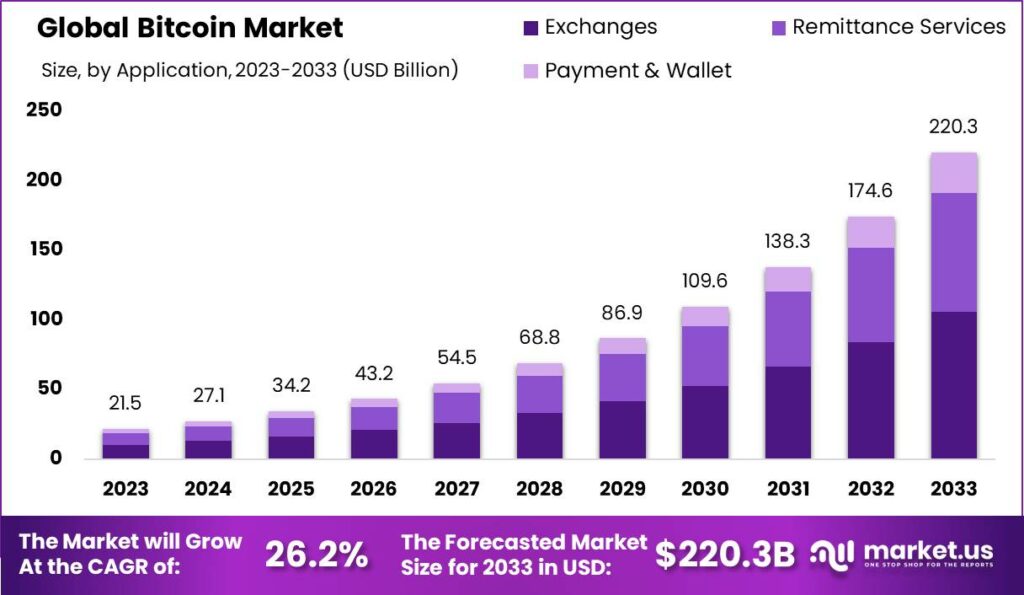

The Broader Bitcoin Landscape

Semler is not the only company diving deeper into Bitcoin holdings. Across the corporate landscape, publicly listed companies collectively hold a staggering 308,442 BTC, amounting to around $21.8 billion on their balance sheets, as reported by bitcointreasuries.net. This trend signals a growing institutional investment in Bitcoin, positioning it as more than just a speculative asset.

In May, Semler made headlines with a $40 million Bitcoin purchase, which propelled its stock up by an impressive 25%, reflecting the market’s positive reception of its cryptocurrency endeavors. However, after the announcement of the latest purchase, the stock’s performance saw a slight dip, closing down by 2.5% in U.S. trading.

Future Outlook: A Dual Strategy

Semler’s dual strategy merges healthcare and cryptocurrency investment, a combination that is becoming increasingly attractive in today’s market. The announcement to raise $150 million indicates a proactive approach to capitalize on Bitcoin’s potential while enhancing corporate growth.

As Doug Murphy-Chutorian reinforced, the company is committed to purchasing Bitcoins with cash, underpinning its transparent investment model. This strategic alignment of healthcare and crypto not only diversifies its investment portfolio but also showcases confidence in the long-term viability of Bitcoin as a financial asset within corporate finance.

Trends in Bitcoin Market—A Corporate Perspective

Trends in Bitcoin Market—A Corporate Perspective

Conclusion: The Growing Trust in Bitcoin

As Semler Scientific continues to integrate Bitcoin into its operations, it reflects a broader trend of increasing acceptance and trust in cryptocurrencies among corporations. The company’s investment strategy demonstrates the potential for Bitcoin to serve as a reliable store of value, particularly as economic uncertainties loom. This signals to investors and the market that Bitcoin is emerging not just as a speculative asset, but as a fundamental part of financial strategies for the future.

With Semler’s continued pursuits, it’s clear that the intersection of technology, healthcare, and cryptocurrency offers exciting possibilities for innovation and investment—a trend that is likely to expand as more companies recognize the value of digital assets.

Stay tuned for more updates on Semler Scientific and its ventures into the cryptocurrency realm as the story continues to unfold.

Photo by

Photo by