The Rise of Cryptocurrency Solutions: Garanti BBVA’s Self-Developed Wallet and the Current State of Crypto Markets

In a move signaling the evolution of banking in an increasingly digital economy, Garanti BBVA has officially launched its own cryptocurrency wallet called Garanti BBVA Digital Assets. This launch positions Garanti BBVA as the first Turkish bank to introduce a self-developed cryptocurrency wallet, following a year of anticipation during its beta phase. With a robust user base of 12 million digital and 11.6 million mobile customers, the bank is poised to significantly impact the Turkish crypto landscape. Users can now conveniently store and transfer major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and the USDC stablecoin via its mobile app.

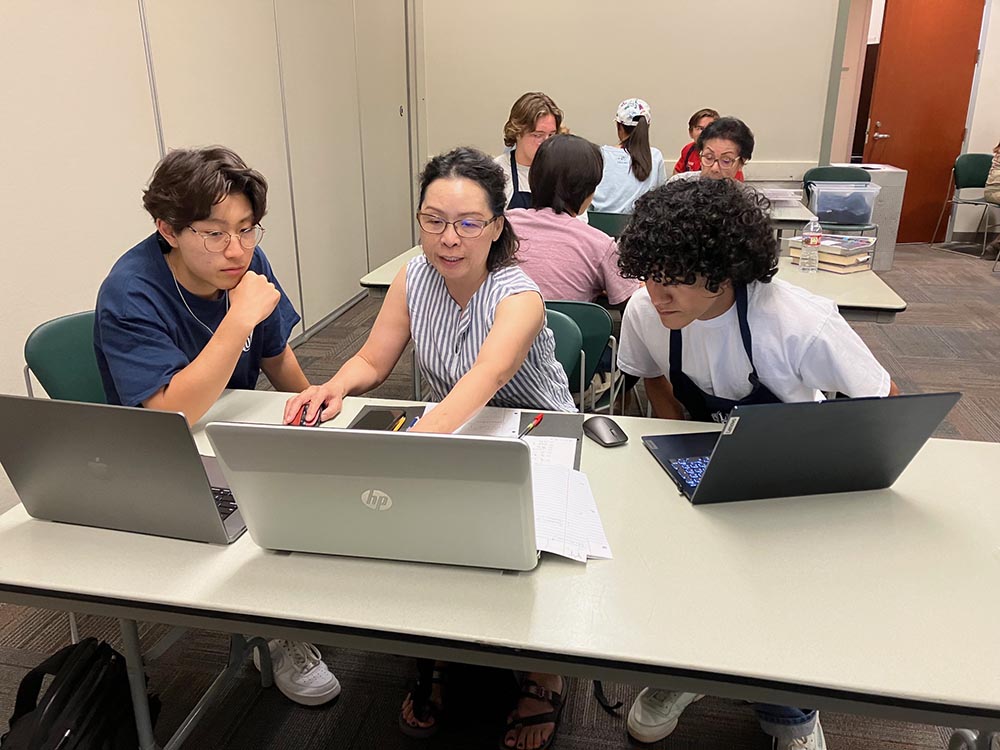

Garanti BBVA’s Cryptocurrency Wallet Launch Event

Garanti BBVA’s Cryptocurrency Wallet Launch Event

In a recent statement, Özgür Süze, the Executive Vice President of BBVA Digital Assets, conveyed the bank’s commitment to innovation. He emphasized that the bank intends to enhance its offerings by diversifying both its asset range and the services around them. This strategy reflects an understanding of the growing demand for cryptocurrencies among consumers, especially in light of the significant depreciation of the Turkish Lira.

Turkish Crypto Legislation: A Double-Edged Sword

Despite the enthusiasm surrounding cryptocurrency wallet innovations, the regulatory framework in Turkey remains a mixed bag. Current legislation, established in 2021, prohibits the use of crypto-assets for payments and restricts some banking activities involving cryptocurrencies. However, there are signs of an impending comprehensive framework that might provide more clarity and potentially promote the use of digital assets.

The discussion about enabling cryptocurrencies comes at a critical time. With the Turkish Lira losing over 80% of its value over the last five years, assets such as Bitcoin and stablecoins are increasingly seen as safe havens. Already, innovative banks like BBVA have embraced cryptocurrency much earlier than many of their Western counterparts, such as BBVA Switzerland, which offered digital asset services starting in 2021.

