The Evolving Landscape of Cryptocurrency: Insights and Trends

In recent years, the popularity of cryptocurrencies has surged globally, and Switzerland and Liechtenstein have emerged as significant players in this dynamic landscape. Driven by a blend of regulatory clarity and innovation, these regions are home to a growing number of companies providing a wide array of crypto-related services and products. The latest findings from the Crypto Assets Study by Hochschule Luzern reveal that between July 2023 and June 2024, both the price and market capitalization of Bitcoin and alternative crypto assets saw notable increases, underscoring the rising interest in cryptocurrency investment.

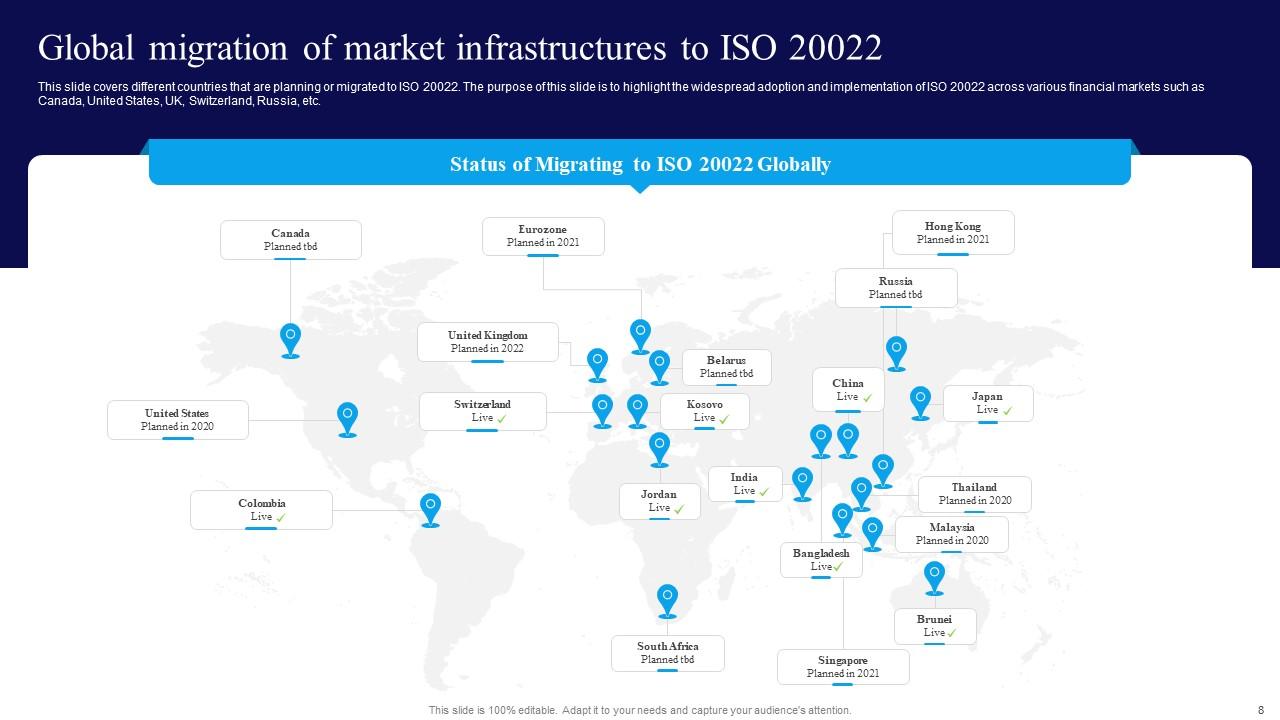

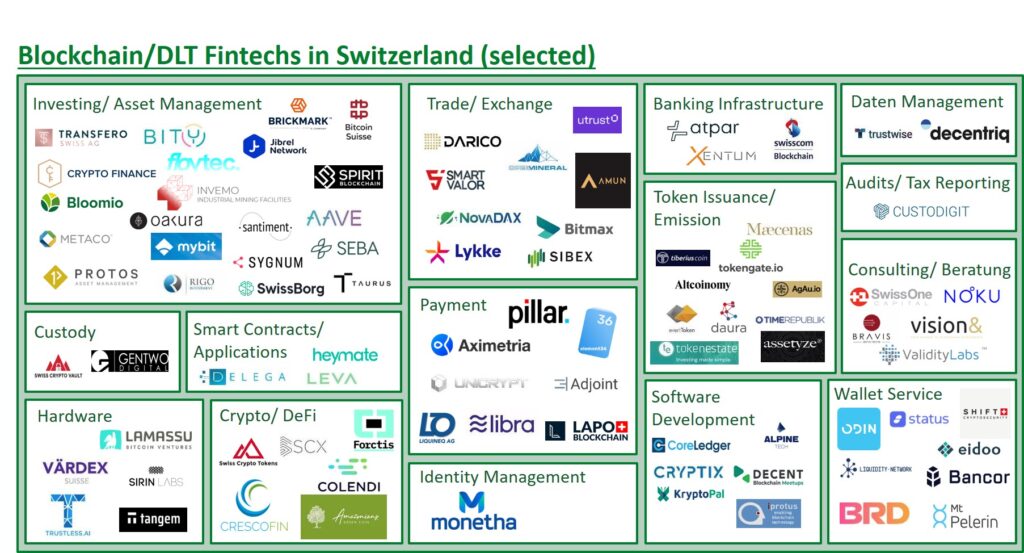

An overview of the Swiss cryptocurrency ecosystem.

