Understanding the Complex Landscape of Hard Forks in Blockchain

In the ever-evolving ecosystem of blockchain technology, the phenomenon of hard forks stands out as a pivotal event that can change the trajectory of cryptocurrency networks. A hard fork occurs when there is a discrepancy in the blockchain protocol, prompting a split that leads to the creation of a new blockchain alongside the existing one. This article delves into what hard forks are, why they occur, and their implications for cryptocurrency players.

An overview of blockchain forks and their impacts.

An overview of blockchain forks and their impacts.

What Is a Hard Fork?

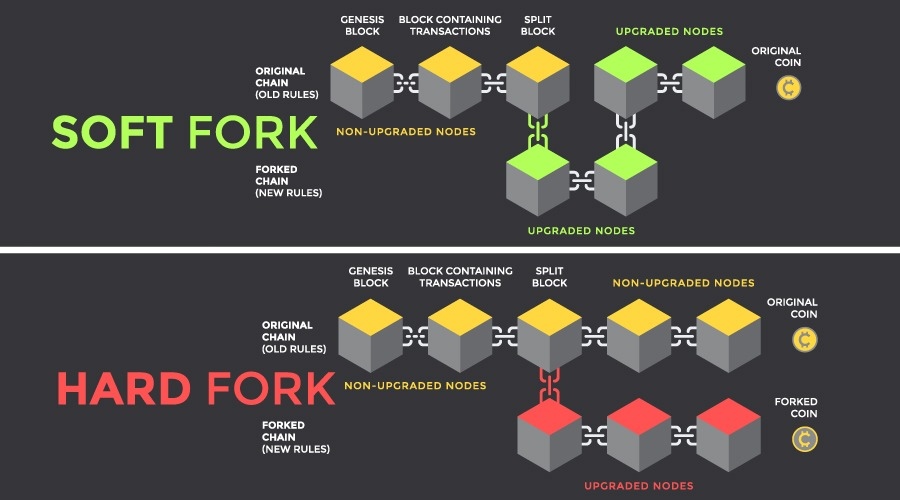

A hard fork represents a significant change in the underlying code of a blockchain. Such a change is incompatible with previous protocol versions, essentially creating a new branch within the blockchain. This branching can lead to the generation of a new cryptocurrency, entailing that holders of tokens on the original chain will also receive tokens on the new chain. However, participants must choose which version of the blockchain they wish to support.

Why Do Hard Forks Happen?

