Genesis Set to Repay $2 Billion to Cryptocurrency Fraud Victims

Bankrupt cryptocurrency lender Genesis has made headlines with a staggering announcement— it will repay $2 billion to victims of its alleged fraudulent practices. This monumental decision comes from New York prosecutors, marking what is set to be the largest settlement ever achieved against a cryptocurrency company. Pending approval from a bankruptcy court, this settlement will establish a victims’ fund targeting investors and creditors across the nation, including over 29,000 individuals from New York alone.

A Call for Justice

New York Attorney General Letitia James heralded this settlement as a pivotal moment for the victims. She stated,

“This historic settlement is a major step towards ensuring the victims who invested in Genesis have a semblance of justice.” With this announcement, it becomes painfully clear how the cryptocurrency landscape, often romanticized for its promise of wealth, can devolve into a realm of deception and pain. The unfortunate reality is that many have been left to pick up the pieces due to the rampant lack of oversight and regulation in this industry.

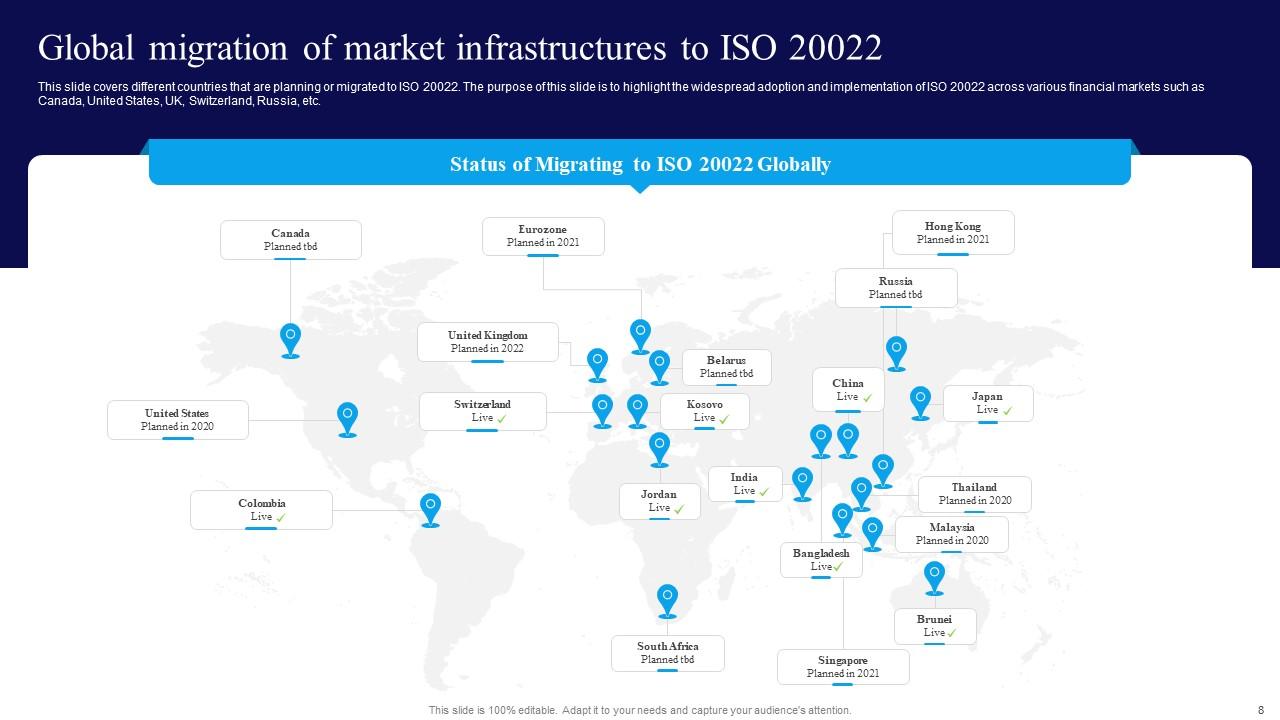

A visual representation of the expanding cryptocurrency landscape.

Ever since Genesis filed for Chapter 11 bankruptcy protection in early 2023, the company has been mired in controversy. The price drops in cryptocurrency and the catastrophic fall of platforms like FTX have sent shockwaves throughout the ecosystem. In a recent statement, James mentioned how the lawsuit filed in October 2023 accused Genesis of masking $1.1 billion in losses from its investors, a claim they have neither admitted nor denied.

Strong Measures and Far-Reaching Impact

The settlement not only mandates the return of funds to victims but also serves as a safeguard against future misconduct. As part of the agreement, Genesis has been barred from operating in New York, an indication that regulatory bodies are tightening the noose on errant firms in the cryptocurrency space. This move reflects a transformative era where investor trust needs tangible protecting measures surrounding transparency and accountability.

With the approval of a Chapter 11 repayment plan earlier this month, the court’s decision paves the way for Genesis to return customer assets that have been on hold since the enterprise’s bleak collapse in November 2022. Such events leave a harsh imprint on the psyches of investors who once viewed the crypto market as the next gold rush.

Lessons to Be Learned

From my perspective, witnessing these unfolding events offers both dread and hope. The devastating losses faced by thousands should serve as a stark reminder to investors— caution is paramount when embarking on the often treacherous journey of cryptocurrency investing. The allure of quick riches can easily hypnotize individuals into overlooking the inherent risks involved in such volatile markets.

An image that encapsulates the importance of making informed financial choices.

As we navigate this new chapter, one question plagues the minds of many seasoned investors: Can we trust this industry again? The swift pace of regulatory actions may lead to a more robust framework—one that mitigates risk and enhances investor protection. However, trust, once shattered, does not easily reassemble.

A Shaky Foundation

The foundation of trust within cryptocurrency has been shaken, with Genesis epitomizing the perils that lurk under the surface. The very fabric that claims to promote decentralization and democratize finance is marred by individuals who exploit the unregulated waters. This settlement should influence other companies to adopt a more responsible approach towards their operations, lest they face similar consequences.

As I reflect on this situation, I can’t help but draw parallels between the evolution of technology and our responsibility as users. We stand at a critical junction— a turning point where we must ensure that those who tread this path of innovation do so with integrity. It is imperative to foster an environment that prioritizes ethics and transparency above all else.

Though we are witnessing enforcement actions and settlements at unprecedented scales, it is essential to keep the discourse surrounding this industry alive.

To ensure that the lessons of Genesis reverberate throughout the industry, we need to foster a community that advocates for transparency and champion practices that protect investors.

Moving Forward

The prospect of recovering funds is a silver lining for many victims. However, it is my hope that this settlement is merely the first step in what will be a concatenation of reforms within the cryptocurrency domain. The time has come for us to demand greater accountability from companies operating within this space. As an investor, what weighs heavily on my mind is how we can ensure a safer environment for future investors amid overarching risks.

As always, the world of cryptocurrency remains unpredictable and fraught with challenges. We must embrace these challenges while advocating for an industry that upholds accountability, transparency, and, ultimately, trust.

Imagining a more accountable future for cryptocurrency.

Photo by

Photo by