The Pitfalls of Crypto Tax Reporting: What You Need to Know

Cryptocurrency trading has soared in popularity, but many traders overlook a critical aspect of their transactions: tax reporting. The Internal Revenue Service (IRS) is closely monitoring crypto activities, and failing to report income, gains, or losses can lead to severe consequences.

Understanding IRS Expectations

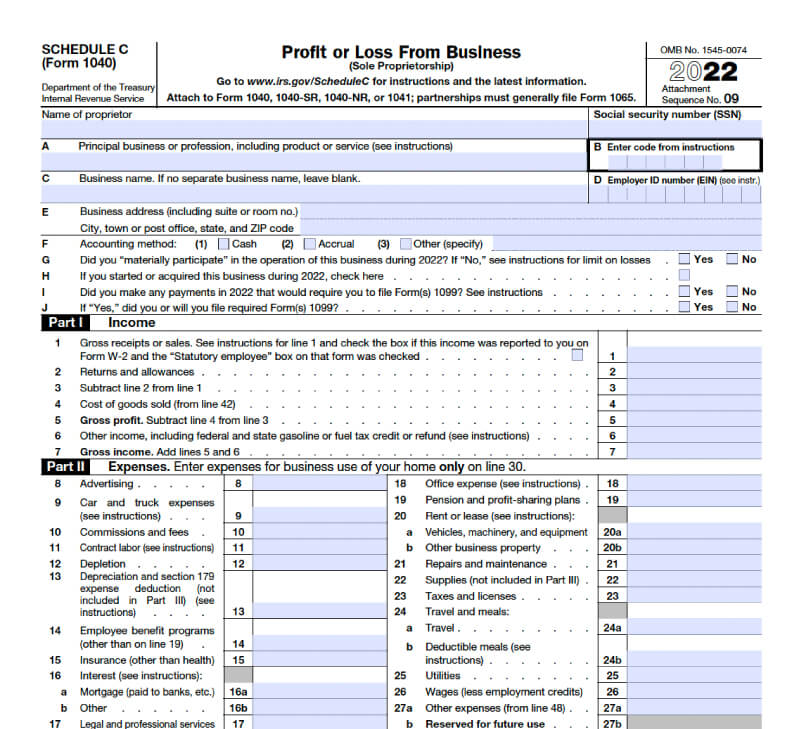

The IRS treats virtual currency as property for tax purposes, subjecting it to capital gains and losses. This means that every taxable crypto transaction must be reported, regardless of the amount involved. Even if you receive a 1099 form from a centralized exchange, it’s crucial to maintain accurate records of all your crypto activities.

Importance of Precise Record-Keeping

Keeping track of your gains and losses can be challenging, especially when trading on multiple exchanges. Utilizing crypto tax software like CoinTracker or Koinly can streamline this process and ensure accurate reporting to the IRS.

Implications of Capital Gains and Losses

If you sell crypto for a profit, you are subject to capital gains tax. Conversely, selling at a loss results in a capital loss. These gains and losses can impact your overall tax liability, with the potential to offset other income up to $3,000 per year.

Recommendations for Crypto Investors

Given the complexities of crypto tax reporting, it’s advisable to seek professional guidance or leverage specialized tools to navigate this landscape effectively. By understanding the IRS requirements and maintaining meticulous records, you can ensure compliance and mitigate the risk of penalties or audits.

Conclusion

Proper tax reporting is a fundamental aspect of crypto trading that should not be overlooked. By adhering to IRS guidelines, accurately documenting transactions, and leveraging available resources, crypto investors can navigate the tax implications of their activities with confidence.