The Impact of Bitcoin Halving on Cryptocurrency Market Dynamics

The Bitcoin halving process, a significant event in the world of cryptocurrency, plays a crucial role in shaping the market dynamics of Bitcoin. This process involves reducing the reward for mining new blocks by half, occurring approximately every four years. The upcoming Bitcoin halving, estimated to take place around April 20, 2024, has garnered significant attention within the crypto community.

To understand the implications of Bitcoin halving, it’s essential to delve into its purpose. The primary goal of halving is to maintain scarcity within the Bitcoin ecosystem and influence the overall supply dynamics. By reducing the rate of new coin creation, Bitcoin aims to control inflation and ensure a controlled growth trajectory.

Bitcoin Halving Process

Bitcoin Halving Process

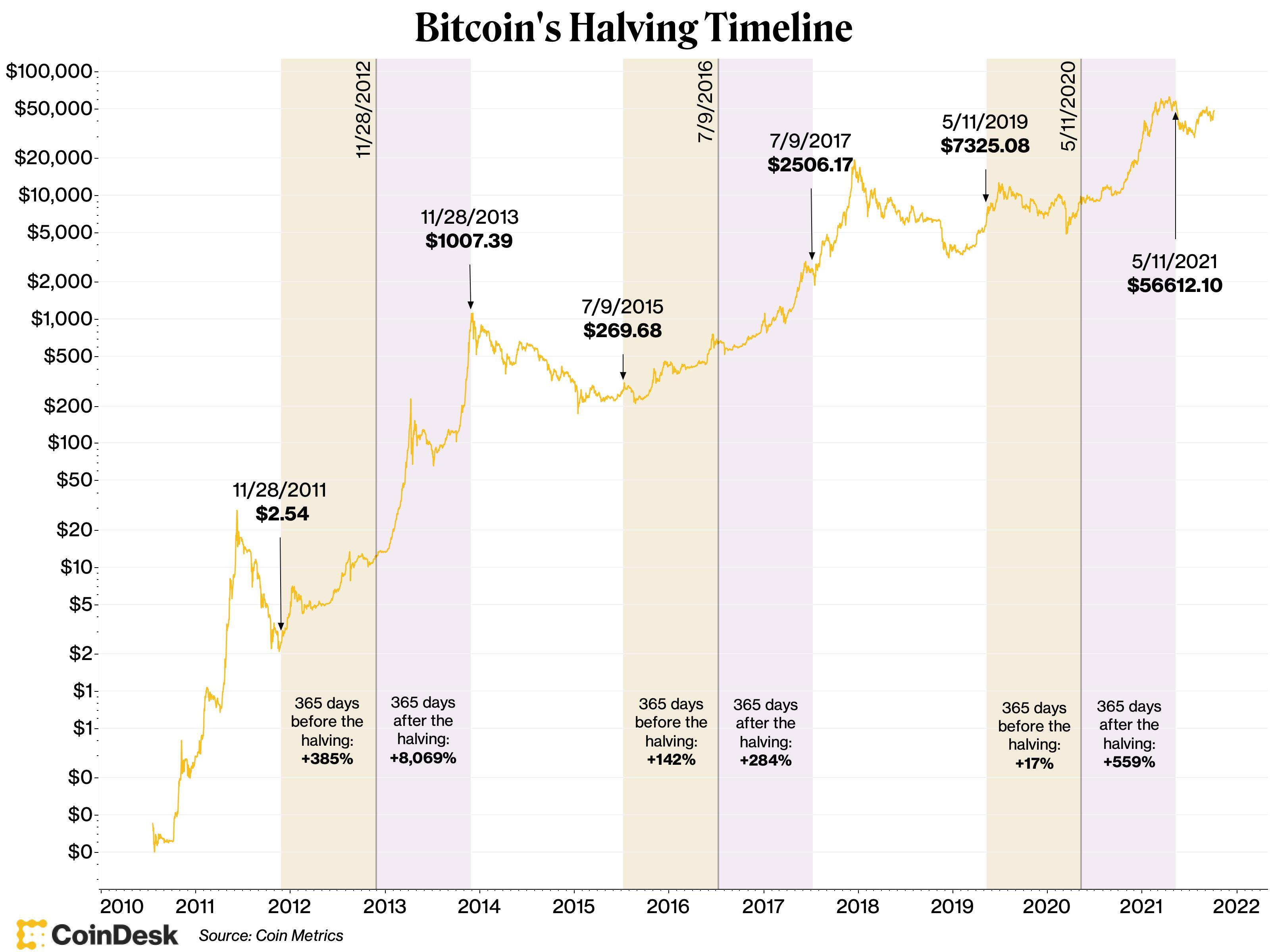

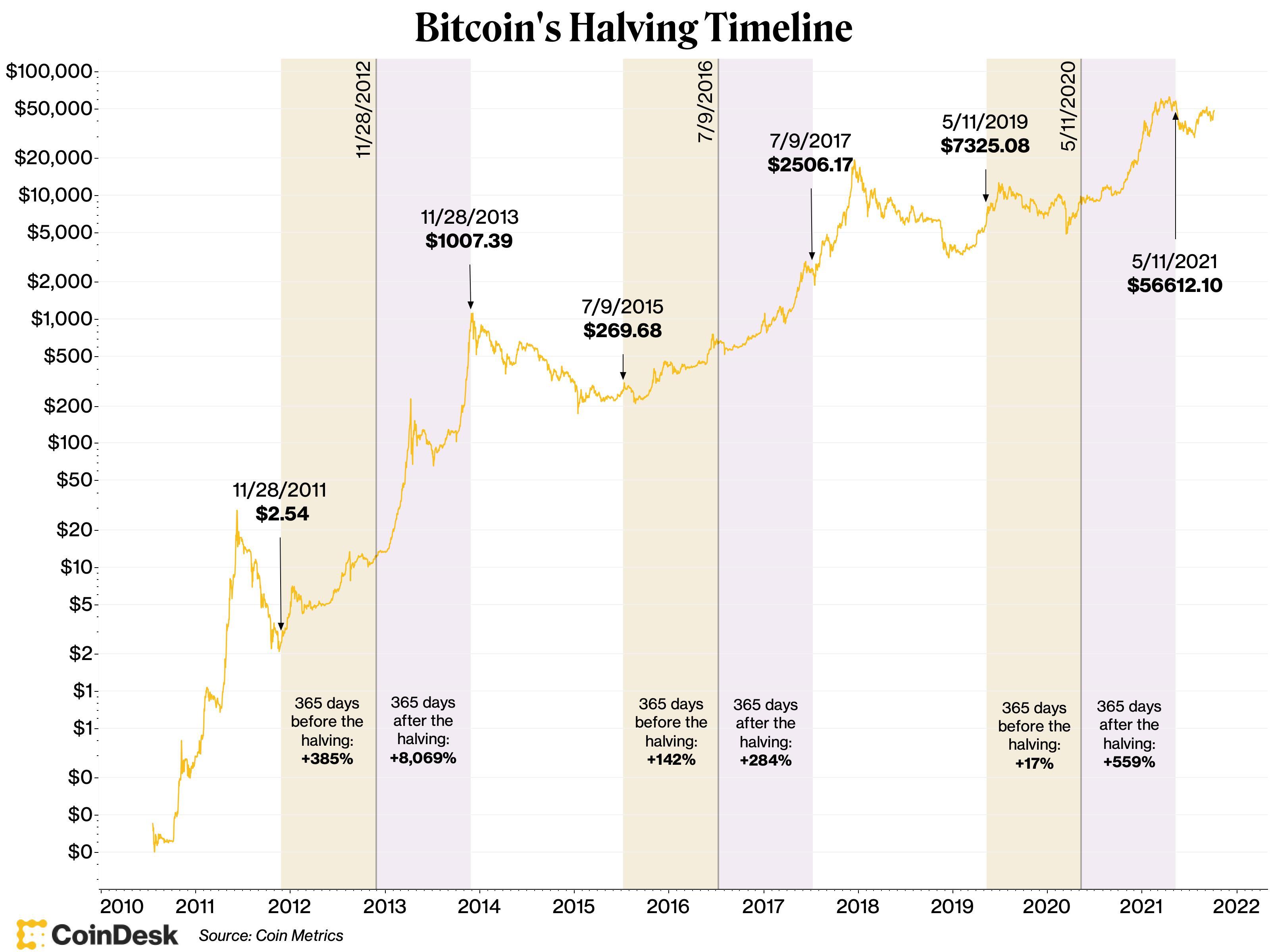

One of the most intriguing aspects of Bitcoin halving is its historical impact on the price of Bitcoin. Past halving events have been associated with substantial price surges, driven by the decreased supply of new coins entering the market. This phenomenon underscores the significance of supply and demand dynamics in determining the value of cryptocurrencies.

Historically, Bitcoin has experienced notable price increases following halving events due to the reduced rate of new coin creation.