Market Performance: Bitcoin’s Recent Struggles

As Garanti BBVA’s progress unfolds, the global cryptocurrency market faces its own set of challenges. Major cryptocurrencies have seen significant declines, particularly Bitcoin, which recently fell below the $66,000 mark. This downturn, triggered by a mix of profit-taking and substantial outflows from U.S.-listed Bitcoin ETFs, has cast a shadow over market sentiment. According to CoinGecko, Bitcoin was pricing at nearly $66,500 while Ethereum tested levels around $3,400, illustrating a broader pullback impacting the entire sector.

In a commentary, Neil Roarty, an analyst at Stocklytics, suggested that external factors, including heightened political uncertainty in Europe, particularly after French President Emmanuel Macron’s unexpected decision to call a snap election, have contributed to a stronger dollar, which traditionally weighs down Bitcoin prices.

“A strong dollar tends to put downward pressure on Bitcoin,” Roarty stated. “It would take considerably lower interest rates and a weaker dollar to push BTC closer to the $70,000 mark.”

The Altcoin Landscape

While Bitcoin and Ethereum have been leading the downturn, altcoins such as Dogecoin (DOGE) and Solana (SOL) have witnessed even sharper losses, plummeting by nearly 9% in recent trading hours. Notably, the broader CoinDesk 20 Index has declined by 4.2%, reflecting widespread bearish sentiment across the market. Consequently, positive developments regarding Ethereum ETFs have done little to sustain its price, a situation analysts like Alex Kuptsikevich from FxPro predict will continue in the near term due to increased liquidity and selling pressure.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/D3KVNETAPFAN3EYJGV2M7JCRR4.jpg) Crypto Market Trends: Navigating the Downturn

Crypto Market Trends: Navigating the Downturn

BTC Prague 2024: A Hub for Bitcoin Advocacy

Amidst this financial backdrop, events like BTC Prague 2024 have showcased the resilience and innovation within the cryptocurrency community. The conference, held in the culturally rich city of Prague, served as a gathering for enthusiasts and advocates, highlighting the ongoing dialogue surrounding Bitcoin’s role in achieving financial freedom. Featuring significant discussions such as “Building the Bitcoin Revolution for Fun & Profit,” participants urged commitment to the Bitcoin cause as a countermeasure against existing financial systems.

In one memorable quote, Erik Cason, a known figure in the cypherpunk movement, urged those present to embrace their role in this evolution, saying, > “The only way to deal with an unfree world is to become so free that your very existence is an act of rebellion.” This commentary underscores the intrinsic link between Bitcoin and the pursuit of personal freedoms in an increasingly regulated financial landscape.

Promoting Inclusivity in Cryptocurrency

A significant highlight was the event organized by Les Femmes Orange, which aimed to enhance women’s representation in the Bitcoin sphere. With over a hundred women gathering for networking and discussion, organizer Rachael Geyer emphasized the role of inclusivity in fostering a balanced future for the cryptocurrency ecosystem. Initiatives like these underscore not just the tech-driven aspects of cryptocurrency but also the imperative of community engagement and education.

As the conference closed, conversations around “Protecting Bitcoin from Fiat Corruption”, led by Michelle Weekly, reiterated the urgency of instilling integrity and transparency into the evolving digital asset landscape. With the industry’s future in flux, the pursuit of education and strategic discussions at forums like BTC Prague is vital for navigating the upcoming challenges.

In summary, while Garanti BBVA moves forward with its cryptocurrency wallet to meet new consumer demands in Turkey, the global crypto markets navigate a tricky environment marked by price volatility, regulatory scrutiny, and the need for proactive community engagement. The juxtaposition of institutional efforts and grassroots movements speaks to the diverse avenues through which the cryptocurrency revolution continues to unfold, poised for transformation in a complex economic landscape.

Conclusion

The digital asset space is in a state of dynamic flux. As Garanti BBVA leads with its innovative wallet while crypto prices oscillate, these developments reflect a larger metamorphosis within the financial sector, where regulatory frameworks, market sentiment, and community initiatives will collectively shape the future of cryptocurrencies. Whether in Turkey or across the globe, our engagement with these themes will shape the narrative of finance in the years to come.