The Bitcoin Halving: A Closer Look

As the crypto world buzzes with excitement over the upcoming Bitcoin halving event, I can’t help but take a step back and question the prevailing narrative. While many see the halving as a surefire catalyst for bullish price action, I believe there’s more to this story than meets the eye.

The Halving Timeline

The anticipated halving date has been a moving target, initially set for April 28 but now looming closer on April 15. This shift has been attributed to the surge in Bitcoin’s price, drawing in more mining power and accelerating network processes. But what if this acceleration isn’t all it’s cracked up to be?

The Mining Dilemma

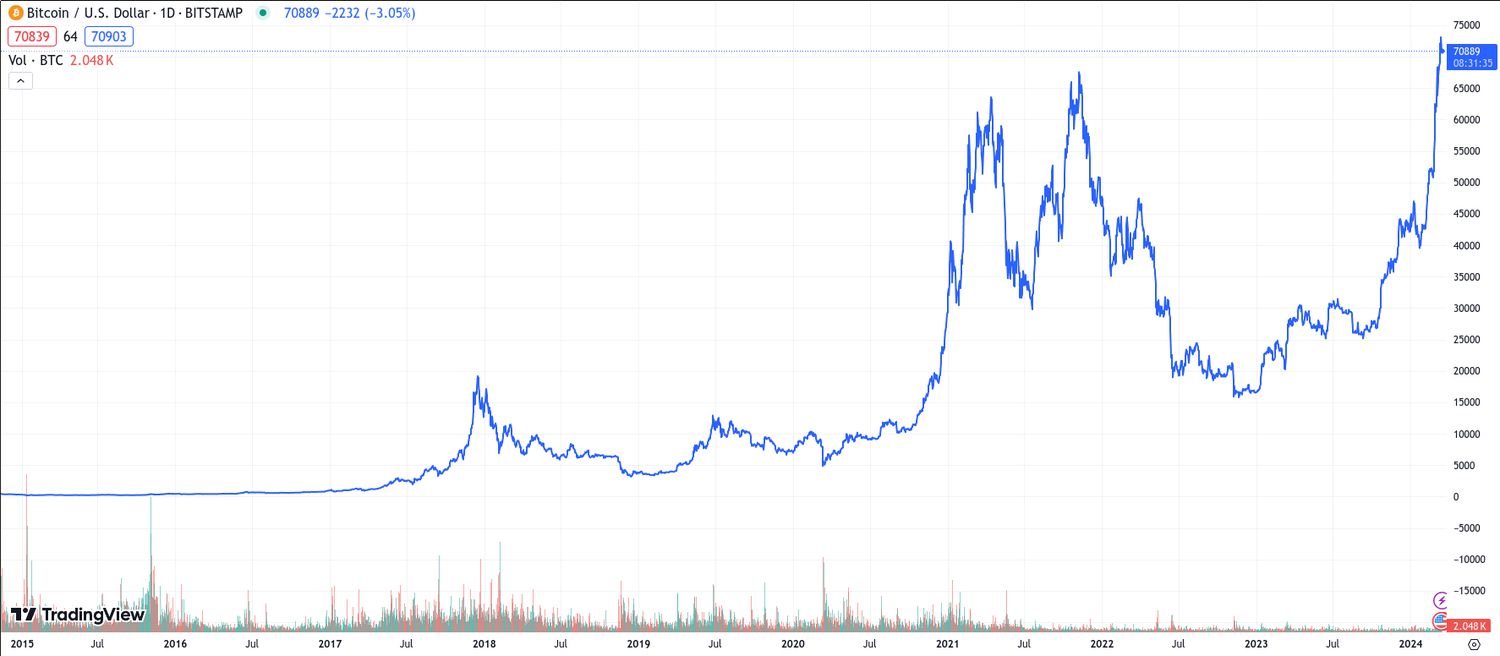

Traditionally, the halving is viewed as a scarcity event, where the reduced block rewards lead to a supply squeeze and subsequent price surge. However, with the recent surge in hashrate, mining rewards have become more lucrative, incentivizing miners to ramp up operations. This influx of computational power could potentially dilute the scarcity narrative, leading to unforeseen consequences.

A Different Perspective

While history may suggest a bullish outcome post-halving, I argue that the market dynamics have evolved since the last event. The influx of institutional players, the rise of DeFi, and the increasing regulatory scrutiny paint a different landscape for Bitcoin’s future.

Conclusion

In conclusion, while the Bitcoin halving remains a pivotal event in the crypto calendar, I urge caution against blindly following the bullish herd. The market is ever-evolving, and what worked in the past may not necessarily hold true in the present. It’s time to rethink our assumptions and approach the halving with a critical eye.

Disclaimer: The views expressed in this article are solely those of the author and do not constitute financial advice.