The Evolving Landscape of Cryptocurrency: Strategies for Success

Cryptocurrency has become a buzzword in recent years, drawing in a diverse array of individuals, from seasoned investors to curious newcomers. This article explores the various dynamics shaping the cryptocurrency market today and offers insights into strategies that can facilitate success in this volatile environment.

Navigating the Volatility

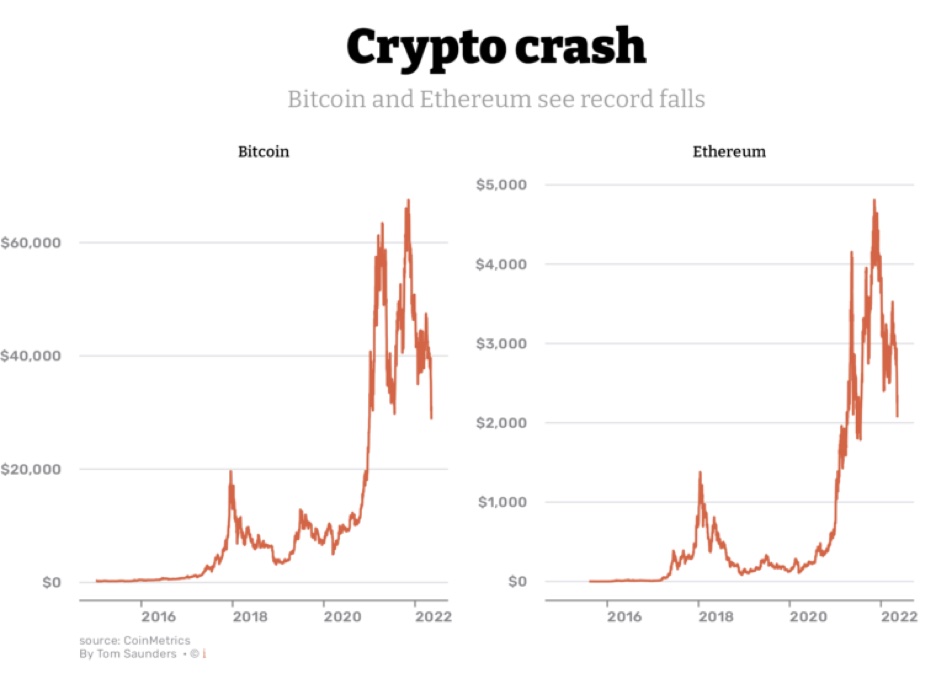

The first thing any investor needs to understand is the inherent volatility of cryptocurrency. Prices can fluctuate wildly within short periods, influenced by various factors including market sentiment, regulatory news, and technological advancements. Therefore, adopting a strategy that blends patience with agility can be a game-changer.

- Understand Market Cycles: Investors should familiarize themselves with market cycles, which can provide a framework for anticipating price movements.

- Risk Management: Implementing strict risk management protocols is crucial. This could involve setting stop-loss orders to minimize potential losses.

Understanding market fluctuations is essential for any investor.

Understanding market fluctuations is essential for any investor.

The Importance of Diversification

Investing solely in Bitcoin or any single cryptocurrency can be risky. Diversifying a portfolio among various cryptocurrencies can reduce risk and improve overall returns. Consideration should be given to a mix of established coins like Ethereum and emerging tokens with strong fundamentals. This approach helps mitigate the adverse effects when one coin experiences a downturn.

- Research Emerging Tokens: Keep an eye on new projects with promising technology or unique use cases, as they can offer significant growth opportunities.

- Stablecoins: Including stablecoins in the portfolio can help stabilize investments during market downturns.

Learning from the Community

The cryptocurrency ecosystem is rich with communities eager to share knowledge and experiences. Engaging with fellow enthusiasts can facilitate learning and provide insights into successful trading strategies. Online forums, social media groups, and local meetups can serve as valuable resources for information and networking.

“Community insights often yield hidden gems in the market that traditional research might overlook.”

Engaging with the community enhances knowledge and trading strategies.

Engaging with the community enhances knowledge and trading strategies.

Keeping Up with Regulations

Regulatory changes can significantly impact the cryptocurrency market. Investors need to stay informed about the latest legal developments to navigate potential risks effectively. For instance, countries might introduce new tax regulations or impose bans on certain activities within the crypto space. Awareness of these changes can help investors adapt their strategies accordingly.

- Global Perspectives: Different regions approach regulation differently, which can create opportunities or challenges for crypto investors.

- Legal Compliance: Ensuring compliance with local laws reduces the risk of penalties and enhances the legitimacy of one’s investments.

Conclusion

In conclusion, the cryptocurrency landscape continues to evolve rapidly, presenting both opportunities and challenges for investors. By understanding market volatility, diversifying assets, engaging with the community, and keeping abreast of regulatory changes, individuals can develop strategies that enhance their chances of success. As this field continues to mature, those who remain informed and adaptable will likely find themselves at the forefront of this financial revolution.

Strategizing wisely will form the backbone of every successful cryptocurrency venture.

Strategizing wisely will form the backbone of every successful cryptocurrency venture.