Ethereum’s Bullish Outlook: Why $8,000 May Be in Sight

The cryptocurrency market has been abuzz with excitement following a bullish analysis from Standard Chartered’s Geoff Kendrick, who predicts that Ethereum could more than double in value by the end of the year. But does this projection make sense, and how might it impact the market?

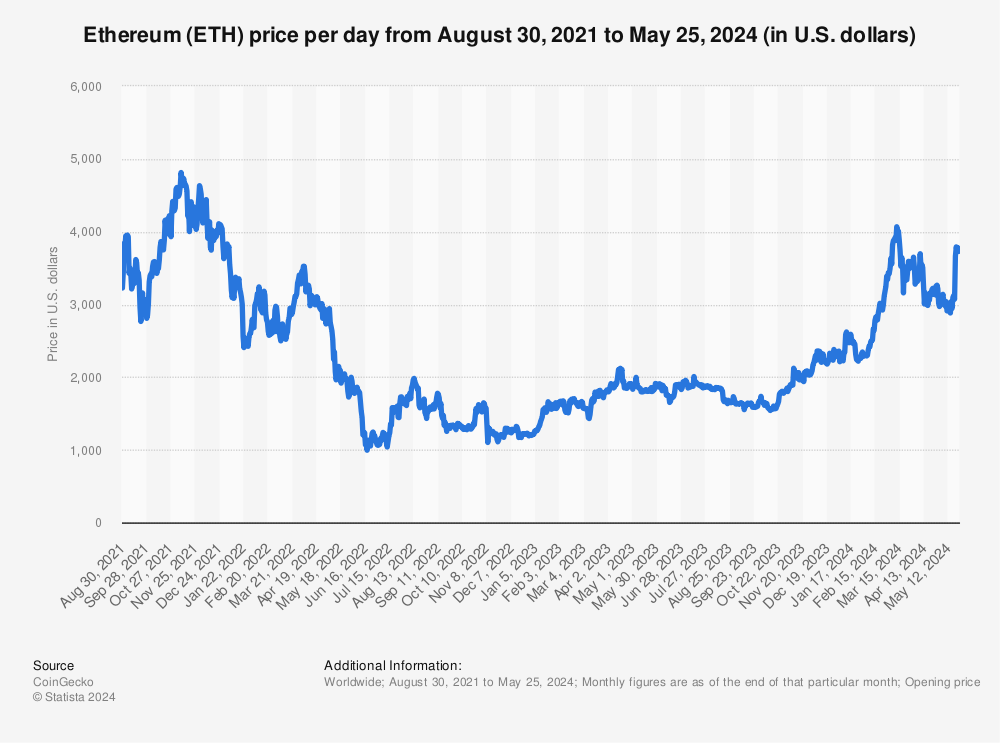

Ethereum’s price has been on the rise, but can it reach $8,000 by the end of the year?

Ethereum’s price has been on the rise, but can it reach $8,000 by the end of the year?

Kendrick’s analysis is based on the assumption that the U.S. Securities and Exchange Commission (SEC) will approve the first exchange-traded funds (ETFs) tracking Ethereum’s spot price. This, he argues, will inspire large money inflows into the Ethereum cryptocurrency, similar to the inflows that followed the approval of spot Bitcoin ETFs in January.

“Given that we now see Bitcoin reaching the $150,000 level by end-2024, this would imply a level of $8,000 for Ether,” Kendrick said.

The SEC has since moved closer to approving Ethereum ETFs, which could be a major boost to the cryptocurrency’s price. While the process may take months, the established precedent of Bitcoin ETFs suggests that the SEC’s approval may be expedited.

The SEC’s approval of Ethereum ETFs could be a major catalyst for the cryptocurrency’s price growth.

The market has already reacted positively to Kendrick’s forecast, with Ethereum’s price surging 23% in the days following the announcement. But what does this mean for investors, and how can they take advantage of this bullish outlook?

