Bitcoin Halving: A Deflationary Asset’s Impact on the Market

The world of Bitcoin is abuzz with anticipation as the next halving event approaches on April 19. This significant event, occurring approximately every four years, involves a 50% reduction in the daily supply of newly minted coins. Historically, such halvings have led to substantial price surges, and the upcoming halving is no exception.

To understand the impact of this event, we must delve into the intricacies of Bitcoin’s supply dynamics. After 210,000 blocks are created, the reward for miners decreases, gradually approaching the minimal unit of Bitcoin – one satoshi, equivalent to 0.00000001 Bitcoin. This process is expected to continue until 2040, with the aim of maintaining Bitcoin’s inflation resistance.

Investors have been closely monitoring Bitcoin’s price movements, especially considering its remarkable 60% surge this year, culminating in an all-time high of over $72,000 in March. This surge is attributed to various factors, including the introduction of ETFs enabling investors to purchase Bitcoin shares on stock exchanges and the projected increase in demand resulting from the halving-induced supply reduction.

The Scarcity Factor: Bitcoin’s Deflationary Nature

Bitcoin’s allure lies in its scarcity, akin to that of precious metals like gold. Currently, Bitcoin’s inflation rate mirrors that of gold at 1.8%. However, post-halving, this rate is set to drop to 0.85% annually, emphasizing Bitcoin’s limited supply and reinforcing its status as a deflationary asset.

The appeal of Bitcoin’s scarcity is not lost on investors, with many viewing it as a hedge against inflation and economic uncertainty. The upcoming halving serves as a stark reminder of Bitcoin’s finite nature, further fueling interest in the cryptocurrency.

Historical Trends and Market Speculation

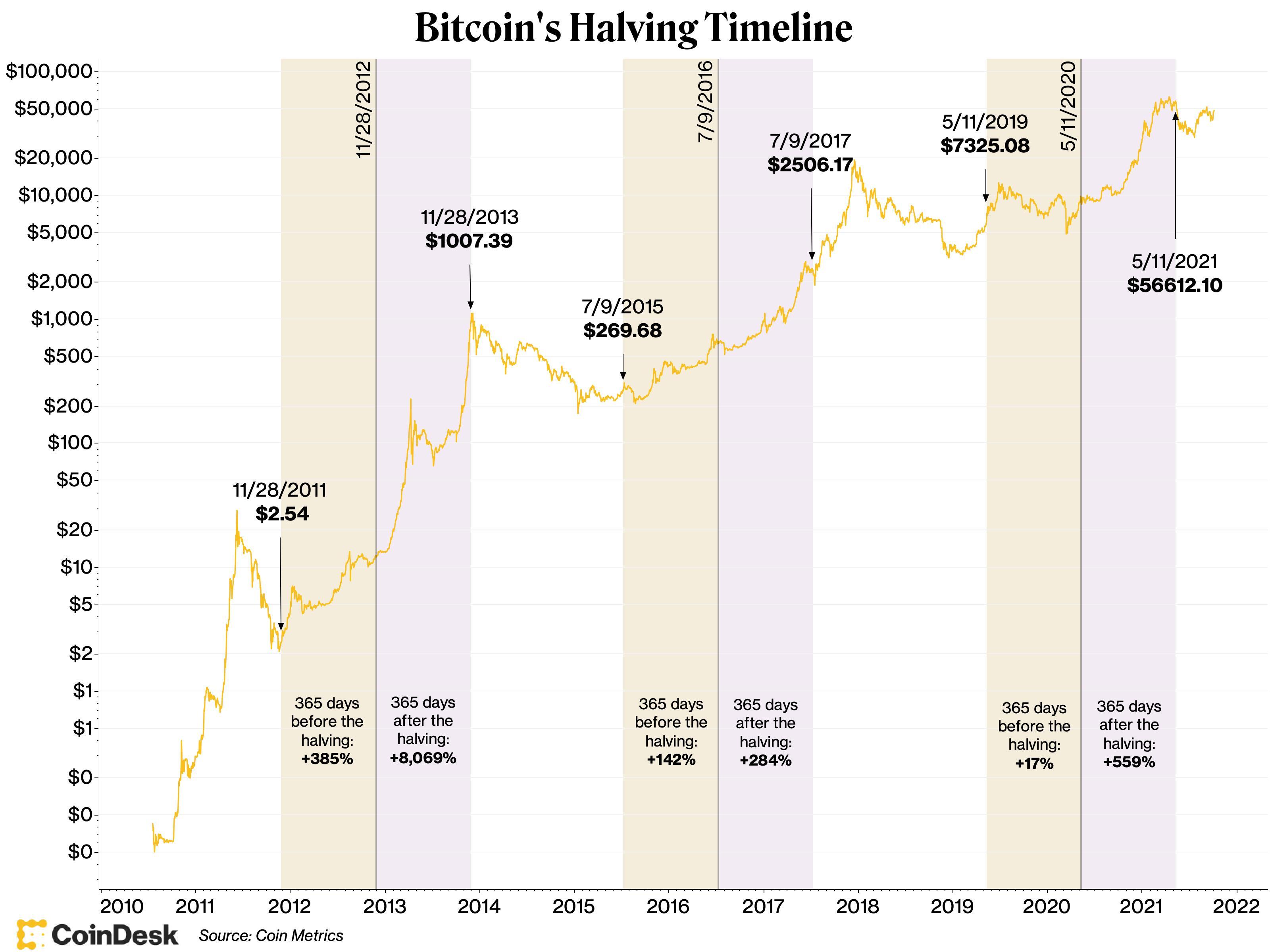

Past halving events have been pivotal moments for Bitcoin, coinciding with significant price rallies. Following previous halvings, Bitcoin’s price surged by remarkable percentages – 8,760% to $1,152, 2,570% to $17,760, and 594% to $67,549 in subsequent years. This trend is largely attributed to the decrease in supply post-halving and the subsequent surge in demand.

Miners, key players in the Bitcoin ecosystem, are adjusting their strategies in anticipation of the halving. Many are reducing their Bitcoin sales, stockpiling coins for opportune moments. Additionally, the ‘buy the rumor, sell the news’ phenomenon is contributing to the price uptrend, with investors driving prices higher in the lead-up to the event.

Future Outlook and Potential Challenges

While historical data paints a bullish picture for Bitcoin post-halving, some analysts caution against overly optimistic projections. Rising production costs and the diminishing impact of successive halvings on new Bitcoin supply could introduce new dynamics into the market.

As the cryptocurrency landscape evolves, market participants are closely monitoring Bitcoin’s price trajectory post-halving. The interplay between supply dynamics, investor sentiment, and external market factors will shape Bitcoin’s future trajectory and its role in the broader financial ecosystem.