The Bitcoin Mining Dilemma: Navigating the Halving

As the cryptocurrency market gears up for the upcoming Bitcoin halving event in April, miners are facing a critical juncture that could reshape the industry landscape. The halving, which will cut mining rewards by half, poses significant challenges and opportunities for miners looking to stay profitable in a rapidly evolving market.

Investors are closely watching the mining sector as the halving approaches, with many questioning the sustainability of mining operations in the face of reduced rewards. The once highly lucrative business of mining is now under scrutiny, prompting miners to explore innovative strategies to maintain profitability.

The Evolution of Mining Strategies

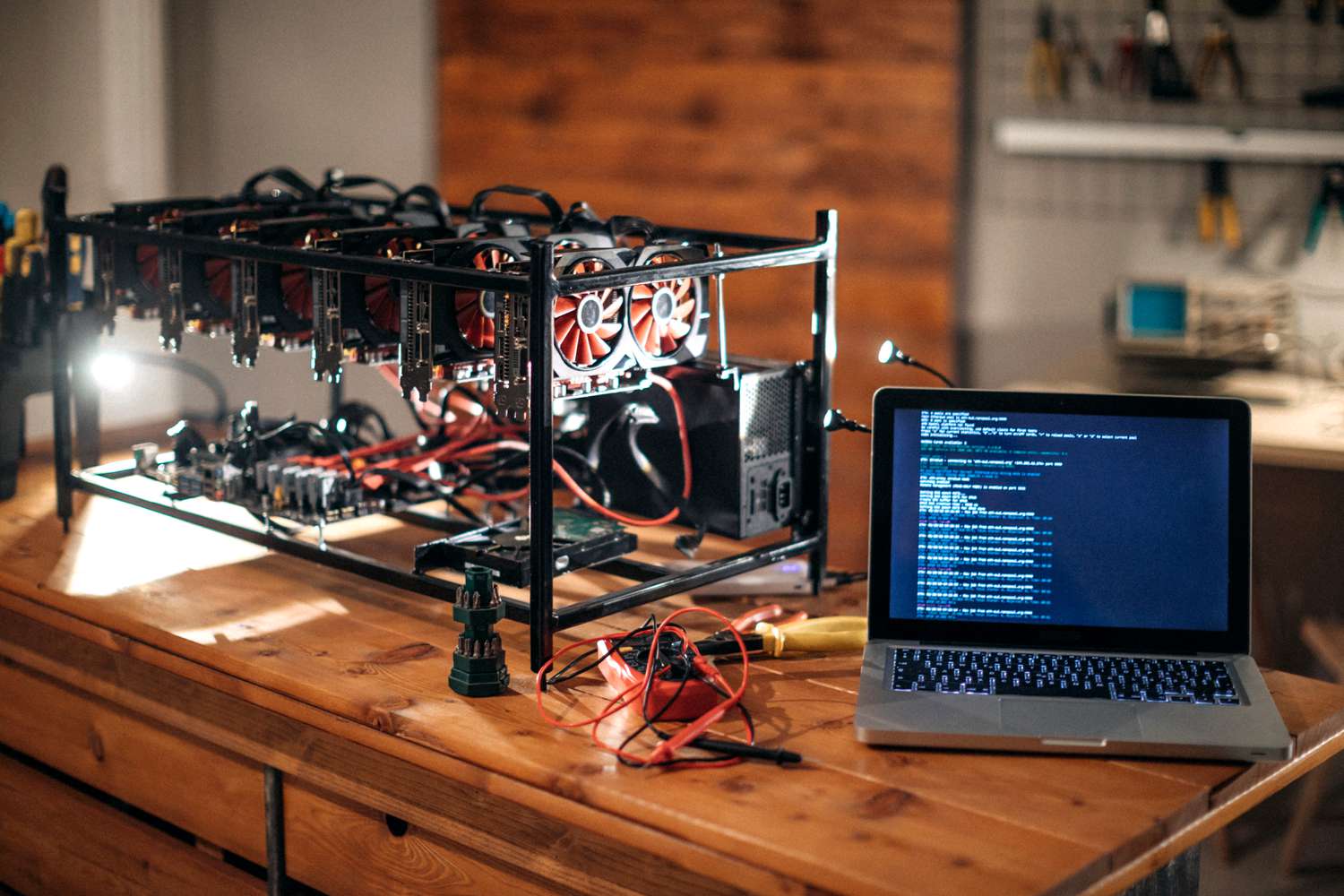

To adapt to the changing market dynamics, miners are focusing on upgrading their mining equipment to enhance efficiency and reduce operational costs. Upgrading to more efficient mining rigs, optimizing power consumption, and exploring cost-effective power sources are key priorities for miners seeking to weather the halving storm.

An image of modern mining equipment

An image of modern mining equipment

Embracing Efficiency for Long-Term Viability

Efficiency is paramount for miners preparing for the halving. By investing in advanced mining machines that offer higher computing power while consuming less energy, miners can position themselves for sustained profitability post-halving. Companies like Riot Platforms are already making significant investments in next-generation mining rigs to boost efficiency and competitiveness.

The Power Predicament: Securing Affordable Energy

In addition to equipment upgrades, securing access to affordable power is crucial for miners to remain profitable. The scarcity of cheap power presents a significant challenge, with companies like Stronghold Digital Mining innovating by converting coal refuse into power to reduce operational costs.

Hedging Strategies and Risk Management

To mitigate the impact of the halving on mining revenues, miners are exploring innovative hedging strategies such as production hedging and derivatives trading. By locking in the price of mined Bitcoin through derivatives, miners can safeguard against price volatility and revenue fluctuations.

Mergers and Acquisitions: A Path to Survival

As the industry consolidates in response to the halving, mergers and acquisitions are becoming increasingly common among mining companies. Larger, more efficient miners are acquiring smaller players to enhance operational excellence and drive strategic growth. The competitive landscape is evolving rapidly, with companies like Hut 8 and CleanSpark leading the way in strategic acquisitions.

In conclusion, the Bitcoin halving presents both challenges and opportunities for miners. By embracing innovation, efficiency, and strategic partnerships, miners can navigate the halving successfully and emerge stronger in a post-halving market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.