Market Shifts and Strategies: Navigating the Crypto Landscape

The cryptocurrency market is known for its volatility, but recent shifts have instigated deep reflections and strategic recalibrations among analysts and investors alike. With Bitcoin seeing fluctuations around $61,145, prominent analyst Justin Bennett is sounding an alarm that may very well lead holders and traders back to their charts and research.

The Cautionary Tale of Bitcoin Trends

Bennett warned his followers on social media that Bitcoin is on the brink of a more significant downturn, possibly falling below the $60,000 mark before any upward movements can be back on the table. For him, the critical moment of transition relies on Bitcoin’s ability to convert key resistance levels into solid support.

“But a sweep without a reclaim is a potential break with follow-through and probably not something you want to long. The reclaim is the trigger. It’s what tips the scales from possible to probable. No trigger, no trade.”

Bennett also opined that we may be heading into a ‘Downtober’ phase before a potential surge in Uptober. This speculation resonates against the backdrop of previous price performances, particularly noting that September for Bitcoin often carries a retracement before momentum resumes higher.

In September alone, Bitcoin oscillated between a low of $52,500 to a high nearing $66,500. With these parameters, traders are urged to keep a vigilant eye on Bitcoin’s behavioral patterns as it approaches pivotal thresholds.

The Impact of Market Dynamics on Altcoins

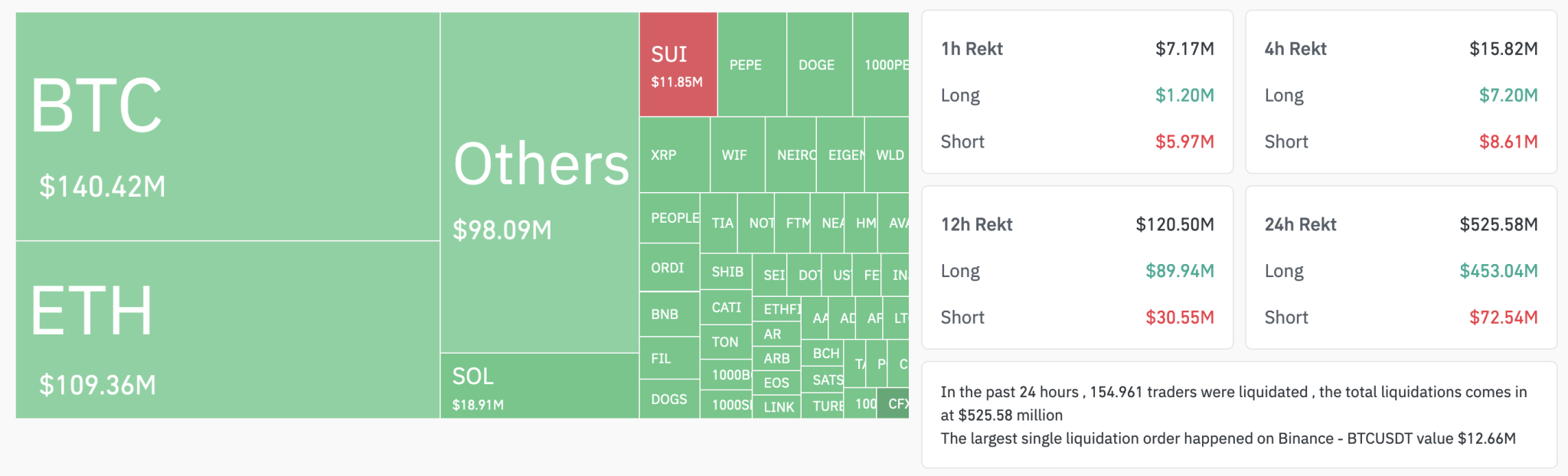

As the landscape evolves, other cryptocurrencies are also feeling the strain. The recent turmoil in the Middle East, marked by escalating conflicts, has instigated turbulence in trading environments, resulting in over $500 million in liquidations across the market within just 24 hours—a phenomenon particularly harsh for high-risk segments like meme-coins and coins associated with artificial intelligence.

Visual representation of recent market liquidations.

Visual representation of recent market liquidations.

Notably, both Ethereum and Solana are among the hardest hit by the current market conditions, mirroring Bitcoin’s instability. Analysts have elaborated on how external geopolitical factors can directly impact market sentiment, revealing how intertwined global dynamics are with cryptocurrency valuations.

The Rise of Japan’s Crypto Enthusiasm

While some markets wade through turbulent waters, Japan displays a burgeoning interest in cryptocurrency investments. YouthMeta, a South Korea-based crypto aggregation platform, is poised to capitalize on this heightened engagement in Japan, where government interest in adding Bitcoin to investment strategies is evident through institutions like the Government Pension Investment Fund of Japan.

YouthMeta facilitates market users with its Goya Premium Chart, providing precise trading times for over 200 crypto assets including Bitcoin, aiming to enhance decision-making processes particularly during periods of volatility.

“The growth of interest in Bitcoin in Japan is substantial. Seminars are consistently full of enthusiastic participants. Many have formed small groups to communicate and share strategies, fostering a community that motivates each other,” shared a representative from YouthMeta’s Japanese operations.

YouthMeta’s endeavor in expanding its reach in the Japanese market.

YouthMeta’s endeavor in expanding its reach in the Japanese market.

As engagement flourishes not solely in Japan but also in growing markets like Vietnam and Indonesia, it is a testament to the broader shift occuring in how cryptocurrencies are perceived globally. Efficient tools like the Goya Chart will likely serve traders well, especially during heightened volatility when accurate signals are paramount.

Strategic Insights Going Forward

In light of the current market situation, it becomes increasingly important for traders and investors to hone their strategies. As Bennett suggests, transformation of resistance into support is key, with the landscape underscoring a deliberate, cautious approach.

While Japan’s enthusiasm symbolizes positive momentum in the decentralized sphere, harmonizing optimism with analytical acumen is critical. The potency of the Tether (USDT) dominance is also a conversation not to be overlooked as it aligns closely with Bitcoin’s potential ascent towards new all-time highs. The market’s fragility indeed presents formidable challenges, yet amid that uncertainty lies a chance for astute investors to carve out a prosperous path.

In conclusion, whether one is operating within the bullish vaults or navigating the lows, the crypto community remains resilient, motivated by market insights and collective strategies that are continuously spurred on by evolving dynamics.