Bridging the Gap: Financial Advisors Embrace the Crypto Frontier

In recent times, the crypto landscape has witnessed a pivotal shift, marked by a significant event at Consensus 2024 in Austin, Texas. This conference not only highlighted the surge of interest among financial advisors regarding digital assets, but also laid the foundation for a new era of integration between traditional finance and innovative crypto solutions.

Exploring the intersection of finance and cryptocurrency.

Exploring the intersection of finance and cryptocurrency.

The Atmosphere of Consensus 2024

Consensus 2024 was electrified by the recent developments in cryptocurrency legislation and the approval of the Ethereum ETF. Approximately 120 financial advisors attended the exclusive RIA & FA Day, where they immersed themselves in learning about digital assets. The buzz was palpable, with thoughtful dialogues taking place, reflecting a growing appetite for understanding and adopting crypto in financial advisory practices. The positive energy was infectious as participants recognized the broader implications of recent ETF approvals and the bullish price trends influencing the market.

The day focused on practical application rather than the nitty-gritty technicalities often associated with blockchain discussions. As financial advisors navigated various investment avenues, it became clear that education would be the cornerstone of crypto adoption. “Advisors need a solid foundation to discuss crypto allocations confidently with their clients,” emphasized one industry leader. This emphasis on clarity and knowledge resonates well in an industry often seen as opaque by clients unfamiliar with cryptocurrency.

Investment avenues in cryptocurrency are expanding.

Investment avenues in cryptocurrency are expanding.

Strategies for Advising Clients in Crypto

Advisors delved into an array of investment strategies during panel discussions, which included direct ownership, custody through SMA (separately managed account) platforms, ETFs, and indirect investments via public companies like MicroStrategy and others involved in the bitcoin mining sector. This diversification approach evokes a sense of caution yet enthusiasm, as advisors grapple with the complexities of compliance and client expectations.

Historically, advisors have shown a tendency to allocate around 2-5% of client portfolios into cryptocurrency, categorizing it as an alternative investment. Over time, the conversations have evolved to include realistic expectations for performance amidst the inherent volatility of the crypto market. The integration of ETFs as a mainstream investment vehicle has enabled advisors to advocate for the rebalancing of portfolios, showcasing the positive effects on overall performance.

Regulatory Challenges and Landscape

The intertwining of cryptocurrency with political discourse adds another layer of complexity to its integration within financial sectors. At Consensus 2024, CFTC Commissioner Summer Mersinger’s keynote emphasized the need for clearer regulatory frameworks that advisors can lean on. The optimistic momentum towards pro-crypto regulations comes at a crucial time, as several legislative movements hint at a progressive shift in how authorities perceive digital assets.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PIB2DGV6QJC3HJ27MLCN5OIVDE.jpg) Regulatory clarity is essential for financial advisors.

Regulatory clarity is essential for financial advisors.

However, uncertainty still looms large, particularly regarding compliance and the implications of forthcoming regulations on crypto investments. Advisors must navigate these murky waters with a well-informed strategy to mitigate risks and leverage opportunities in this dynamic asset class. The evolving political sentiment, favoring supportive legislative measures, indicates a maturing approach to cryptocurrency’s role in the financial ecosystem.

Real-World Implications and Future Directions

As the enthusiasm surrounding digital assets continues to build, several trends emerge, hinting at the future direction of cryptocurrencies in traditional financial advisory roles. Recent reports reveal moves that could significantly reshape investment landscapes, with some financial advisors echoing similar sentiments as presidential hopeful Donald Trump, who expressed a clear preference for Bitcoin over central bank digital currencies (CBDCs).

Trump’s engagement with Bitcoin miners at Mar-a-Lago is a testament to the enduring interest from high-profile figures, potentially swaying upwards of 2024 voters who resonate with pro-crypto sentiments. The former president’s campaign, now accepting crypto donations, reflects a broader cultural shift towards cryptocurrency at all levels of governance and business.

Understanding Market Dynamics

Meanwhile, Bitcoin’s price dynamics add to the ever-changing discourse. Recent fluctuations indicate a knee-jerk reaction ahead of significant financial announcements, such as the Consumer Price Index (CPI) data and interest rate decisions from the Federal Open Market Committee (FOMC). Investors brace for potential volatility that could either stabilize or unsettle the market based on the Federal Reserve’s stance on inflation and economic conditions.

In the wake of market corrections, treasury and financial experts emphasize the cyclical nature of crypto prices, urging investors to maintain a long-term perspective despite short-term volatility. As Bitcoin returns to the spotlight, it is crucial to recognize that this asset class operates within broader economic frameworks, influenced profoundly by regulatory decisions and market sentiments.

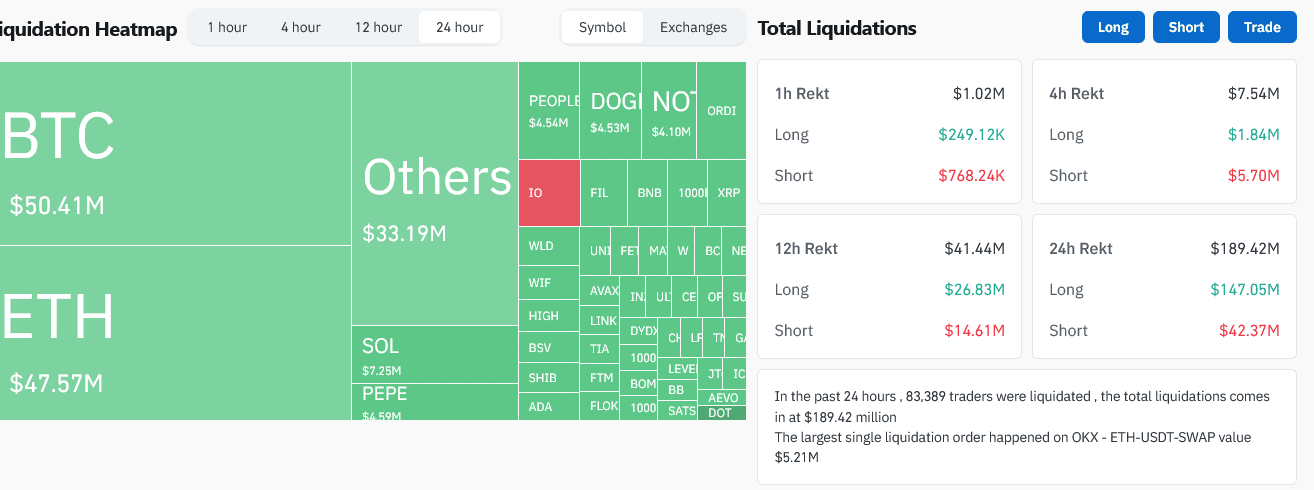

Market volatility is a hallmark of cryptocurrency trading.

Market volatility is a hallmark of cryptocurrency trading.

Conclusion: A New Era for Financial Advisors

Consensus 2024 encapsulates a transformative moment for financial advisors eager to explore cryptocurrency within their practices. As positive sentiments build, the convergence of education, practical application, and regulatory clarity emerges as pivotal factors underpinning successful crypto integration. As the dialogue surrounding digital assets evolves, financial professionals must prepare themselves to meet the increasing demand for crypto investments, thus empowering their clients to navigate through this nexus of financial innovation.

The future is promising, not only for cryptocurrencies but also for the financial advisors committed to understanding and facilitating client access to these evolving opportunities. The realm of crypto is replete with potential, and as this narrative unfolds, advisors play a critical role in bridging gaps between traditional investments and the burgeoning world of digital assets.