The Bitcoin Halving: What Investors Need to Know

As a former software engineer turned cryptocurrency enthusiast, I bring you the latest insights on the upcoming Bitcoin halving event. The primary investment thesis for Bitcoin in 2024 has been the introduction of new spot Bitcoin exchange-traded funds (ETFs), with nearly $1 billion flowing into them daily, driving the cryptocurrency to new all-time highs.

Bitcoin cryptocurrency

Bitcoin cryptocurrency

The Potential Impact of the Halving

Why the Halving Could Send Bitcoin Higher

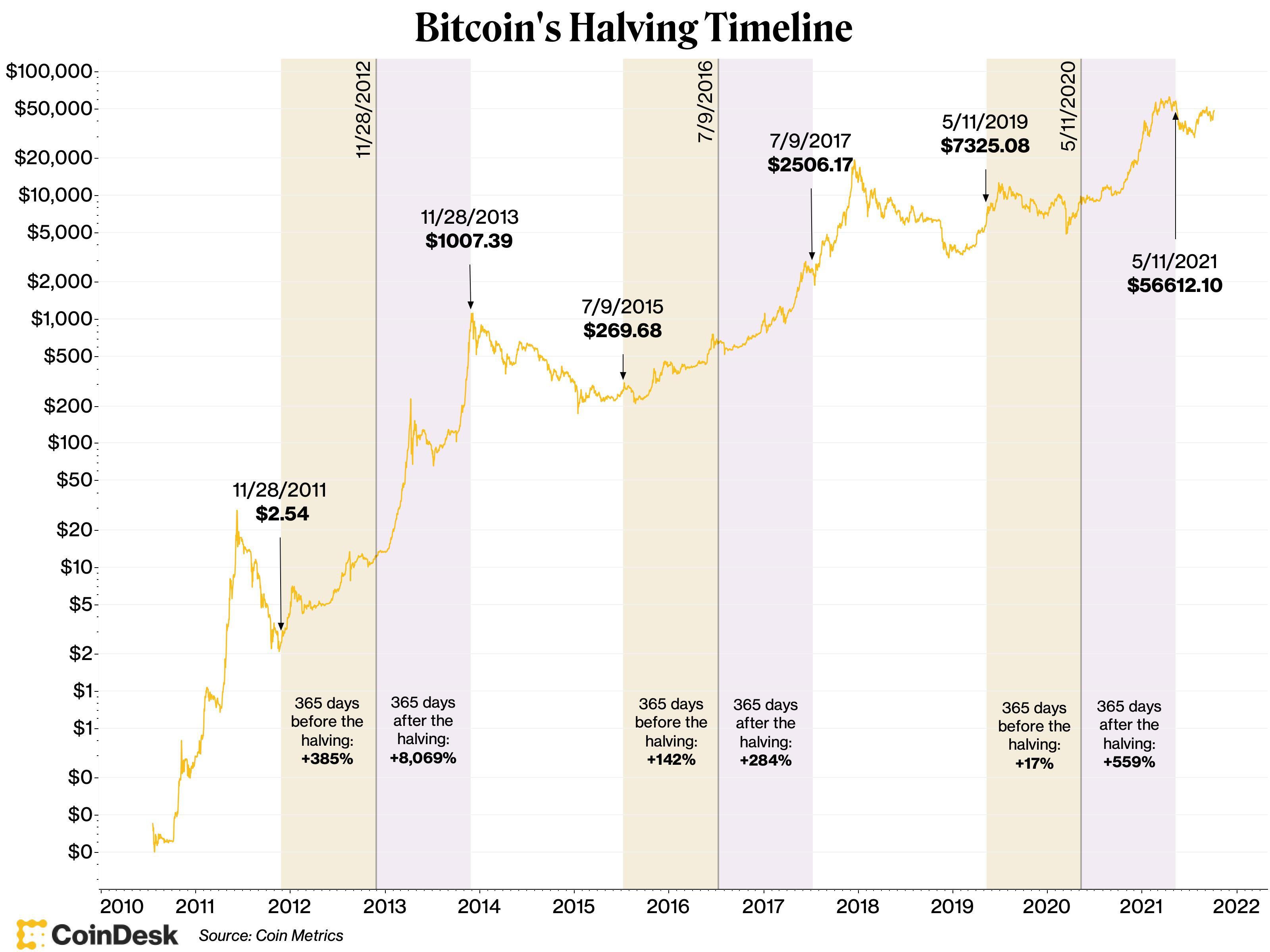

Historically, Bitcoin has seen significant gains following halving events. With the upcoming halving in mid-April, many investors anticipate a surge in Bitcoin’s value. Grayscale Investments predicts this halving cycle to be the best one yet, attributing it to the influx of new money from Bitcoin ETFs.

Why the Halving Could Send Bitcoin Lower

On the flip side, some skeptics believe that the halving may not meet expectations. Concerns have been raised that the impact of the halving is already priced in, potentially leading to a post-halving price decrease. JPMorgan Chase even warned of a potential drop to $42,000 post-halving.

Long-Term Outlook

While the halving date is a focal point for many, it’s essential to consider Bitcoin’s long-term trajectory. With Wall Street embracing crypto and continuous inflow of new money into Bitcoin ETFs, the cryptocurrency’s future looks promising. Both retail and institutional investors are increasing their Bitcoin allocations, indicating a trend with significant long-term potential.

Should You Invest in Bitcoin?

The Motley Fool Stock Advisor team suggests considering the best stocks for investment, with Bitcoin not making the cut. However, the long-term performance of Bitcoin remains strong, outperforming other asset classes since 2011. As the cryptocurrency market evolves, Bitcoin continues to be a compelling investment option.

Conclusion

In conclusion, the Bitcoin halving presents both opportunities and risks for investors. While short-term fluctuations may occur, the long-term outlook for Bitcoin remains positive. As the cryptocurrency market matures and institutional interest grows, Bitcoin’s potential for growth continues to attract investors.

Stay tuned for more updates on Bitcoin and cryptocurrency trends!

Disclaimer: This article is for informational purposes only and should not be considered financial advice.