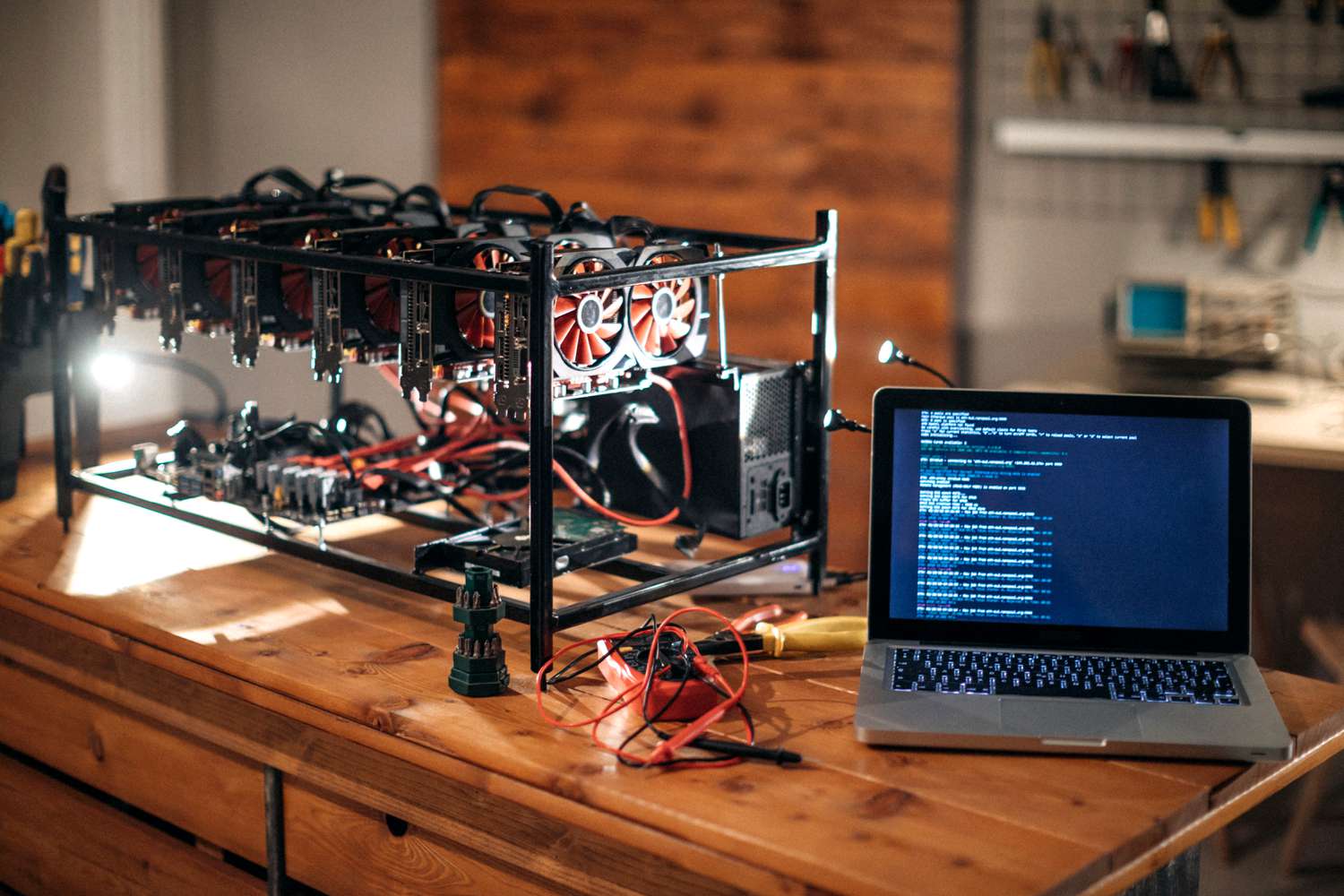

From a logical perspective, the idea of rising crypto prices makes sense. The halving of Bitcoin mining rewards makes it harder to come by freshly minted digital coins, while the new ETFs open the floodgates to nearly direct Bitcoin investments by several new types of buyers.

The halving of Bitcoin mining rewards could lead to a surge in price.

The halving of Bitcoin mining rewards could lead to a surge in price.

So, what’s the takeaway for investors? While it’s impossible to predict the future with certainty, it’s clear that Ethereum and Bitcoin are poised for a price surge in the coming year. A diversified approach with crypto playing a modest part in a diversified portfolio will let you enjoy the benefits of a price surge without risking it all.

Ethereum looks like a solid buy today, but I wouldn’t hold my breath waiting for Kendrick’s specific $8,000 target to materialize. Instead, focus on the bigger picture and the long-term potential of this burgeoning market.

The cryptocurrency market is poised for a surge in the coming year.

The cryptocurrency market is poised for a surge in the coming year.