Crypto News: Bitcoin’s Transformation and Lower Costs for Investments

The financial landscape is experiencing a drastic shift as major players begin to embrace digital currencies. Recently, Larry Fink, the CEO of BlackRock, acknowledged a significant error in his past reservations regarding Bitcoin. In an insightful interview, he revealed that his earlier skepticism has transformed into genuine support for the cryptocurrency, now viewing it as a legitimate financial instrument in today’s complex economic climate.

Larry Fink’s Change of Heart

In a candid moment with CNBC, Fink confessed, “I was wrong about #Bitcoin”. Recognizing Bitcoin’s potential, he articulated how it can serve as a stable asset against currency devaluation, particularly in economically challenged countries. He emphasized Bitcoin’s role as a safeguard for individuals concerned about their financial security, suggesting that it grants them increased control over their assets beyond government scrutiny.

An evolving perception of Bitcoin’s role in financial portfolios

An evolving perception of Bitcoin’s role in financial portfolios

Fink further characterized Bitcoin as “digital gold”, arguing for its essential inclusion in investment portfolios, especially during turbulent times. However, he cautioned that Bitcoin is not for the overly optimistic but instead for those seeking financial security in an unpredictable world.

Market Sentiment and Bitcoin’s Stellar Performance

This new wave of optimism surrounding Bitcoin, echoed by influential figures like Michael Saylor and even Donald Trump, has contributed to a surge in BTC’s value. In recent weeks, Bitcoin witnessed a price explosion, bouncing back from its lowest point of $52,500 to surpass $64,000. Currently, it sits at around $63,750.

Prominent analysts also share this bullish sentiment. For instance, Lark Davis pointed out that Bitcoin had already climbed 6% in September, a month historically known for declines. He reflects on the past, where positive Septembers often led to remarkable Q4 recoveries for Bitcoin, raising hopes for another rally.

The Future Looks Bright: Resistance Levels and New Heights

Should Bitcoin maintain its upward trajectory, analysts speculate it could breach critical resistance at $70,000, a level it has struggled to overcome in recent months. With growing momentum, the breakout this time could propel Bitcoin towards unprecedented heights, potentially reaching over $80,000 by year-end and edging closer to that elusive $100,000 mark.

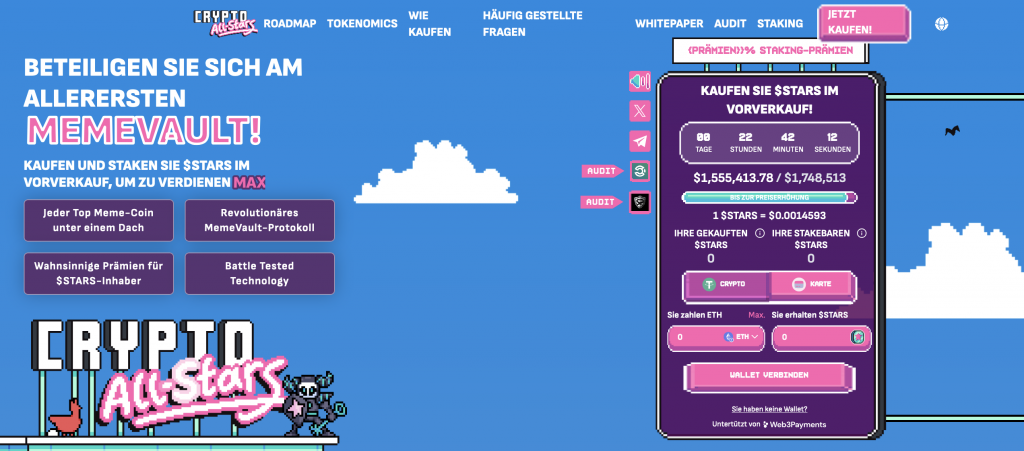

This potential rally bodes well not only for Bitcoin but also for various altcoins and innovative projects. One such initiative gaining traction is the newly emerging Crypto All-Stars with its STARS coin, aiming to revolutionize the meme coin staking landscape.

Revolutionizing staking in the meme coin arena

Revolutionizing staking in the meme coin arena

Crypto All-Stars promises to simplify the staking process for popular meme coins, allowing users to stake assets like DOGE and SHIB in one consolidated platform. Their recently introduced MemeVault protocol allows meme coin holders to earn rewards through their own STARS coin, redefining how users engage with their assets.

Lower Costs, Greater Accessibility with 21Shares

As the cryptocurrency market grows increasingly mainstream, financial accessibility is paramount. In this context, 21Shares, known for its pioneering crypto exchange-traded products (ETPs), has recently announced significant fee reductions for its flagship offerings: the 21Shares Crypto Basket 10 ETP and the 21Shares Bytetree BOLD ETP. This strategic move lowers management fees to 0.49% and 0.65%, respectively, making these innovative instruments available to a broader audience.

The 21Shares Crypto Basket 10 ETP provides diversified exposure to the ten largest digital assets by market cap, updating its allocations quarterly. The recent fee reduction enables investors to engage more cost-effectively with this growing asset class. Simultaneously, the 21Shares Bytetree BOLD ETP blends Bitcoin with gold, striking a balance between traditional and digital asset security, ideal for investors seeking inflation hedges.

Quotes from Mandy Chiu, Head of Financial Product Development at 21Shares, reaffirm the company’s commitment to broadening access to cryptocurrency investments: “By lowering the fees for HODLX and BOLD, we empower more investors to partake in the future of finance at minimal costs.”

Conclusion: Embracing a New Financial Era

Both Fink’s shift in perspective and the fee reductions from 21Shares illustrate the rapidly evolving landscape of cryptocurrency investments. With increasing validation from established financial giants and initiatives aimed at lowering barriers to entry, the future of cryptocurrencies appears more promising than ever. As Bitcoin and altcoins pave new pathways in finance, they offer investors not just opportunities but a new paradigm of investment possibilities in an increasingly digitized world.

Investments in these financial instruments are both exciting and risky. Prospective investors should remain informed and mindful of individual financial circumstances when considering options. For a comprehensive exploration of the available ETPs and the burgeoning crypto market, visit www.21.co and www.21shares.com.

Photo by

Photo by