Ethereum’s Price Surge: What Lies Ahead?

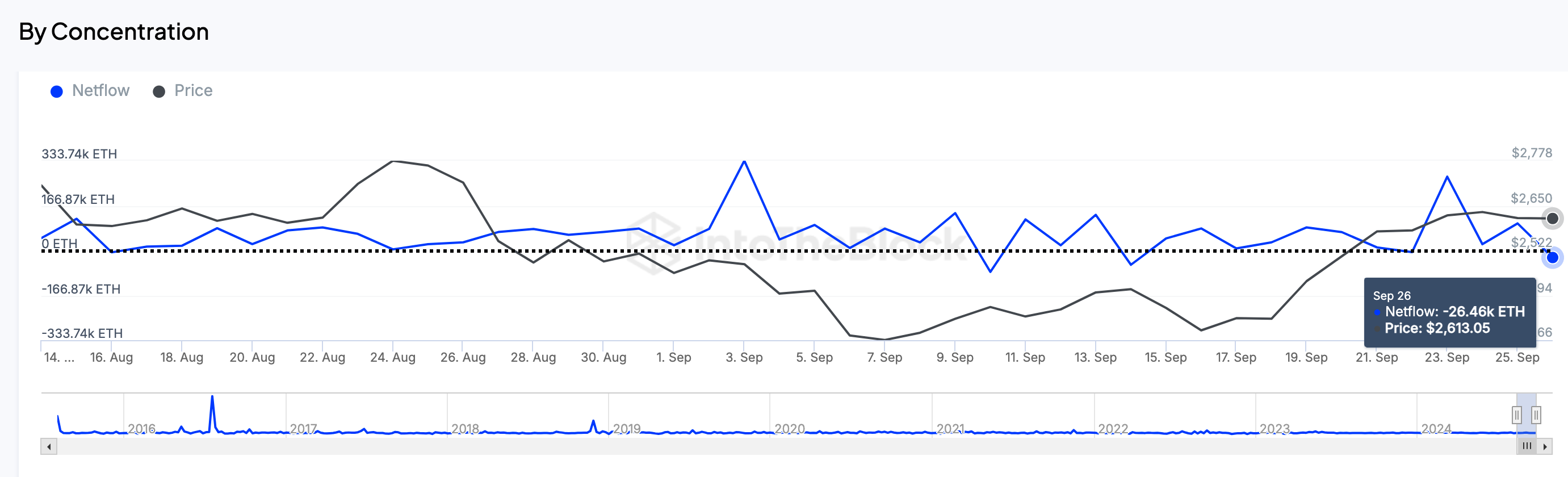

Ethereum has recently made headlines by breaching the significant $2,700 resistance level on September 27, marking a 10% increase over the week. Following this pivotal movement, data from on-chain analytics revealed that major investors, particularly Ethereum whales, began to unload substantial amounts of ETH as the price surpassed $2,650 just a day prior. This sudden shift in investor behavior came amid mounting speculation regarding Ethereum’s price trajectory.

Analyzing the effect of strategic sell-offs on Ethereum’s price stability.

Analyzing the effect of strategic sell-offs on Ethereum’s price stability.

Recent Trends and Market Sentiment

The boost in Ethereum’s price is notable, especially considering the coinciding release from prison of former Binance CEO Changpeng Zhao, which has rejuvenated the optimism surrounding the cryptocurrency sector. As a result, Ethereum reached a new monthly high of $2,727, demonstrating strong bullish sentiment.

However, the euphoria was short-lived, as profit-taking became evident almost immediately. On September 26, Ethereum experienced a sizable net sell-off of approximately 26,460 ETH by whales, leading to a potential correction as the market evaluated its next steps amidst the profit-taking activity.

Technical Analysis: Levels to Watch

For Ethereum to continue on its upward trajectory, it must decisively break through the next resistance level at $2,755. This price point serves as a crucial threshold, as exceeding it could pave the way for a climb towards $2,800 or higher. Conversely, if Ethereum fails to uphold the current support levels, it may signal deeper corrections ahead, raising concerns among traders who opt for shorter positions as selling pressure mounts.

“A decisive break above $2,755 is crucial for ETH’s bullish outlook,” analysts warn. “Anything below that might trigger a more pronounced correction.”

Charting the resistance and support levels for Ethereum’s price dynamics.

Charting the resistance and support levels for Ethereum’s price dynamics.

The Bigger Picture: Ethereum in the Crypto Landscape

Ethereum’s recent performance in the market underscores its volatility and the influence of high-stake investors. Cracks in this bullish momentum also reflect a broader trend in cryptocurrency trading, where minor sell-offs can lead to substantial corrections. Traders and investors are now turning their focus on upcoming events and market sentiment assessments that could dictate Ethereum’s performance as the month progresses.

Furthermore, the shifting dynamics around regulatory developments and market speculation surrounding major cryptocurrencies like Bitcoin (BTC) and Ripple (XRP) continue to instigate further price adjustments across the board.

Related Articles

- XRP News Today: XRP Faces Pressure as Appeal Risk Clouds Price Outlook

- Ripple (XRP) Price Analysis: XRP Traders Raise Leverage by 200% as BTC, BNB, TON Flash Bullish Signals

- Bitcoin Weekly Price Forecast – Bitcoin Breaks Higher Again

Conclusion: Eyes on Ethereum

As Ethereum pushes through key resistance levels, traders remain cautiously optimistic yet aware of market conditions that could influence future performance. Increasing volumes of trading, particularly from whale investors, could foreshadow significant volatility in the coming weeks. All eyes will be on the ethereal path Ethereum takes, with many hoping for a clear discarding of bear tendencies as it approaches critical resistance levels. With the crypto atmosphere buzzing with activity, Ethereum’s trajectory may ultimately be guided by the attitudes of its most influential investors.

Ethereum trading trends raise questions about future price movements.

Ethereum trading trends raise questions about future price movements.

Photo by

Photo by