Why Bitcoin Cash, Kaspa, and Stacks Surged Higher Today

Sentiment in the cryptocurrency world appears to be cooling this afternoon, after a rather hot morning of trading, in which most major tokens saw impressive rises. As of 3:15 p.m. ET, Bitcoin Cash and Kaspa remain two of the biggest winners, surging 6.7% and 12.8%, respectively, over the past 24 hours. Over the same time frame, Stacks is also up 1.6%, but was up more than 8% at its intraday high.

Interestingly, these three altcoins have continued to move in relatively high correlation to other risk assets, such as the high-growth technology stocks represented in the Nasdaq Composite. This morning’s earlier surge has seen some selling pressure this afternoon, with investors of all stripes appearing to be taking a breather (and maybe some profits) after this year’s very hot start.

Of course, the macro picture will likely continue to determine directional intraday moves, and investors will want to pay close attention to such drivers. However, these three tokens also have their own unique catalysts worth diving into.

Why are these three tokens surging today?

Sticking with the macro picture for a second, capital flows into Bitcoin have permeated into other areas of the crypto market. Bitcoin Cash is one notable and obvious beneficiary of this move, as investors look for exposure to cryptocurrencies with transaction-based business models. Interestingly, an announcement from Coinbase Global yesterday that the largest centralized exchange in the U.S. will offer futures trading for Bitcoin Cash and two other tokens on April 1 has sent this token higher. Expectations are that traders will be looking to trade Bitcoin Cash via these future contracts, increasing trading liquidity (and potentially spurring even greater higher-volatility moves).

Kaspa has continued to see interest in its high-speed network grow alongside its reported transaction throughput numbers. The proof-of-work blockchain player recently hit an all-time high amid increasing transaction activity on its network, and remains a top-40 crypto by market capitalization investors continue to watch closely.

Stacks’ pop and drop today is among the more intriguing moves, as it appears the token’s initial increase earlier today (and over the past few days for that matter) can be tied to commentary from the project’s founder, Muneeb Ali, who mentioned that crypto investors are increasingly focusing on altcoins such as Stacks for greater exposure to the trends this sector has to offer. And while mega-cap tokens like Bitcoin may be better bets from a store of value perspective, his view is that the more utility that’s built on-chain, the better it will be for all tokens. In other words, investors are once again factoring strong ecosystem and network effects into their investing activity.

How sustainable are these catalysts?

To some degree, the catalysts driving these three tokens higher today come with a certain amount of risk. The Commodity Futures Trading Commission (CFTC) hasn’t approved Coinbase’s futures offerings for Bitcoin Cash (though these products have been offered via a program that allows for such issuances), fundamentals can always deteriorate on any blockchain, and network effects in the crypto world are only as good as the influx of users into the ecosystem. In other words, if investor and user sentiment turns, these catalysts could turn out to be moot.

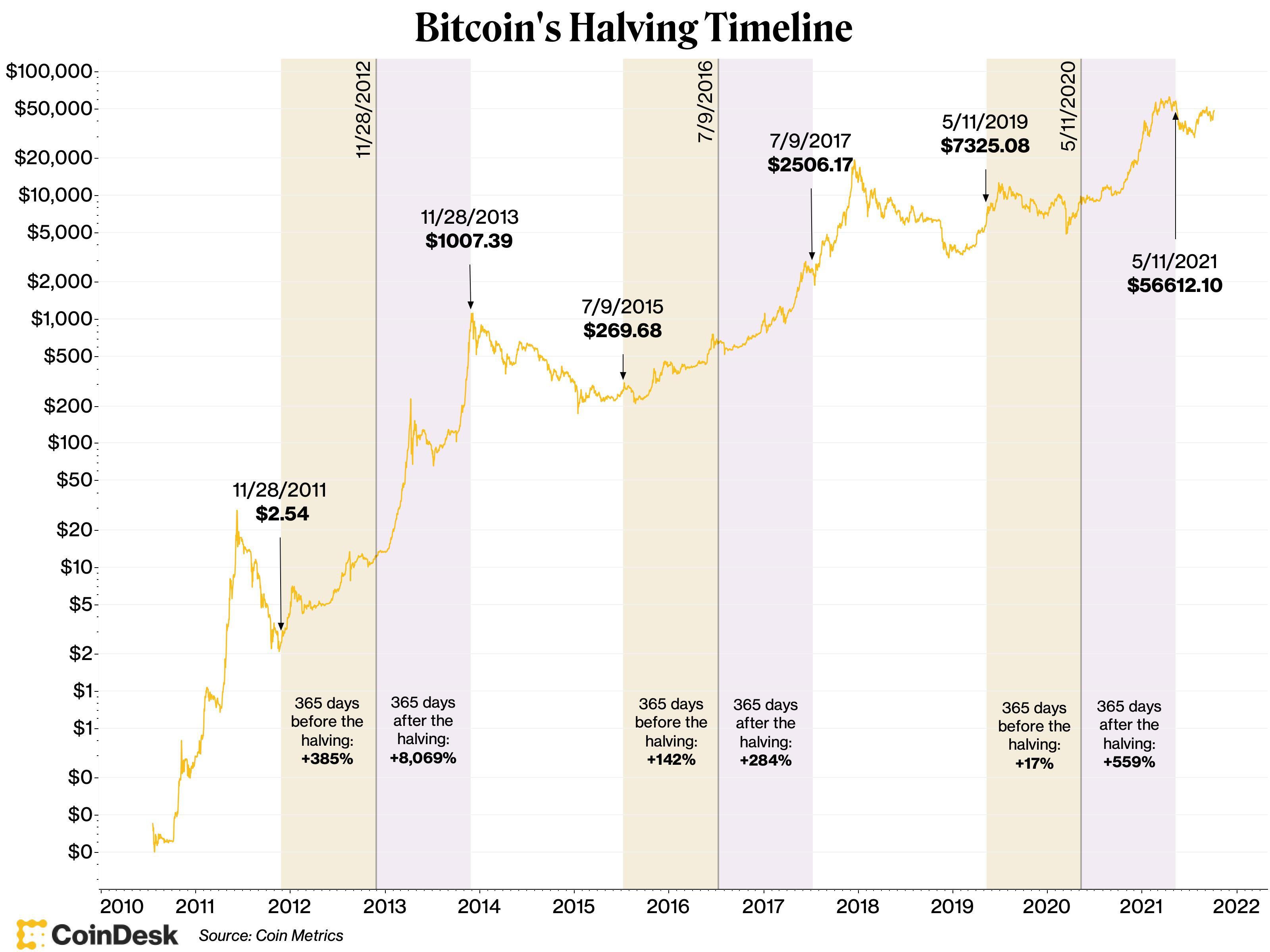

That said, it’s clear that many investors are simply playing the supply and demand game in the crypto sector right now. More demand for these existing tokens should lead to higher prices, all things being equal (which they aren’t; many of these tokens are highly inflationary, but you get my point). So long as money is coming in, these altcoins could see higher prices. It’s as simple as that, and the market appears to be seeing things this way right now.

Should you invest $1,000 in Bitcoin Cash right now?

Before you buy stock in Bitcoin Cash, consider this: The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now& and Bitcoin Cash wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002.*

*Stock Advisor returns as of March 21, 2024

Chris MacDonald has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Coinbase Global. The Motley Fool has a disclosure policy.