An overview of the Swiss cryptocurrency ecosystem.

The Expanding Ecosystem

According to recent data, the number of companies operating in the crypto space across Switzerland and Liechtenstein reached a remarkable total of 359 by the end of June 2024. Most of these firms are concentrated in Zug and Zurich, areas that are quickly becoming synonymous with crypto innovation, often referred to as the region’s “Crypto Valley.” While many companies focus on institutional clients, a surprising trend has emerged: individual investors are showing greater enthusiasm for crypto assets, challenging traditional norms where institutional investors typically take the lead.

Crypto Assets: A Closer Look

The multifaceted crypto ecosystem includes a variety of business models catering to both private and institutional investors. Many companies are prioritizing centralized investment services, providing direct access to cryptocurrency markets. Notably, self-custody solutions, often referred to as Crypto Wallets, are also gaining traction, with around 90% of the enterprises surveyed operating on an international scale rather than being confined to national markets.

Recent developments indicate a revival in trading volumes for indirect crypto products on traditional Swiss exchanges, marking the first significant increase in two years. This reflects the growing acceptance of crypto assets among mainstream investors. Additionally, direct investment volumes through crypto exchanges continue to rise, solidifying the position of Switzerland as a central hub for cryptocurrency trading in Europe.

The Political Scene and Cryptocurrency

Historically, cryptocurrencies have experienced a tug-of-war in the political arena. Prominent politicians, including former President Donald Trump, have shifted their stances on digital assets, highlighting the increasing prominence of cryptocurrencies in political fundraising and advocacy. Trump has recently announced that his campaign will accept donations in various cryptocurrencies, signaling a strategic pivot aimed at engaging younger, tech-savvy voters who may gravitate towards libertarian principles embraced by many in the crypto community.

Trump’s acceptance of cryptocurrencies is not merely a political maneuver; there are financial incentives at play. With personal investments in Ethereum and profitable ventures such as NFT sales, Trump’s involvement in the crypto space could enhance his financial portfolio while rallying support from the growing number of American cryptocurrency enthusiasts.

Electoral Influence on Crypto Regulations

As countries grapple with the implications of cryptocurrency, recent elections, particularly in the UK, are beginning to influence regulatory frameworks. Prime Minister Rishi Sunak has scheduled a general election that could potentially usher in a new government less favorable to pro-crypto policies. The Conservative Party had positioned the UK as a burgeoning crypto hub, promoting legislation aimed at integrating digital assets into the financial system. However, the Labour Party’s ambiguous stance on cryptocurrencies might lead to regulatory uncertainty.

The outcome of this election may prove pivotal in determining the future of the crypto industry in the UK. While the Labour Party appears open to the idea of promoting tokenization—creating digital representations of real-world assets—the lack of a clear regulatory framework could pose challenges for industry stakeholders hoping to drive innovation.

The interplay between politics and cryptocurrency regulations.

Risks and Opportunities in Cryptocurrency Investment

While the potential for profit in crypto investments is enticing, the landscape is fraught with risks. Investors must navigate the volatile nature of crypto prices, as well as operational and liquidity risks associated with various investment types, ranging from decentralized solutions to centralized providers. Understanding the categorization of crypto assets—based on token design, underlying blockchain characteristics, and market dynamics—is crucial for making informed investment decisions.

Notably, the burgeoning space of decentralized finance (DeFi) offers robust opportunities, but investors should remain vigilant of the regulatory landscape and potential pitfalls. The rise of DeFi highlights the shift towards automation and transparency in financial services, challenging traditional banking paradigms.

The Road Ahead for Cryptocurrency

As the crypto market continues to evolve, stakeholders—from individual investors to politicians—must navigate the complexities inherent in this dynamic environment. The convergence of heightened political interest and technological innovation presents a unique moment in the history of finance. Both Switzerland and Liechtenstein serve as ideal case studies for observing the impacts of regulation, adoption, and market behavior in relation to cryptocurrency.

As seen in the recent studies and political developments, the interplay between regulation and innovation will be crucial in shaping the future of cryptocurrency. Will the regions continue to thrive as leaders in this space, or will regulatory shifts significantly alter the landscape? Only time will tell. Amidst these changes, the onboarding of new technologies will likely pave the way for more secure and efficient pathways for investment, demonstrating the resilience of the crypto ecosystem.

Emerging trends in the cryptocurrency landscape.

Emerging trends in the cryptocurrency landscape.

In conclusion, as we look towards the future of cryptocurrency, attention must be paid to the nuances of market dynamics, the influence of political decisions, and the evolving regulatory environment. This combination of factors will undoubtedly shape the trajectory of digital assets and their role within the global financial system.