Bitcoin and the Cryptocurrency Landscape: A Weekly Update

As cryptocurrency enthusiasts, we’ve come to embrace the volatility of digital assets, and the landscape has never been more dynamic. Currently, Bitcoin is floating in a relatively stable range, right around $61,000. This week’s data reflects a solid performance over the year, with Bitcoin up approximately 39% year-to-date.

Market Insights: Bitcoin and Beyond

It’s fascinating to observe how Bitcoin, since its inception in 2009, continues to hold its ground as the linchpin of the cryptocurrency market. My own journey into this world began with Bitcoin, and like many, I witnessed the transformative nature of this digital currency.

In addition to Bitcoin, Ether remains a strong player on the scene, holding the title of the second-largest cryptocurrency by market capitalization. Even though its price has dipped recently, it is still up 22% since the start of the year. The Ethereum platform’s ongoing innovations fuel excitement around Ether, particularly with the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Bitcoin: The Digital Gold of Our Time

Bitcoin: The Digital Gold of Our Time

The Ripple Effect: Understanding XRP

No discussion of the top cryptocurrencies can ignore XRP, the token linked to Ripple. Once a giant in the space, it has recently struggled, down approximately 21% year-to-date. Despite its pitfalls, including ongoing legal battles with the SEC, its historical significance as one of the early cryptocurrencies cannot be understated. In my opinion, Ripple’s efforts toward revolutionizing cross-border payment systems highlight a promising use case that many still find relevant.

Tether’s Controversy

As we track the performance of these cryptocurrencies, one cannot help but glance at Tether. Often labeled a ‘stablecoin’, it represents an attempt to anchor volatility by pegging its value to fiat currencies like the dollar. Yet, this approach has raised eyebrows due to claims of manipulative practices within the crypto markets. It serves as a stark reminder that transparency remains paramount in maintaining trust within this ecosystem.

Bitcoin ETFs: A Game Changer

Mid-January proved pivotal for Bitcoin, as the SEC greenlit a series of spot Bitcoin ETFs. Various issuers, including Grayscale and Fidelity, unveiled their offerings, increasing retail and institutional interest in Bitcoin. Having followed the ETF discussions for years, I am optimistic that this move could promote broader adoption. It’s akin to giving everyday investors permission to explore this realm, solidifying Bitcoin’s place as a mainstream asset class.

Investing in Bitcoin is Limited Only by Your Imagination

Investing in Bitcoin is Limited Only by Your Imagination

Looking Ahead

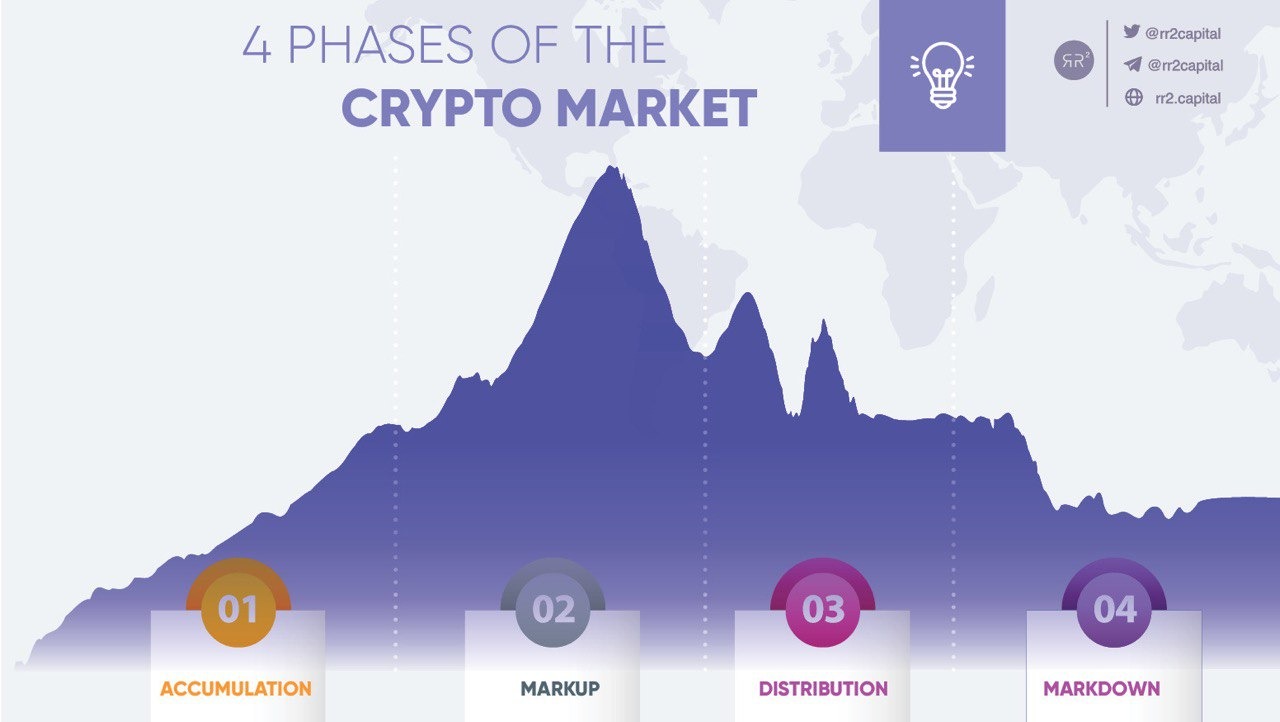

As of now, the broad trend indicates that cryptocurrencies remain on an upward trajectory, despite the occasional dips in individual assets. A key point to remember is that understanding market cycles is essential for anyone interested in tapping into this ecosystem. It’s an ongoing education—one that I personally find exhilarating. Each drop or spike presents not just a challenge, but an opportunity to reassess and refine investment strategies.

Reflecting on my own experiences and the cycles I’ve witnessed, I view current events as a compelling backdrop for the potential that lies ahead in the crypto space. With more regulatory clarity and ongoing technological advancements, I believe we are on the cusp of a significant era for cryptocurrencies.

In conclusion, whether you are a believer in Bitcoin as the digital gold, an enthusiast of Ethereum’s smart contracts, or cautiously optimistic about XRP, the essential takeaway remains clear: the cryptocurrency market is alive with possibilities. The key is to stay informed, adapt to changes, and engage thoughtfully within this transformative financial landscape.

Continuous Learning is Key in the Crypto World

Continuous Learning is Key in the Crypto World

To explore further about the evolving cryptocurrency scene, check out Wikipedia’s Cryptocurrency section.