FTX’s Road to Redemption: A New Chapter for Customers

The cryptocurrency exchange FTX has filed a plan to fully reimburse its customers, who were defrauded of billions of dollars. This move marks a significant step towards redemption for the company, which imploded in 2022.

FTX’s new chapter

FTX’s new chapter

According to the amended Plan of Reorganization filed in a U.S. bankruptcy court, FTX estimates that it has between $14.5 billion and $16.3 billion to distribute to customers and other creditors around the world. This is a welcome relief for customers who were left in the lurch when the exchange collapsed.

“We are pleased to be in a position to propose a chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors,” said John Ray III, FTX’s new CEO.

The plan provides for supplemental interest payments to creditors, to the extent that funds still remain. The interest rate for most creditors is 9%. This may be a small consolation for investors who were trading cryptocurrency on the exchange when it collapsed. However, it’s a step in the right direction.

Bitcoin’s remarkable recovery

Bitcoin’s remarkable recovery

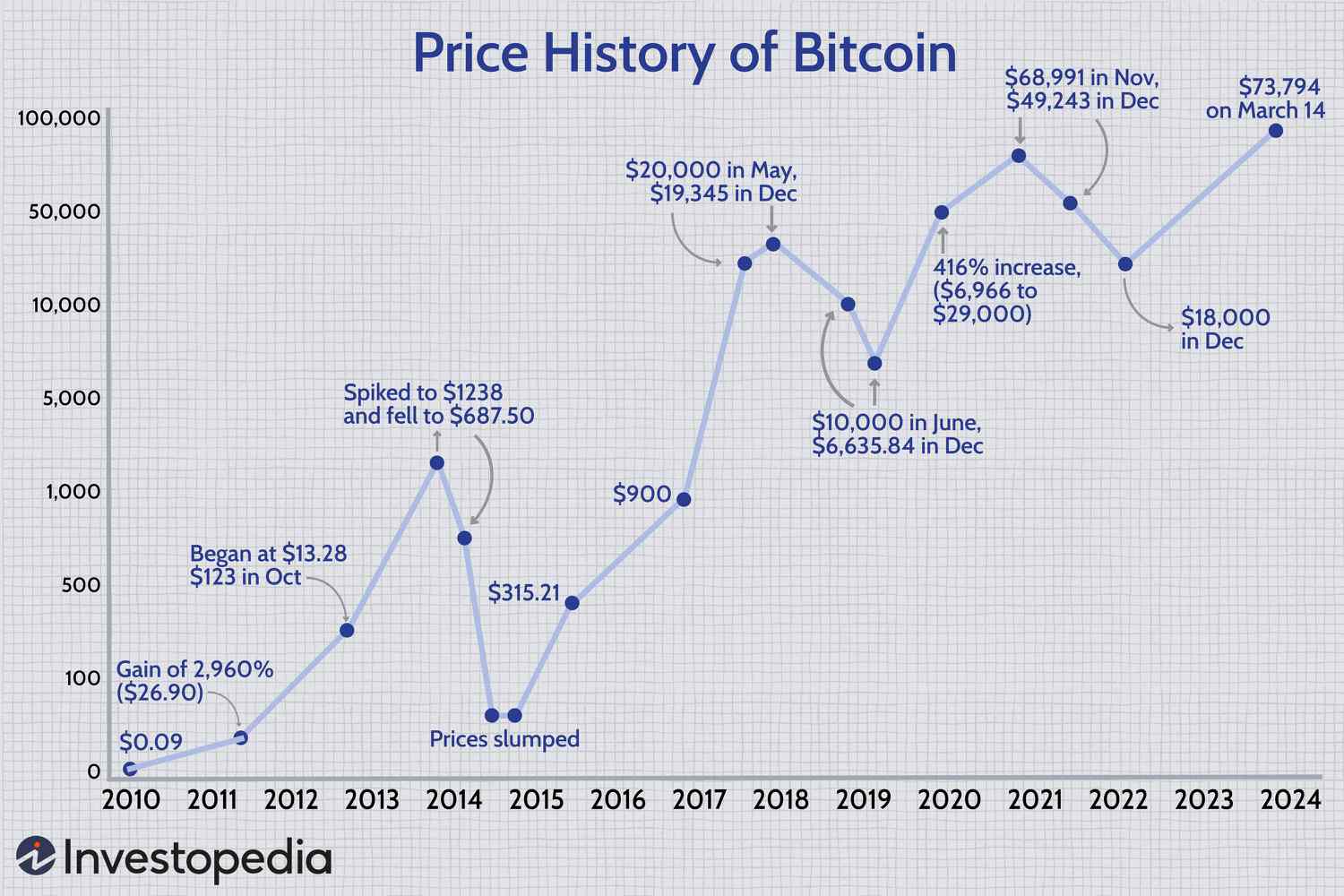

When FTX sought bankruptcy protection in November 2022, bitcoin was trading at $16,080. However, crypto prices have soared since then, with a single bitcoin selling for close to $62,675 on Tuesday. This represents a 290% increase, a bit less than that if accrued interest is counted.

Customers and creditors who claim $50,000 or less will receive about 118% of their claim, covering about 98% of FTX customers. FTX was able to recover funds by monetizing a collection of assets, mostly consisting of proprietary investments held by Alameda or FTX Ventures businesses, or litigation claims.

Sam Bankman-Fried’s fall from grace

Sam Bankman-Fried’s fall from grace

FTX’s collapse was a dramatic fall from grace for its founder and CEO, Sam Bankman-Fried. He was convicted of fraud and conspiracy in November and sentenced to 25 years in prison. The company appointed John Ray III, a long-time bankruptcy litigator, as its new CEO.

The future of FTX remains unclear, but the company is exploring the possibility of reviving its crypto exchange, FTX.com. However, the sordid details of the company’s past may hamper its comeback.

Binance, the largest crypto exchange

Binance, the largest crypto exchange

The rival crypto exchange Binance briefly explored acquiring FTX before it collapsed in late 2022. Its founder and former CEO, Changpeng Zhao, was sentenced to four months in prison for looking the other way as criminals used the platform to move money connected to child sex abuse, drug trafficking, and terrorism.

The bankruptcy court is set to hold a hearing on the dispersion of FTX assets on June 25. As the crypto world watches, one thing is clear: FTX’s road to redemption is long and arduous, but it’s a step in the right direction.