Bitcoin and Crypto Market Volatility: Understanding the Recent $300 Billion Loss

The cryptocurrency market has been hit hard recently, with Bitcoin and major altcoins like ethereum and XRP experiencing significant drops in value. Traders are on edge as they anticipate a market correction and potential regulatory actions from the Biden administration.

Bitcoin’s Price Plunge

In the past week, the price of Bitcoin has plummeted by more than 10%, surprising many after JPMorgan’s CEO expressed support for Bitcoin. This sudden downturn has resulted in a staggering $300 billion being wiped out from the total cryptocurrency market, which had reached a peak valuation of $2.8 trillion earlier this month.

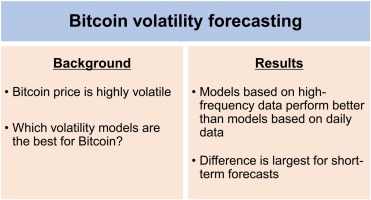

Bitcoin market volatility

Bitcoin market volatility

Federal Reserve’s Impact

Tomorrow, Federal Reserve Chair Jerome Powell is set to announce the central bank’s latest interest rate decision. The anticipated decision to maintain current rates could lead to significant fluctuations in Bitcoin’s price and the broader cryptocurrency market.

Inflation Concerns and Central Bank Actions

Rising expectations of the Federal Reserve declaring victory over inflation have driven both crypto and stock markets to all-time highs. However, recent data from the consumer price index (CPI) and producer price index (PPI) have shown unexpected price hikes. Additionally, Japan’s central bank has raised interest rates for the first time in over a decade, signaling a shift in monetary policy amidst rising inflation.

Expert Insights

Tristan Frizza, CEO of Zeta Markets, highlighted the potential impact of high inflation rates on central bank decisions. While rate hikes may slow down price surges and lead to a temporary crypto market pullback, consumers facing inflation pressures could turn to cryptocurrencies as a hedge. The narrative of cryptocurrencies being a hedge against inflation, coupled with growing institutional interest, is likely to drive further participation in the crypto space.

For more information on financial markets and global economy, visit Financial Times and Forbes.