FTX’s New Plan: A Glimmer of Hope for Crypto Customers

A new restructuring plan from the fallen FTX cryptocurrency exchange is expected to give 98% of its creditors more than 118% of allowed claims. This comes as a welcome relief to customers who lost their assets when the exchange collapsed in November 2022.

FTX’s new plan aims to return more than 118% of allowed claims to creditors

FTX’s new plan aims to return more than 118% of allowed claims to creditors

The plan follows a previous offer in October 2023 that allowed investors access to 90% of their assets left on the bankrupt exchange. FTX founder and CEO Sam Bankman-Fried was sentenced in late March to 25 years in prison for his part in the exchange’s downfall.

What’s in FTX’s New Plan?

The new plan provides for 98% of all customers, including those holding claims of $50,000 or less, to receive up to 118% of their allowed claims within 60 days. FTX forecasts that the total value of assets collected, converted to cash, and available for creditors will be between $14.5 billion and $16.3 billion.

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors.” - John J. Ray III, chief restructuring officer of FTX

FTX’s new plan aims to return 100% of bankruptcy claim amounts plus interest for non-governmental creditors

FTX’s new plan aims to return 100% of bankruptcy claim amounts plus interest for non-governmental creditors

How Is This Plan Different From the One Before?

A previous plan proposed refunding up to 90% of distributable assets to customers. The recovered assets were those held by the company in various entities in the Bahamas, Australia, and the U.S. Investors who withdrew more than $250,000 from the exchange in the nine days before its collapse were expected to pay a 15% fee on the value of the funds to avoid potential clawback.

Is It Enough?

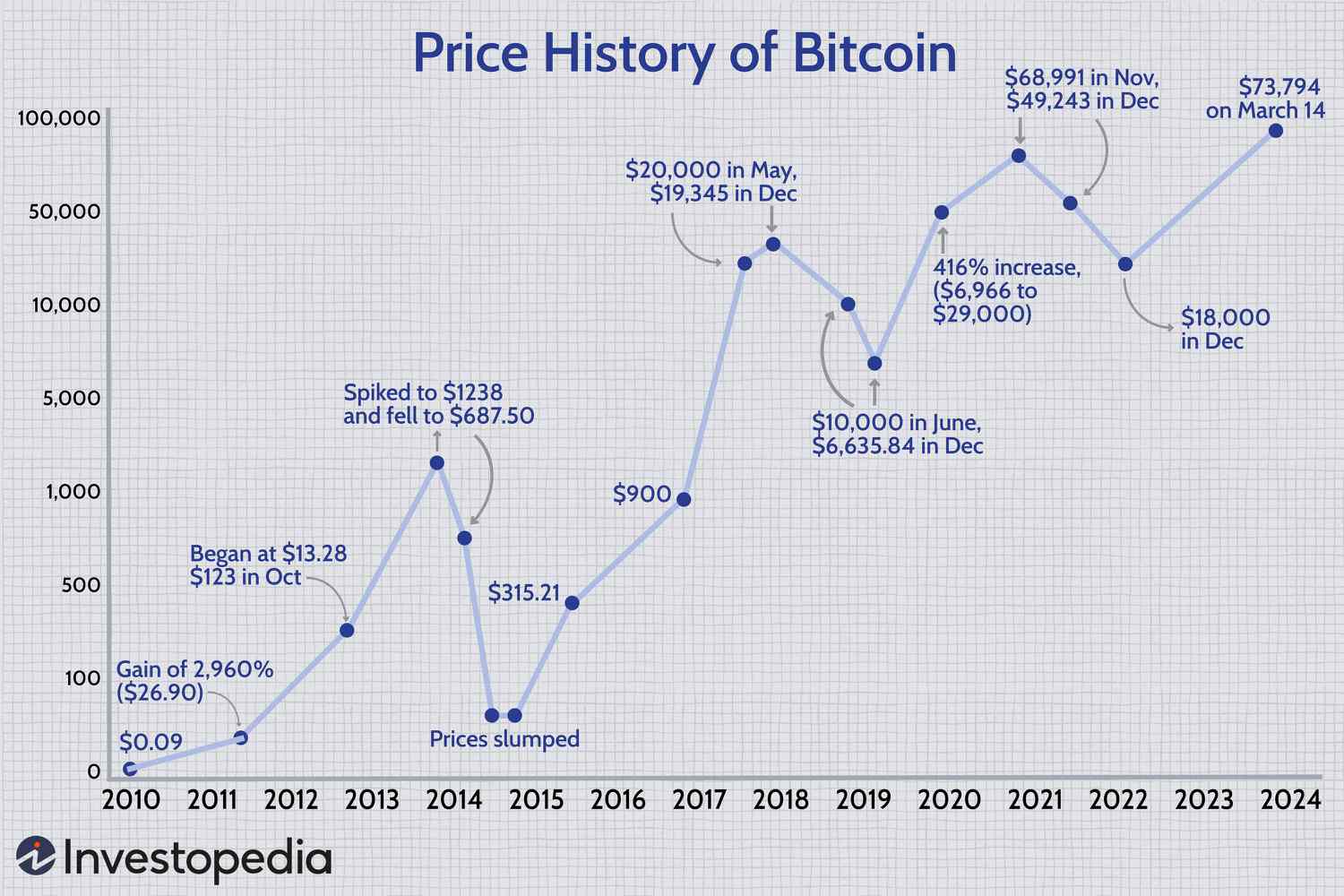

One of the biggest criticisms of any FTX plans to repay its customers’ lost funds is that it’s returning money in dollars based on Nov. 11, 2022, cryptocurrency prices, not the cryptocurrency itself or repaying at its current value, which has appreciated greatly. For example, bitcoin (BTC) was trading roughly around $17,000 on Nov. 11, 2022; today, its price is more than 3.5 times that at about $62,500.

Bitcoin price has appreciated greatly since November 2022

Bitcoin price has appreciated greatly since November 2022

FTX collapsed and filed for bankruptcy in November 2022 after commingling of customer funds between FTX and its Alameda Research investment arm meant customers were unable to withdraw more than $8 billion in investments that had been used for other purposes.

Former FTX CEO Bankman-Fried was sentenced to 25 years in prison for crypto fraud in late March. As the crypto community continues to grapple with the aftermath of FTX’s collapse, this new plan offers a glimmer of hope for customers who lost their assets.