Forget Spot Bitcoin ETFs: Invest in These 2 Stocks Instead

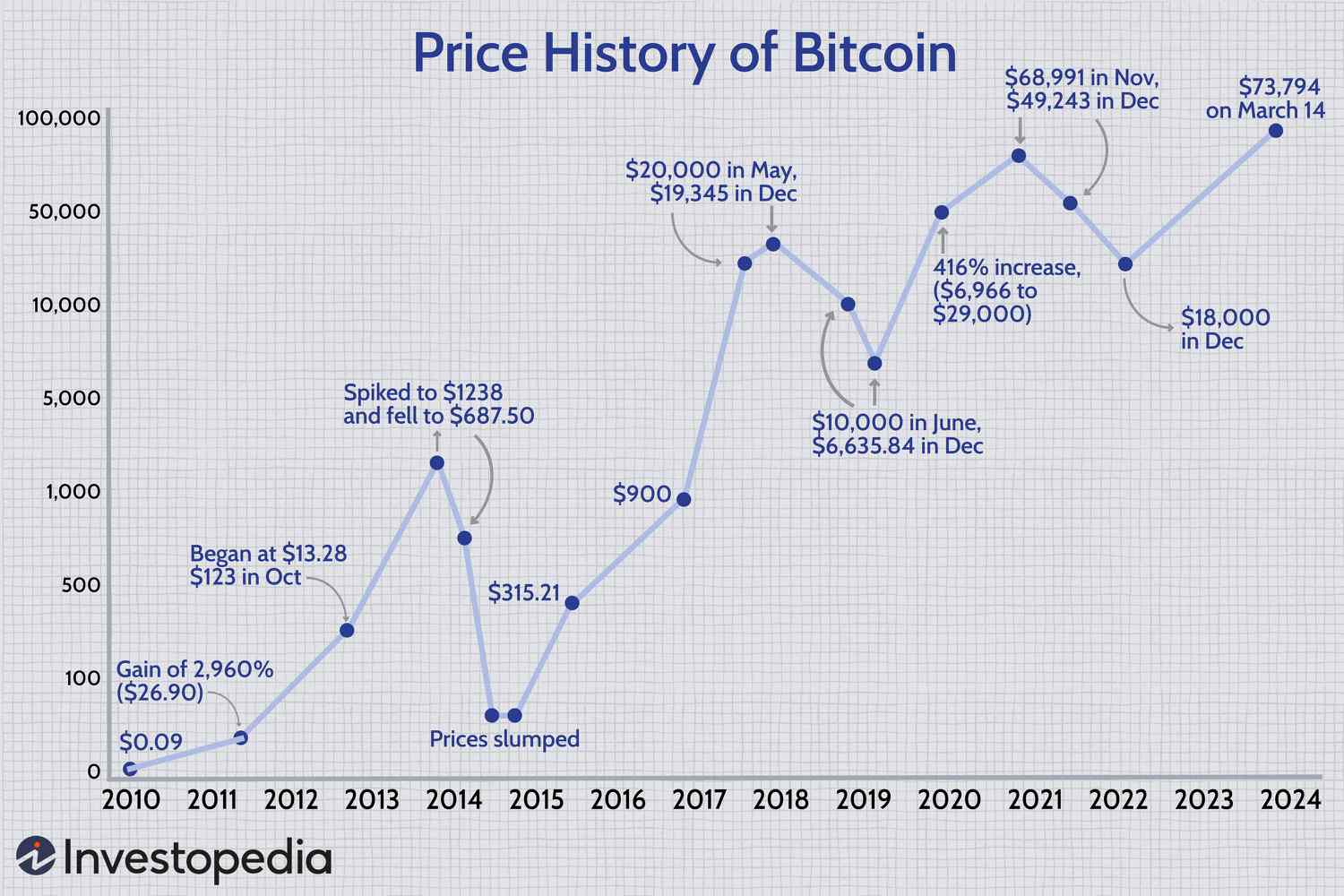

The crypto markets have been on fire this year, with Bitcoin reaching new all-time highs back in March. As a result, many new investors have been gaining exposure to the cryptocurrency through exchange-traded funds (ETFs). However, these ETFs track Bitcoin’s price movements, which means investors are still vulnerable to wild swings in the crypto market.

Bitcoin’s price volatility can be daunting for new investors.

Bitcoin’s price volatility can be daunting for new investors.

Instead of investing in spot Bitcoin ETFs, I believe investors should consider stocks that have strong underlying businesses and exposure to Bitcoin. Two such examples are Block (NYSE: SQ) and PayPal (NASDAQ: PYPL). Here’s why these might be better options for you.

Block: A Safer Bet for Crypto Exposure

Block, formerly known as Square, helps merchants process payments easily using its app and point-of-sale devices. Bitcoin has been a key part of its business, with Bitcoin-related transactions bringing in a whopping $9.5 billion in sales last year, representing 43% of the company’s top line. While Block doesn’t generate strong margins on Bitcoin transactions, the company still posted a profit overall last year with net income totaling $9.8 million.

Block’s Cash App makes it easy for people to buy and sell Bitcoin.

Block’s Cash App makes it easy for people to buy and sell Bitcoin.