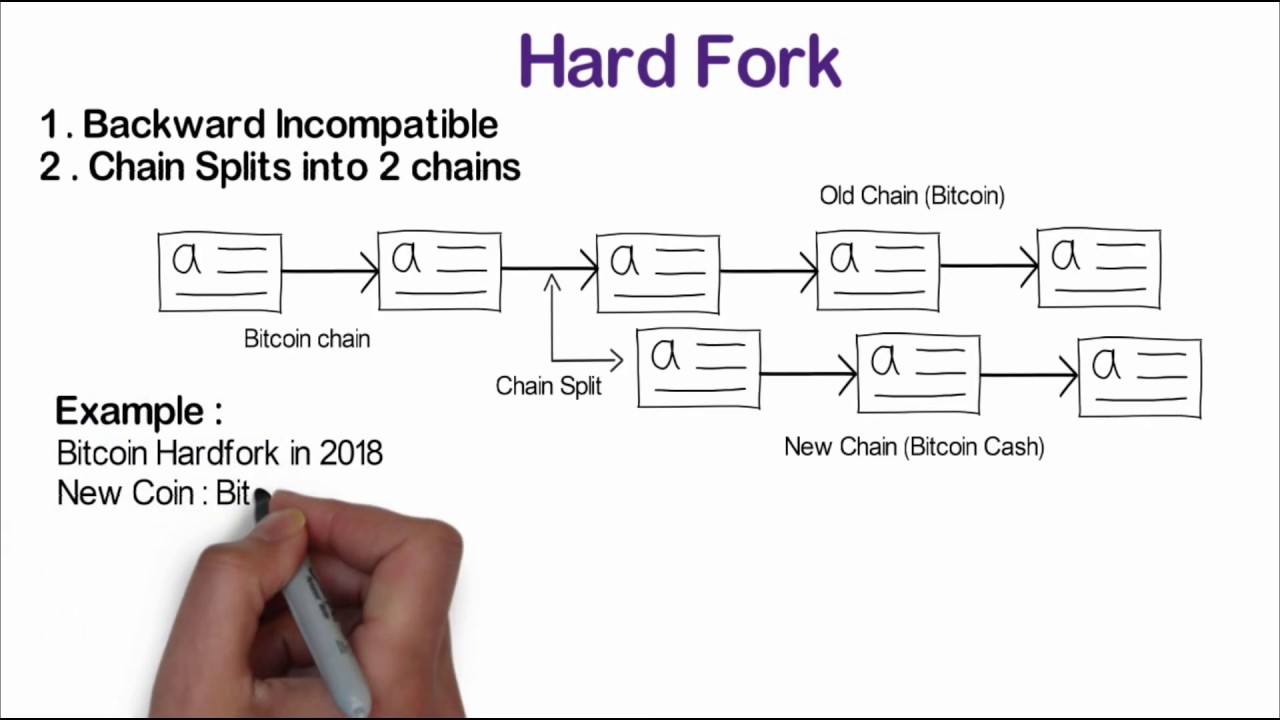

Hard forks can be initiated for various reasons, often deeply rooted in community disagreements or necessary advancements in technology. For instance, when the infamous hacking incident of the Decentralized Autonomous Organization (DAO) occurred, Ethereum underwent a hard fork through a decisive community vote aimed at rectifying the situation and restoring lost funds. Another prominent case involves Bitcoin Cash emerging from a hard fork of Bitcoin, driven by differing philosophies on block size and transaction fees.

Within the crypto community, opinions about hard forks can be polarizing. Some participants view these changes as necessary evolutions of a platform that enhance its functionality or security, while others may regard them as detrimental fragmentation that muddles brand identity and user trust. The reality is that the impact of a hard fork often depends on the specific circumstances leading to its creation and the reception by the community.

The Process of a Hard Fork

When a hard fork is on the horizon, developers typically need to implement code changes that all nodes (computers operating within the blockchain protocol) must adopt. If consensus is reached among community members, a hard fork is declared, leading to the creation of a new blockchain. This transition, while impactful, does not mean that the original blockchain ceases to exist; both chains will continue to operate independently, each with its community and vision.

The Landscape of Major Hard Forks

One of the most interesting aspects of hard forks is how they shape the cryptocurrency landscape. Hard forks have been witnessed across numerous blockchains, not limited to Bitcoin and Ethereum. Litecoin, for instance, has also experienced its share of forks that introduce new features and protocols, further distinguishing itself in a saturated market.

The fork that led Ethereum and Ethereum Classic on divergent paths.

Is a Hard Fork Good or Bad?

This fundamental question arises every time a hard fork occurs. On one hand, proponents argue that hard forks can lead to innovation—placing forward much-needed upgrades to a network’s scalability, security, or functionality. On the other hand, detractors warn that a split can confuse investors and users, diluting brand value and leading to fragmentation within the community.

How Hard Forks Impact Users

For holders and users of cryptocurrencies, the implications of a hard fork are significant. When a fork happens, users may find they now have tokens on both chains, and they must decide whether to maintain, trade, or participate in either blockchain. This decision can carry risks and rewards, especially considering how market sentiments might react to the news of a hard fork. Some coins may see increased attention and value, while others may plummet following the divide.

