Navigating the Waves of Market Volatility: The Fed’s Role and Investor Strategies

By Riley Emerson

In the ever-turbulent sea of financial markets, the Federal Reserve’s interest rate decisions serve as both beacon and storm, guiding and challenging investors navigating through stocks, cryptocurrency, and commodities. As we delve into the impacts of these decisions, it’s crucial to understand the broader implications for your investment portfolio.

The Fed’s Influence on Market Dynamics

The Federal Reserve’s recent move to hike interest rates for the eleventh time since November 2021 marked a significant pivot point. Cryptocurrencies and high-risk stocks, which had been soaring, faced a reality check around this period. Steve Azoury, a financial expert, encapsulates the sentiment, stating, “The stock market will never not worry about future interest rates.” The anticipation alone can trigger market reactions, underscoring the profound effect of borrowing costs across investing and savings landscapes.

However, the fear surrounding rate hikes seems to be diminishing. Investors are now less spooked by the prospect of increasing rates, with many anticipating a downward adjustment in the near future.

Analyzing Market Performance

Despite some resilience in the market, the shadow of potential downturns looms large. High-growth stocks, particularly in the tech sector, have not fully recovered from their 2022 slump. Names like Cloudflare and Zoom Video Communications linger far below their zeniths, suggesting a cautious approach for investors.

The Federal Reserve’s decisions impact global markets

The Federal Reserve’s decisions impact global markets

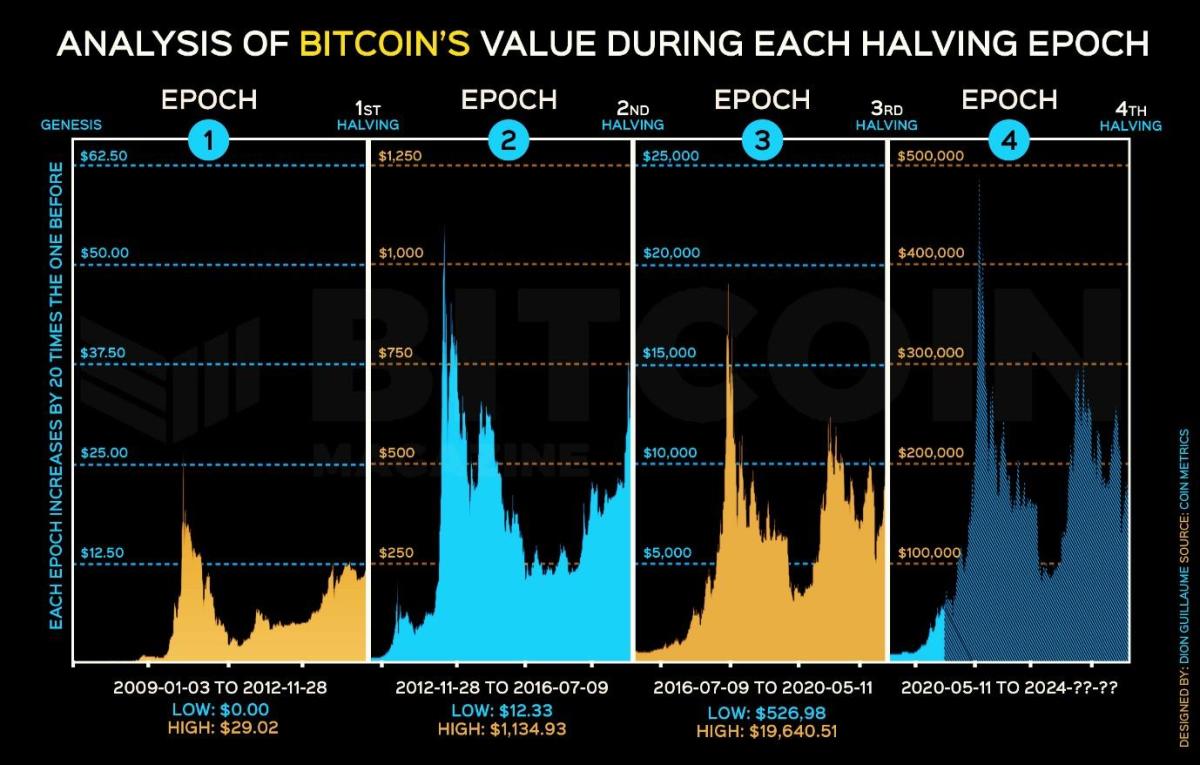

Cryptocurrency markets, too, have felt the ripples of the Fed’s policies. With interest rates poised to decrease, we’ve seen a notable uptick in crypto valuations. The introduction of Bitcoin ETFs has further energized Bitcoin’s market presence, pushing it to unprecedented heights.

Commodities and Investment Strategies

The commodities sector experienced a surge in early 2022, with oil prices leading the charge. Yet, this trend was short-lived, illustrating the volatile nature of these markets in response to Federal Reserve policies.

Investment strategies have evolved in 2023, with a discernible shift towards big tech stocks and a cautious stance on regional and small bank stocks. This reflects a broader trend of investors looking beyond immediate news, focusing instead on long-term growth and stability.

Conclusion

In the complex dance of interest rates, inflation, and market volatility, investors are best served by adhering to a long-term strategy. Diversification and regular investment in a mix of stocks and bonds can shield against the market’s unpredictability. As we navigate these uncertain waters, remember, the key to successful investing is not to let emotions steer the ship.

Adopting a long-term investment strategy is crucial in volatile markets

Adopting a long-term investment strategy is crucial in volatile markets