The German government has made its largest-ever Bitcoin transfer, shifting over $900 million worth of BTC to various external addresses. According to onchain data from Arkham Intelligence, the wallet associated with the German government transferred a total of roughly 16,309 Bitcoin (BTC) in multiple transactions to crypto exchanges Bitstamp, Coinbase, and Kraken, as well as market makers Flow Traders and Cumberland DRW.

German Government Wallet.

German Government Wallet.

In one of the largest transactions, 3,500 BTC was sent to Flow Traders, 200 BTC to Kraken, 400 BTC to Bitstamp, and 400 BTC to Coinbase. Another 700 BTC, worth over $38.5 million, was sent to the wallet &139Po, which remains unknown but has previously received funds from the German government.

BTC Transferred.

Following these transfers, the Bitcoin price dropped sharply during the European trading session, falling as much as 6.75% from a high of $58,200 to as low as $54,278. This drop in Bitcoin price triggered massive liquidations across the crypto market. According to data from CoinGlass, a total of $425 million leveraged positions have been liquidated across the crypto market — $216 million of which were long liquidations.

Total Crypto Liquidations.

Total Crypto Liquidations.

More than $189 million in Bitcoin positions have been liquidated over the last 24 hours, $87 million of which have been liquidated in the previous 12 hours alone. Of these, $81 million were long BTC positions against $107.97 million short BTC liquidations.

The consequences of such massive liquidations are unpredictable, and market participants should be cautious in the coming days.

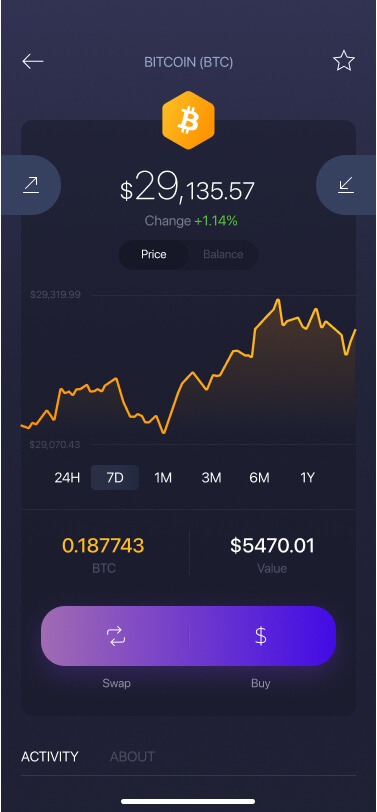

Bitcoin appears to have amassed significant support at the $54,700 mark. However, a move below it would liquidate approximately $750 million worth of cumulative leveraged long positions across all exchanges, according to CoinGlass data.

Bitcoin Support.

Bitcoin Support.

In addition to the German government’s selling spree, the long-awaited repayment process for the creditors of the defunct crypto exchange Mt. Gox has begun, with repayments in Bitcoin and Bitcoin Cash (BCH) scheduled. The balance to be repaid stands at a significant $9 billion worth of BTC and BCH, as well as additional funds held by the trustee.

Mt. Gox Repayment.

Mt. Gox Repayment.

Crypto exchange Bitstamp aims to swiftly distribute its portion of Bitcoin repayments to Mt. Gox creditors, even though it has up to two months to do so once it receives the coins. This comes after Bitcoin was moved out of wallets associated with Mt. Gox, according to blockchain analytics firm Arkham Intelligence, with $2.71 billion being transferred from the exchange’s cold wallet, supposedly in readiness for the repayments.

Despite the expected near-term selling pressure, market participants still expect Bitcoin prices to climb again, continuing the bull market once the selling cools off.