Decoding the Ether ETF Filings: What You Need to Know

As the excitement around spot Ether ETFs continues to build, investors are eagerly awaiting the launch of these new investment vehicles. But what exactly do the S-1 filings reveal about these ETFs, and what can we expect from their launch? In this article, we’ll delve into the details of the S-1 filings and explore the implications for investors.

The potential launch of spot Ether ETFs has sparked excitement among investors.

Understanding S-1 Filings

S-1 filings are registration statements filed with the SEC, providing detailed information about the ETFs. These filings offer a glimpse into the inner workings of the ETFs, including their investment strategies, risk factors, and management structures. By analyzing these filings, we can gain a better understanding of what to expect from these ETFs.

Concentration in Custodians

One key takeaway from the S-1 filings is the concentration of custodians. The majority of issuers have chosen Coinbase as their custodian, which could lead to concentration issues or conflicts of interest among competing products. Only VanEck and Fidelity have chosen custodians outside of Coinbase.

Coinbase is the preferred custodian for many Ether ETF issuers.

Creation/Redemption Baskets

Another important aspect of the S-1 filings is the creation and redemption baskets. Larger issuers like iShares, Fidelity, and VanEck will issue and redeem shares in blocks of 40,000, 25,000, and 25,000, respectively. Many of the other issuers will use baskets of 10,000.

Fees and Risk Factors

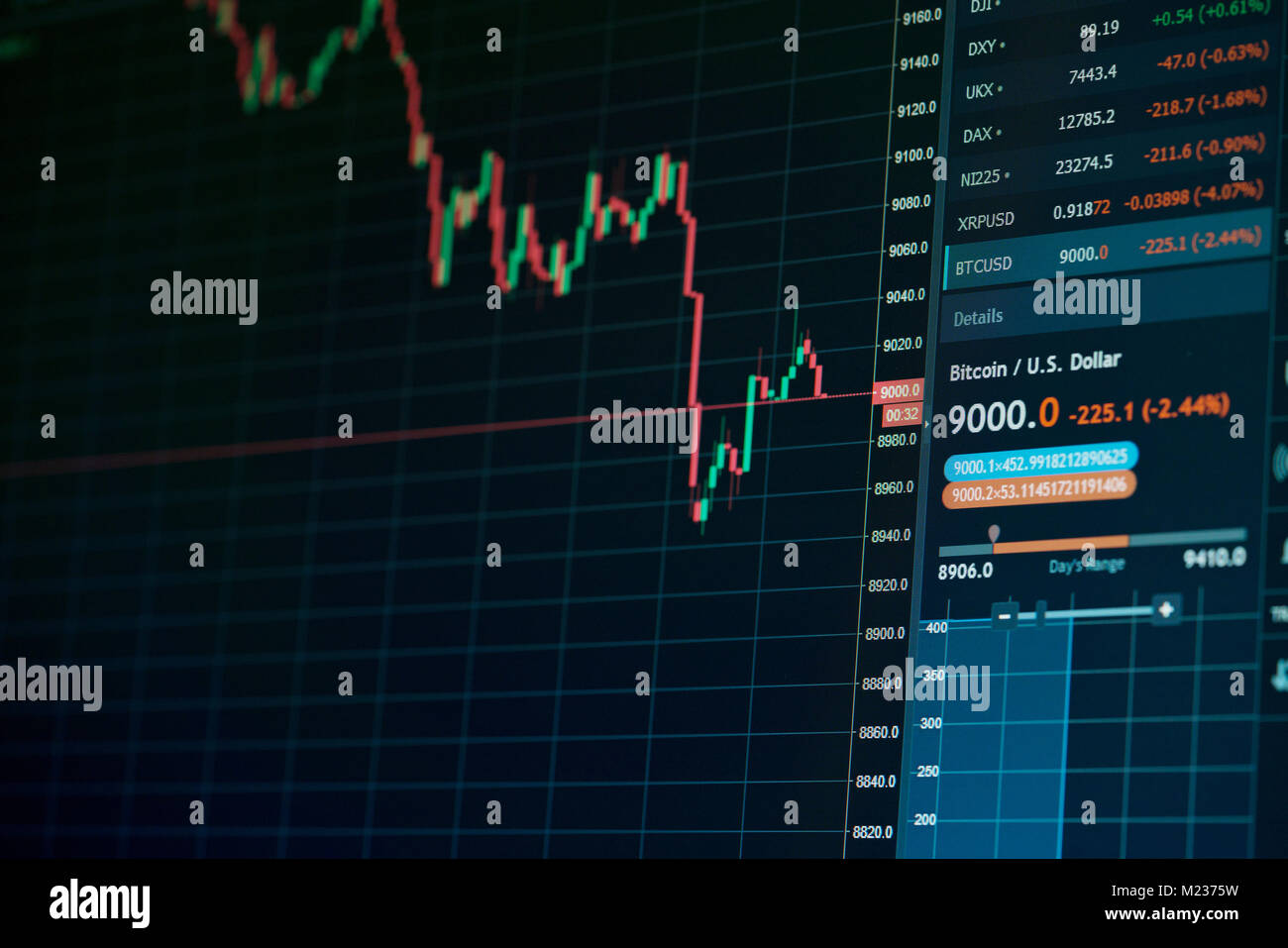

The S-1 filings also reveal information about fees and risk factors. While fees have been left blank, we can expect them to be competitive with spot Bitcoin ETFs. The risk factors section is lengthy, but most of these are standard disclosures, such as risks related to volatile markets and lack of demand.

The Future of Ether ETFs

As we look ahead to the potential approval of spot Ether ETFs, we can expect the pathway for other crypto ETFs to become clearer. The launch of these ETFs will likely create easier access for investors and open up new opportunities for the digital asset industry.

The launch of spot Ether ETFs could create new opportunities for investors.

Ask an Expert

We spoke with Eric Tomaszewski from Verde Capital Management to get his take on the potential launch of spot Ether ETFs.

“The recent initial approval of the first step for an Ethereum ETF represents a significant milestone for the digital asset industry, partly because it could create easier access for the average person.”

“There is a concern that spot ETF approvals could potentially create massive players who could significantly influence validator power over time. The same applies for counterparty, centralization, and concentration risks.”

“Being on-chain opens a world of possibilities, permissionless innovation, and inclusive financial services.”

Eric Tomaszewski shares his insights on the potential launch of spot Ether ETFs.