Seven Keys to Winning in Cryptocurrency

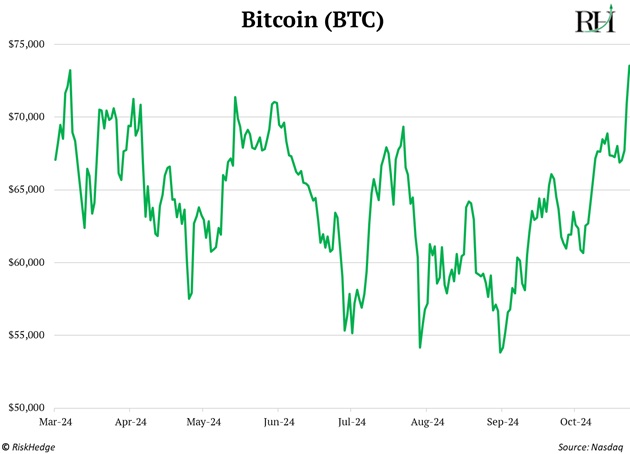

As Bitcoin approaches unprecedented heights, recently crossing the $72,000 mark, many are considering their entry into the cryptocurrency arena. The volatility and potential for significant returns can be daunting for newcomers. To navigate this unpredictable landscape, here are seven essential rules for success in crypto investing.

Rule #1: Embrace the Volatility

The history of emerging assets shows that volatility is a common thread. Just as the U.S. stock market has weathered its share of tumultuous periods over the past century, other industries have experienced similar fluctuations. The railroads, oil booms, and the internet bubble all had their share of dramatic ups and downs. Embracing this volatility is crucial for anyone looking to capitalize on early-stage investments in cryptocurrency.

Bitcoin price chart showcasing significant growth.

Bitcoin price chart showcasing significant growth.

Rule #2: Expect Downturns

Crypto investors should prepare for the psychological challenge that comes with market dips. Unlike traditional stock markets, where 50% declines are almost unheard of, cryptocurrency landscapes can witness such drops frequently. Understanding that being “underwater” at times is normal will help investors manage their expectations and emotional responses during market fluctuations.

Rule #3: Maintain an Optimistic Outlook

In the world of crypto, negativity often abounds. Headlines declaring that “Bitcoin is dead” have persisted since the inception of cryptocurrencies. However, it’s essential to rise above these naysaying narratives and remain focused on long-term potential. Optimism has historically proven to yield dividends amid widespread skepticism.

Rule #4: Profit in Bear Markets

Investing during bear trends can cultivate future wealth. Renowned investor Shelby Davis famously noted, “You make most of your money in a bear market; you just don’t realize it at the time.” This perspective underscores the importance of looking beyond immediate losses to recognize opportunities for growth when prices are low.

Rule #5: Be Strategic with Position Sizing

A key principle in cryptocurrency investing is to allocate only a small portion of your overall portfolio to these assets. A recommended range of 1-2% is prudent, allowing room for growth without jeopardizing financial stability.

Strategic investing is essential for navigating the crypto landscape.

Strategic investing is essential for navigating the crypto landscape.

Rule #6: Stick Around

The thrill of the bull market can easily overshadow the uncertain path of recovery that follows a downturn. It’s critical for investors to remain engaged, as timing the market is notoriously challenging. Those who weather tough times often find themselves in a position to invest in robust projects when prices have significantly corrected.

Rule #7: Adopt a Venture Capitalist Mindset

Successful crypto investors often think long-term, similar to venture capitalists. This means ignoring the noise of daily price fluctuations and concentrating on the fundamental value of their investments. By nurturing this perspective, investors can better appreciate the growth potential that cryptocurrencies offer over time.

Cryptocurrency presents a world of opportunities for those willing to adopt a strategic, informed approach. While the terrain may be rocky, sustainable growth is possible by following these principles. The potential for significant returns is not just a distant dream; it’s within reach for those prepared to engage with the market wisely.

As we watch Bitcoin potentially reach new heights, remember—success in crypto requires patience, conviction, and an informed strategy.

For more insights on disruptively transformative trends, consider joining our Jolt investing letter to stay ahead in the rapidly evolving landscape of cryptocurrency, AI, biotech, and beyond.

Photo by

Photo by