Larry Fink’s Bitcoin Revelation: A Paradigm Shift in Crypto Adoption

The landscape of cryptocurrency has taken a turn as BlackRock’s CEO, Larry Fink, openly admits he was mistaken about Bitcoin. This shift from skepticism to acceptance is not just a personal journey; it represents a potential turning point for the entire financial industry.

The pivoting views of influential leaders like Larry Fink signal a new era for Bitcoin.

The pivoting views of influential leaders like Larry Fink signal a new era for Bitcoin.

A Change of Heart: Understanding Fink’s New Perspective

In a recent interview with CNBC, Fink shed light on his evolving thoughts about Bitcoin, initially viewing it with skepticism. His more profound engagement with the cryptocurrency appears to have opened his eyes to its potential. Now, he regards Bitcoin as a legitimate financial instrument during uncertain economic times.

Fink asserts that Bitcoin offers a safeguard against currency devaluation, particularly in countries grappling with significant economic challenges. This ability to provide individuals more control over their assets is pivotal, especially as cryptocurrencies operate outside governmental jurisdictions. As he puts it, Bitcoin is not merely a speculative asset, but rather a crucial tool for those concerned about financial security in a precarious world.

Bitcoin: Digital Gold in the Making

When someone of Fink’s stature acknowledges he was wrong about Bitcoin, it grabs attention. He goes so far as to label Bitcoin as “digital gold,” suggesting it deserves a place in diversified investment portfolios. However, he emphasizes that Bitcoin isn’t for those seeking quick profits; it’s designed for individuals looking to secure their finances in turbulent scenarios.

“Bitcoin is a beacon for those in pursuit of financial stability amidst chaos.”

The optimism surrounding Bitcoin has recently surged due to endorsements from market influencers, including the likes of Michael Saylor and Donald Trump. These endorsements have correlated with a significant uptick in Bitcoin’s value, which jumped from a low of $52,500 to around $63,750 within weeks.

The recent performance of Bitcoin shows an encouraging trend as optimism reigns.

The recent performance of Bitcoin shows an encouraging trend as optimism reigns.

Historical Trends and Future Possibilities

What’s especially notable this September is the 6% rise in Bitcoin’s value. Historically, this month has proven challenging for Bitcoin, often leading to losses. In the last 12 years, there have been only four instances of positive performance in September. However, when Bitcoin manages to thrive in this month, a flourishing fourth quarter typically follows.

Analyst Lark Davis highlights this promising trend and poses the question: could history repeat itself? If Bitcoin manages to keep its upward momentum until the end of September, it could push towards the significant resistance level at $70,000. Surpassing this threshold might pave the way for a new all-time high, potentially exceeding $80,000 before the year concludes.

Emerging Opportunities: The Rise of STARS Coin

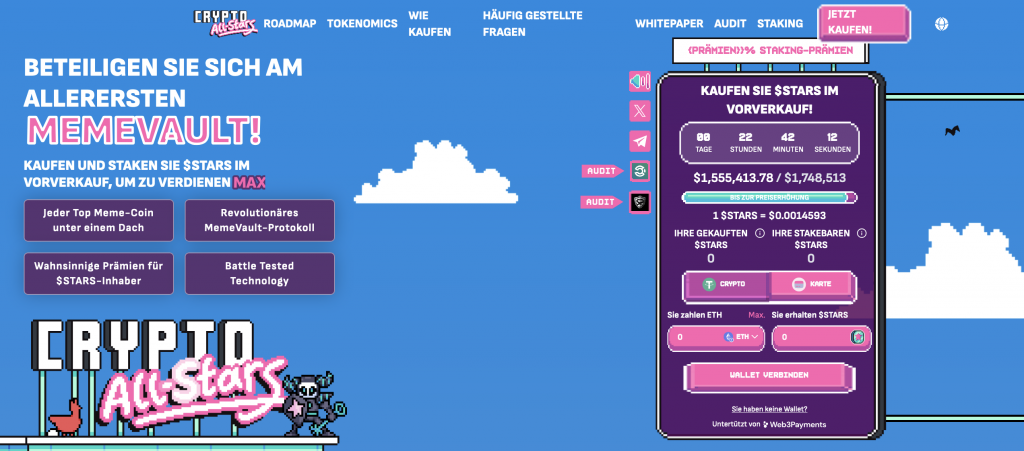

As Bitcoin’s rally intensifies, new projects are also capturing investor interest, such as the recently launched meme coin, STARS, from Crypto All-Stars. This innovative project simplifies the staking of meme coins, which has often been a cumbersome process for investors.

The STARS coin utilizes the ERC-1155 multi-token standard and allows users to stake popular meme coins like DOGE, SHIB, and PEPE in a single platform, generating returns in STARS. What’s even more enticing is that investors can stake their STARS coins for a staggering annual return of about 950%.

Currently in its pre-sale phase, STARS can be acquired at a promotional price.

STARS could offer significant returns for early investors.

STARS could offer significant returns for early investors.

Conclusion: A Bright Future Ahead

The influx of institutional support from leaders like Fink represents a transformative moment for Bitcoin and the cryptocurrency landscape. With optimism soaring and Bitcoin on the rise, now may be the best time to engage with this asset—whether as an investment or as a protective measure against economic instability. However, it’s crucial to proceed with caution; every investment carries its risks. Nonetheless, the changing tides certainly present opportunities worth exploring.

Disclaimer: All investments come with risks. This article is for informational purposes only and should not be construed as financial advice.