However, it’s crucial to recognize that the cryptocurrency market is influenced by a myriad of factors beyond the halving event itself. While halving can create a bullish sentiment among investors, market sentiment, regulatory developments, and macroeconomic trends also play a pivotal role in shaping the price movements of cryptocurrencies.

In preparation for the upcoming halving event, investors and traders are closely monitoring market indicators and analyzing historical data to anticipate potential price movements. The volatility often associated with cryptocurrency markets adds an element of unpredictability, making it essential for market participants to stay informed and adapt their strategies accordingly.

Bitcoin Market Analysis

Bitcoin Market Analysis

As the crypto community awaits the next Bitcoin halving, discussions around its potential impact on the market continue to intensify. Whether the event will trigger another price rally or lead to a period of consolidation remains a topic of debate among analysts and enthusiasts.

In conclusion, Bitcoin halving serves as a fundamental mechanism that shapes the supply dynamics and price trajectory of Bitcoin. While historical trends suggest a positive correlation between halving events and price surges, the complex nature of the cryptocurrency market underscores the need for a comprehensive analysis of various factors influencing price movements.

Riley Emerson is a former software engineer turned cryptocurrency enthusiast, bringing a unique tech-savvy perspective to the world of Bitcoin and blockchain. When not exploring the latest crypto trends, Riley can be found surfing the waves or tinkering with IoT gadgets.