The company’s Cash App makes it easy for people to buy and sell Bitcoin. And Block is going even deeper into crypto as it plans to build its own Bitcoin mining system. It also recently finished developing its own Bitcoin mining chip. For crypto investors, Block may be a safer long-term play than investing in spot Bitcoin ETFs. With a diversified and profitable business, it’s easy to track the company’s performance and growth; it’s a less speculative investment than crypto can be.

PayPal: A More Conservative Option

PayPal also allows users to buy and sell crypto, but its operations are smaller, and it doesn’t have an entire segment devoted to Bitcoin-related revenue the way Block does. In that sense, PayPal may be an even safer option for investors. However, it is still clearly bullish on crypto, as it has launched its own stablecoin, PayPal USD, which it says is designed for payments.

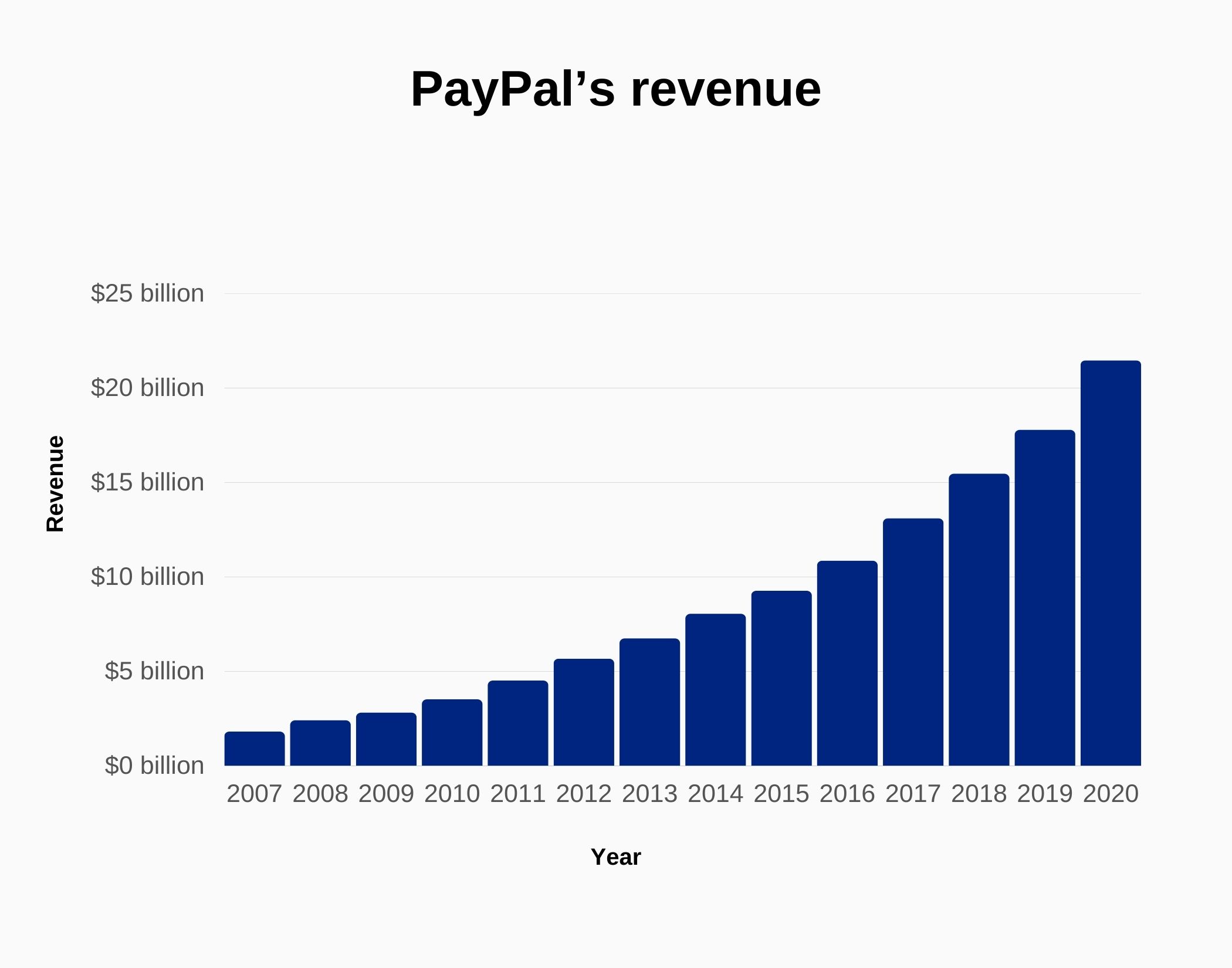

PayPal’s revenue growth has been steady, making it a more conservative option.

PayPal’s revenue growth has been steady, making it a more conservative option.

Unlike with Block, investors have come to expect consistent profits from PayPal. The big knock on the business has been simply that its growth rate has been underwhelming. But it’s a fairly safe option for crypto enthusiasts.

In conclusion, while spot Bitcoin ETFs may seem like an attractive option for investors, I believe Block and PayPal offer safer and more diversified ways to invest in crypto. With their strong underlying businesses and exposure to Bitcoin, they may be better options for those looking to invest in the crypto market.