The Crypto Rollercoaster: Bitcoin’s Wild Ride

Bitcoin, the flagship cryptocurrency, has been on a rollercoaster ride in recent days, experiencing significant price fluctuations that have left investors on edge. Let’s delve into the events that have unfolded and the impact they have had on the crypto market.

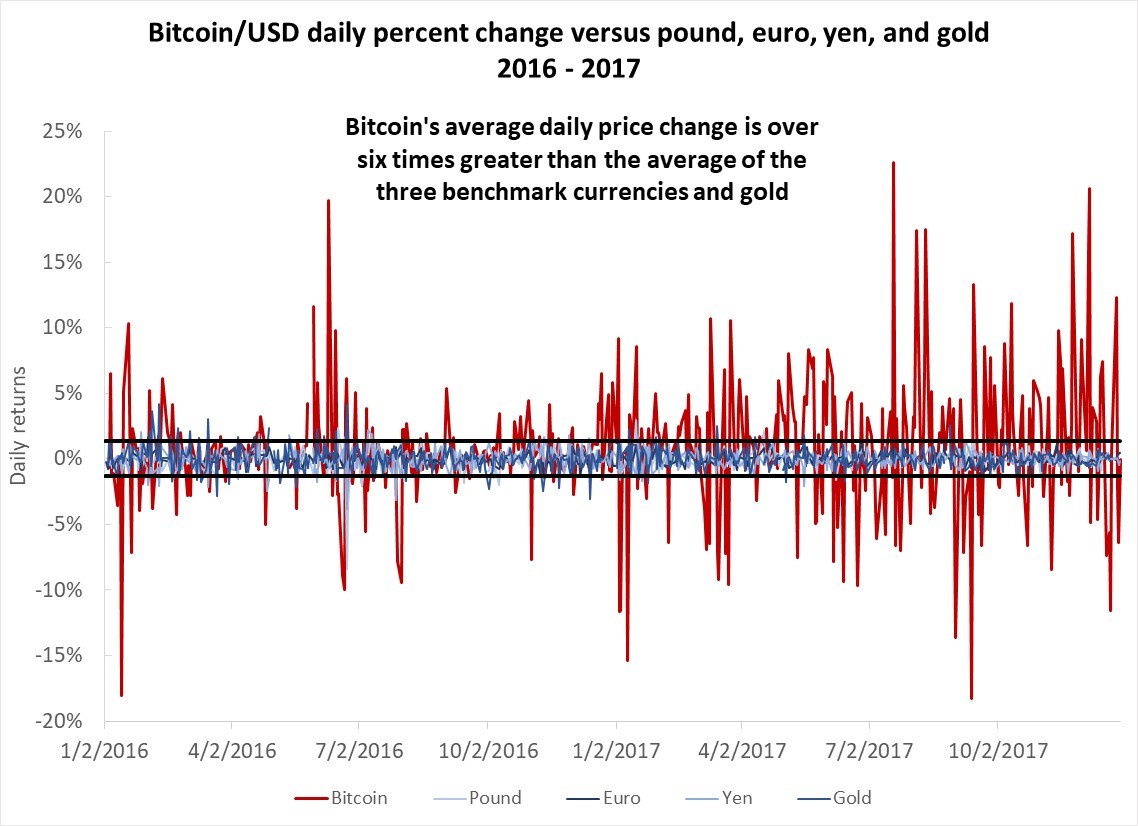

Bitcoin’s Price Volatility

Bitcoin’s price fell below $67,000, wiping out over $800 million in long positions. The sudden drop to $66,800 marked an 8% decline in just 24 hours after hitting a new all-time high above $70,000 earlier in the week. The CoinDesk 20 index, which measures the largest digital assets, also saw a 6% decrease. Analysts attributed this pullback to a ‘bull breather’ following a sharp rally.

El Salvador’s Bitcoin Move

In a surprising move, El Salvador, known for its Bitcoin-forward approach, transferred $400 million worth of bitcoin into a cold wallet. President Nayib Bukele referred to this as ‘our first #Bitcoin piggy bank,’ showcasing the nation’s growing interest in cryptocurrency. The stored wallet, containing 5,689.68 BTC, was placed in a physical vault within the country’s borders.

Galaxy Digital: A Core Investment

Investment bank Stifel recommended Galaxy Digital (GLXY) as a core holding for equity investors seeking exposure to the digital asset ecosystem. With a buy rating and a price target of C$20, Galaxy Digital has been highlighted as a promising investment opportunity.

Market Turbulence

The cryptocurrency market faced turbulence, with Ether and Dogecoin experiencing significant losses of 17% and 22%, respectively, in a week. Bitcoin’s value dropped below $61,000, marking its most substantial slide since the FTX collapse. The overall crypto market lost $400 billion, with various cryptocurrencies witnessing a sharp decline.

The Impact of Spot Bitcoin ETFs

Spot Bitcoin ETFs experienced a notable decrease in demand, with Grayscale’s ETF seeing a record outflow of $643 million. This shift in ETF dynamics has raised concerns about the market’s stability and future outlook.

Federal Reserve’s Influence

All eyes are on the Federal Reserve as investors await announcements on interest rate adjustments and the FOMC’s economic outlook. The upcoming FOMC meeting could bring further excitement and uncertainty to the cryptocurrency market.

Bitcoin’s Future Prospects

As Bitcoin faces a period of correction and consolidation, experts like Vijay Ayyar suggest that pullbacks are a normal part of the market cycle. If Bitcoin falls below key support levels, such as $60,000, it could signal further downside potential.

In conclusion, the crypto market’s recent fluctuations highlight the inherent volatility and unpredictability of digital assets. Investors must navigate these turbulent waters with caution and a keen eye on market developments.