Bitcoin’s Record High Slump: Profit-Taking or Economic Slowdown?

Cryptocurrency markets have been abuzz with the recent rollercoaster ride of Bitcoin’s price. After reaching a new record high last week, Bitcoin has experienced a significant downturn, leaving many investors questioning the reasons behind this sudden shift in momentum.

Bitcoin’s Recent Slump

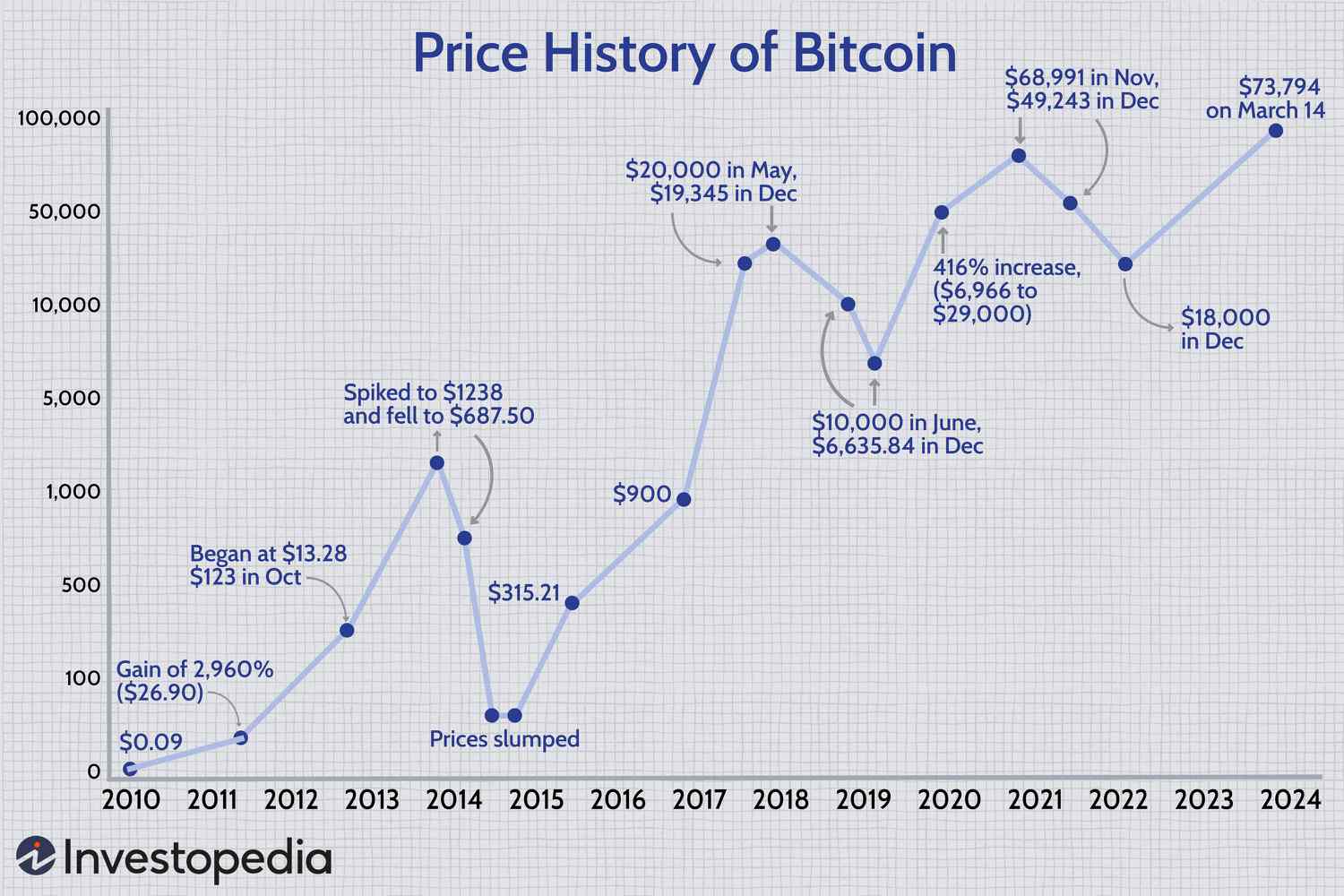

The price of Bitcoin plummeted by as much as 13% following its peak at nearly $74,000, now hovering just below $68,000. While such fluctuations are not uncommon in the volatile world of cryptocurrencies, Bitcoin still maintains a strong year-to-date growth of approximately 50%.

Profit-Taking or Economic Slowdown?

The primary cause of this recent slump remains a topic of debate among market participants. Many analysts attribute the decline to profit-taking behavior, where traders capitalize on the prolonged rally by selling a portion of their holdings to secure profits. This trend has also affected other major tokens like ether and solana, with both experiencing notable price corrections.

Economic Slowdown Concerns

Some experts speculate that Bitcoin’s bearish trend could persist if investors perceive signs of an impending economic slowdown. In such scenarios, market participants may opt to liquidate their cryptocurrency positions in favor of more stable assets such as bonds or traditional currencies like the US dollar. Marc Ostwald, chief economist at ADM Investor Services International, highlighted the potential impact of adverse economic conditions on Bitcoin’s valuation.

The Anticipated Halving Event

Despite the recent market turbulence, optimism prevails among certain analysts who view the current sell-off as a temporary setback preceding the highly anticipated ‘halving’ event scheduled for April. During this event, the reward for mining new Bitcoin blocks will be halved, a mechanism designed to maintain the token’s scarcity and potentially drive its value higher.

Historical Precedent

Drawing parallels from the past, Bitcoin experienced a similar price decline of up to 20% ahead of the previous halving event in 2020. However, post-event, Bitcoin’s price surged from under $9,000 to around $60,000 within a year as the market adjusted to the reduced supply levels.

Market Sentiment

Industry experts like Kathleen Brooks from online brokerage XTB emphasize the growing mainstream acceptance of Bitcoin, attributing the current market dynamics to the token’s perceived scarcity akin to precious metals like gold. The convergence of the halving event and the emergence of spot Bitcoin ETFs has sparked anticipation for a potentially explosive market setup.

For more insights and analysis on the cryptocurrency market, stay tuned to CRYPTOBITE.