The Bitcoin Rollercoaster: Why I’m Bullish When Others Panic

As the world grapples with the recent Bitcoin price drop, panic seems to be the prevailing sentiment among investors. However, I take a contrarian view on this matter. While many are selling off their holdings, I see this as a golden opportunity to buy the dip and capitalize on the market’s volatility.

My Personal Experience

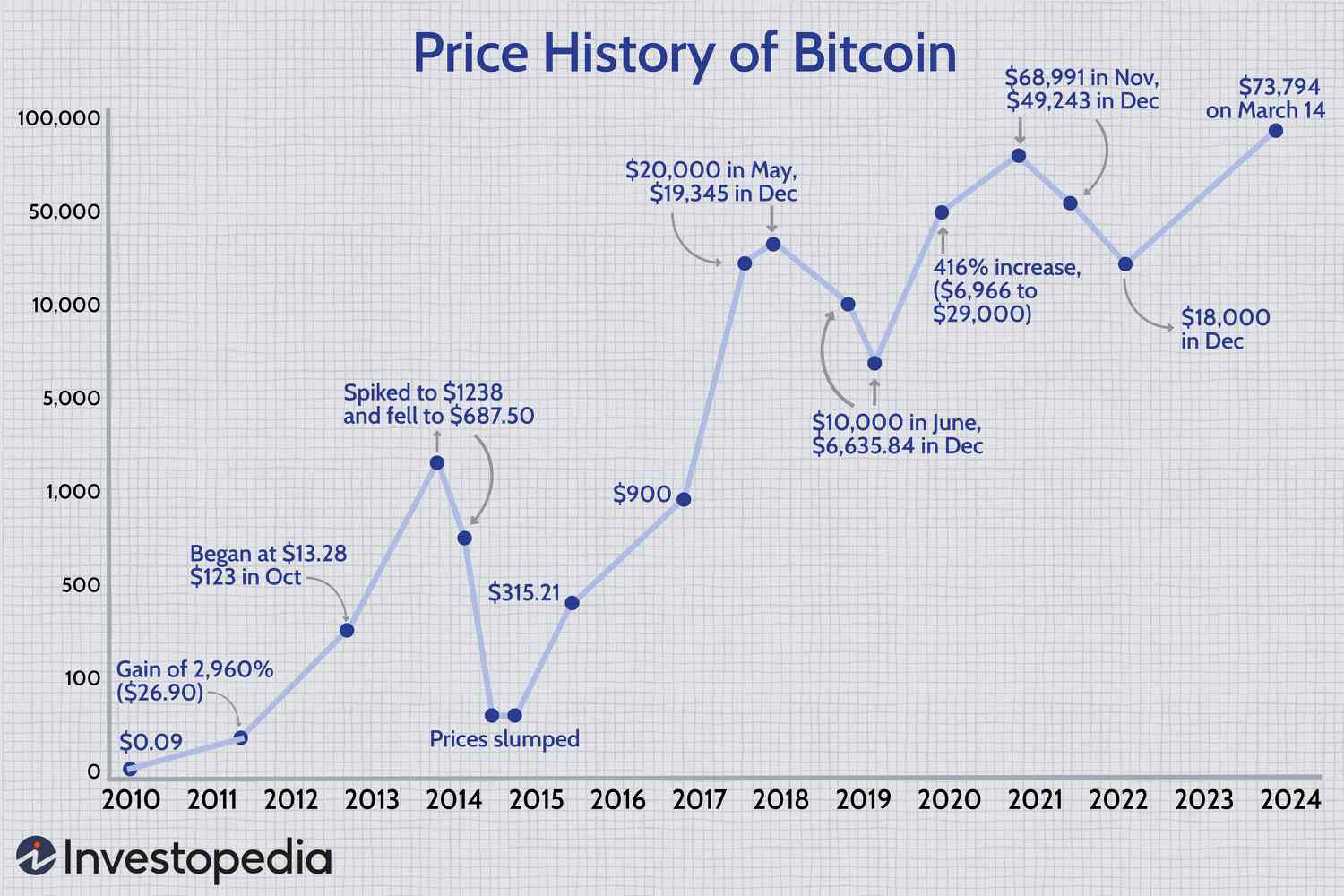

I vividly remember a similar situation back in 2017 when Bitcoin experienced a massive crash. At that time, I decided to hold onto my investments despite the prevailing fear in the market. To my surprise, Bitcoin not only recovered but also reached new heights. This experience taught me the value of patience and long-term vision in the crypto space.

Alternative Facts and Anecdotes

Contrary to popular belief, the recent price drop is not a sign of Bitcoin’s demise. In fact, it presents a chance for new investors to enter the market at a discounted price. I recently spoke to a group of young investors who see this downturn as an opportunity to build their crypto portfolios.

Embracing the Volatility

While mainstream media focuses on the negative aspects of Bitcoin’s price decline, I choose to embrace the volatility. The crypto market has always been known for its ups and downs, and these fluctuations are part of what makes it so exciting. Instead of fearing the uncertainty, I see it as a chance to ride the waves and potentially profit from the market’s movements.

Conclusion

In conclusion, my bullish stance on Bitcoin remains unwavering despite the recent price drop. I believe that this setback is temporary and that Bitcoin will continue its upward trajectory in the long run. As I prepare to increase my holdings, I encourage fellow investors to consider the bigger picture and not be swayed by short-term market fluctuations.