Senators Call for Caution in Crypto ETF Approvals

As the cryptocurrency market continues to evolve, U.S. Senators Jack Reed and Laphonza Butler have raised concerns regarding the approval of new crypto exchange-traded products (ETPs), specifically those tied to cryptocurrencies other than Bitcoin.

In a letter addressed to SEC Chair Gary Gensler on March 11, the senators emphasized the need for the Securities and Exchange Commission (SEC) to exercise prudence in greenlighting additional ETPs, citing issues related to trading volumes and the overall integrity of non-Bitcoin digital assets.

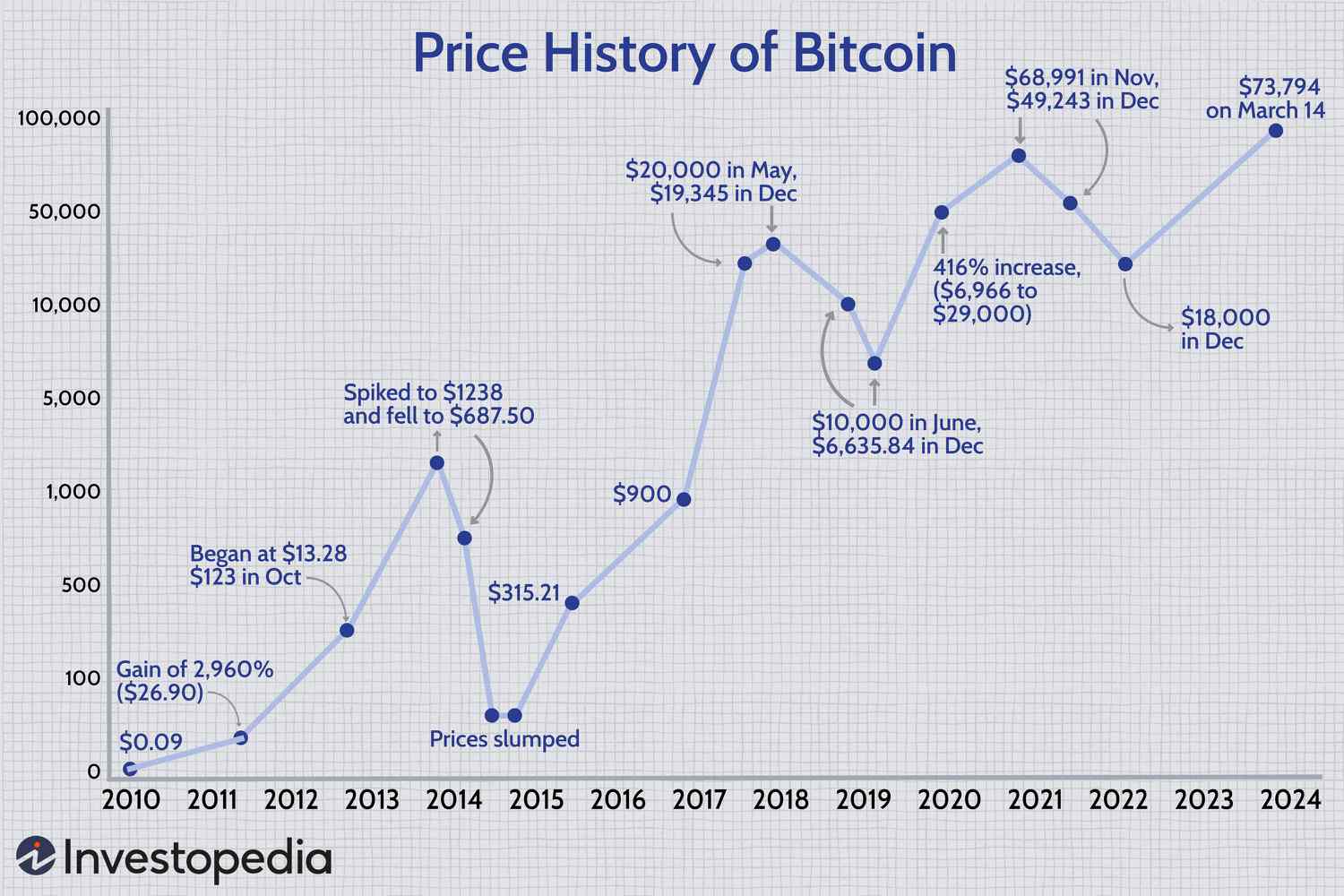

The recent surge in Bitcoin’s value, reaching a peak of US$73,737 following the introduction of ten spot Bitcoin ETFs in the U.S. in January, has sparked debates on the potential risks associated with expanding the ETP market to include other cryptocurrencies.

The senators’ correspondence coincides with the SEC’s ongoing evaluations of proposals for spot Ethereum ETFs. Analysts at Bloomberg have revised the likelihood of a spot Ethereum ETF approval down to 35%, while the SEC has postponed its verdict on several Ethereum ETF applications, with a final ruling expected in May.

Institutional interest in Bitcoin has been steadily increasing, buoyed by the approval of U.S. spot Bitcoin ETFs. Despite this positive momentum, industry experts caution that unresolved issues such as security vulnerabilities and regulatory compliance could impede the pace of institutional adoption.

The Impact of Regulatory Hesitation

The hesitation displayed by regulatory bodies, as highlighted by Senators Reed and Butler, underscores the delicate balance between fostering innovation in the crypto space and safeguarding investors from potential pitfalls. While the allure of diversifying investment options beyond Bitcoin is enticing, the senators’ call for restraint reflects a broader concern for investor protection and market stability.

Expert Insights

-

Market Volatility: The recent volatility in the cryptocurrency market, exemplified by Bitcoin’s price fluctuations, underscores the need for a cautious approach to expanding the range of crypto ETPs available to investors.

-

Regulatory Oversight: Striking a balance between regulatory oversight and fostering innovation remains a key challenge for policymakers and industry stakeholders alike.

-

Investor Safeguards: Ensuring adequate safeguards for retail investors, particularly in light of the speculative nature of certain cryptocurrencies, is paramount to maintaining market integrity.

Looking Ahead

As the SEC deliberates on the future of spot Ethereum ETFs and the broader landscape of crypto ETPs, the outcome of these decisions will likely shape the trajectory of institutional involvement in the crypto market. The senators’ plea for caution serves as a reminder of the complexities inherent in regulating a rapidly evolving industry.

Illustration of Cryptocurrency Regulation

For more details, you can read the full article here.