The Technical Side: Public Keys and Hard Forks

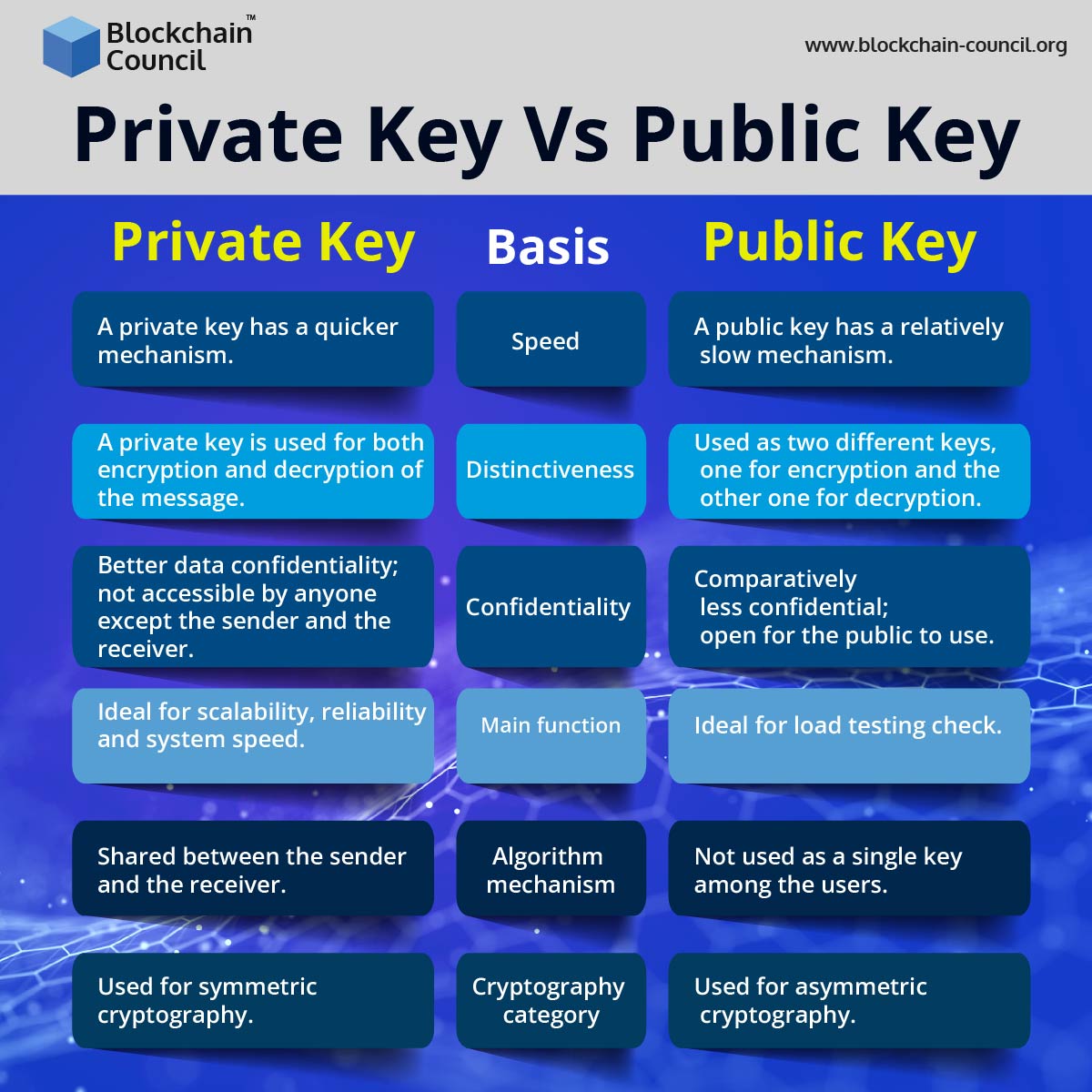

As we explore the intricacies of blockchain technology, it’s essential to address the role of public keys in relation to hard forks. Public keys, derived from private keys, serve as digital signatures that authenticate ownership and initiate transactions on the blockchain. This cryptographic relationship assures that users maintain control over their assets and helps in defining addresses on both blockchain forks.

When a hard fork occurs, users still effectively manage their holdings as long as they safeguard their private keys. The separation of chains invariably leads to the generation of new public keys associated with the new blockchain, which must be managed accordingly to ensure continuity of access and ownership.

Understanding public keys within the blockchain ecosystems.

Understanding public keys within the blockchain ecosystems.

Navigating Your Way Through Crypto Trading Platforms

As the blockchain breathes new life into the realm of digital finance, users keen to trade cryptocurrencies must harness the power of crypto trading platforms. Various platforms cater to different trader needs, providing avenues for not just buying, but also for engaging with new forks that come into existence through hard forks.

Binance and Bitfinex remain among the most prominent platforms offering a plethora of trading options. These exchanges allow their users to gain exposure to original tokens and the newly forked alternatives, paving the path for strategic investments tailored to the user’s market analysis.

As cryptocurrency trading continues to mature, knowing which platforms best align with a trader’s goals can either bolster their position or lead to potential losses, especially during events like hard forks.

A Case Study: Ethereum Classic vs. Ethereum

The divide between Ethereum and Ethereum Classic exemplifies the potential outcomes of a hard fork. When Ethereum underwent a hard fork following the DAO incident, a faction chose to uphold the original chain and ideology, resulting in Ethereum Classic. This case demonstrates how a hard fork can splinter communities but also allow for differing visions to coexist, each fostering distinct developments over the years.

In conclusion, as cryptocurrencies continue to adapt and shape the future of finance through mechanisms like hard forks, both developers and users must navigate this complex landscape. Understanding the technical and community implications of hard forks not only influences investment strategies but also helps in making informed decisions about participation within the blockchain universe.

Conclusion

Hard forks are a double-edged sword in the cryptocurrency world. They open doors to innovation and new opportunities while simultaneously posing risks of confusion and division. As blockchain technology evolves, the ripples created by hard forks will undoubtedly influence the conversations and strategies surrounding digital currencies for years to come. The ability for users to adapt and grasp the underlying principles behind these events will be crucial in their continuing journey through the burgeoning space of cryptocurrencies.