MtGox’s $9 Billion Payout: A Boon for Creditors, but a Threat to Bitcoin’s Stability?

The long-awaited payout to MtGox creditors has finally arrived, with approximately $9 billion worth of bitcoin and $50 million of bitcoin cash set to be distributed to those affected by the exchange’s 2014 collapse. While this news may bring relief to creditors, it has sparked concerns about the potential impact on the cryptocurrency market.

The defunct Tokyo-based exchange, once the largest spot bitcoin exchange in the world, shut down in 2014 after a series of hacks.

The MtGox saga has been a long and arduous one, with thousands of creditors left stranded after the exchange lost approximately 950,000 bitcoins. Although 140,000 of these were recovered, the road to repayment has been fraught with delays and setbacks. Now, trustee Nobuaki Kobayashi has announced that the exchange will begin distributing bitcoin and bitcoin cash to creditors next month.

“We expect that the payouts would be a stress for the market, nevertheless, it might be a tremendous opportunity for the ones awaiting to ‘buy the dip’,” said Georgi Koreli, cofounder and CEO of privacy protocol Hinkal.

However, not everyone is convinced that the market will be severely impacted. Alex Thorn, head of research at Galaxy Digital, believes that the market is overestimating the potential impact. Of the 140,000 bitcoins held by the bankruptcy estate, only about 65,000 are set to be delivered to 20,000 individual creditors, many of whom are tech-savvy early followers and well-known bitcoiners.

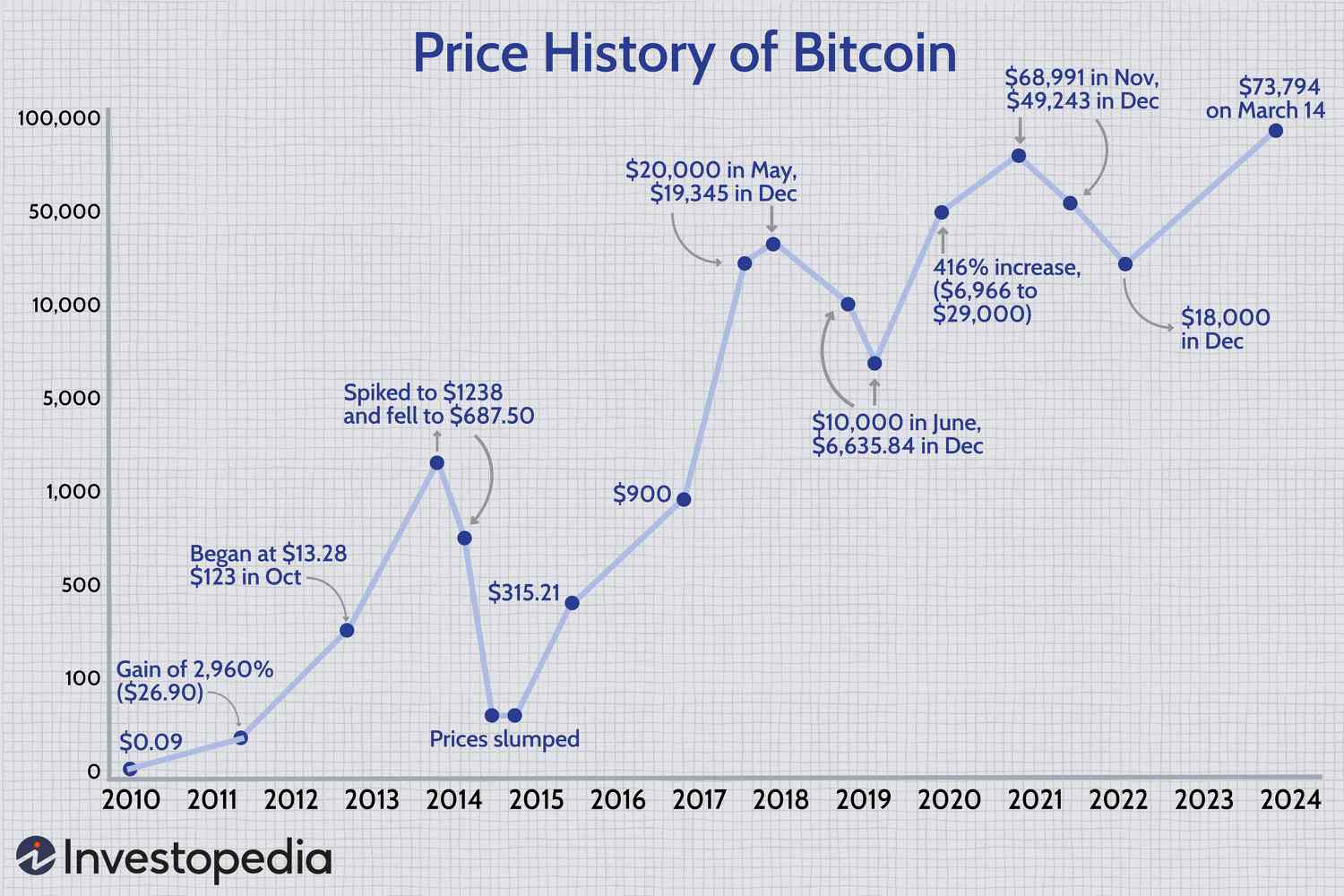

Bitcoin is trading below $60,000 for the first time since early May, sparking concerns about the potential impact of the MtGox payout.

A significant reason for creditors not to sell all their tokens at once is the risk of massive capital gains tax. Many creditors bought their bitcoin at $451 (the price when MtGox filed for bankruptcy) at most, and with bitcoin now trading just below $60,000, the tax implications are considerable.

The remaining tokens will be sent to large claims funds and a separate bankruptcy. Contrary to market expectations, Thorn suggested that these funds won’t flood the market. “From speaking with several LPs in these funds, we do not believe there will be significant selling from this cohort,” he wrote.

Bitcoin cash, however, is expected to fare worse, with many creditors unlikely to have an affinity for the 2017 bitcoin fork.

Matt Hougan, chief investment officer of crypto asset manager Bitwise, agrees: “The best studies of MtGox claims suggest that most early investors have already sold their claims in the secondary claims market. For instance, NYDIG has some quality research suggesting that the real amount that is likely to come on the market is closer to $3 billion than $10 billion. Still, $3 billion is a lot of bitcoin. I suspect what you’re seeing now is the market pre-positioning for these distributions. That makes this a ‘sell the rumor, buy the news’ event.”

As the MtGox payout begins, all eyes will be on the cryptocurrency market, waiting to see how it will react to this influx of new bitcoin and bitcoin cash. Will it be a stress for the market, or a tremendous opportunity for those waiting to ‘buy the dip’?

Photo by

Photo by