Affordable Crypto Investments: 21Shares Slashes Fees on Key ETPs

Zürich/München, September 24, 2024 — In a progressive move to enhance accessibility in the evolving crypto landscape, 21Shares AG, one of the world’s foremost providers of crypto asset exchange-traded products (ETPs), has announced significant fee reductions for two of its flagship ETPs: the 21Shares Crypto Basket 10 ETP and the 21Shares Bytetree BOLD ETP. This change, effective immediately, lowers the management fees for these products to 0.49% and 0.65%, respectively, thus broadening the appeal of these innovative investment vehicles.

Analyzing the 21Shares Crypto Basket 10 ETP (HODLX)

The 21Shares Crypto Basket 10 ETP offers diversified exposure to the ten largest digital assets ranked by market capitalization, with rebalancing occurring quarterly to capture market dynamics effectively. With a substantial fee reduction from 2.5% to just 0.49%, this ETP now presents a more attractive option for investors looking to capitalize on the growth potential of the digital asset sector within a single diversified product.

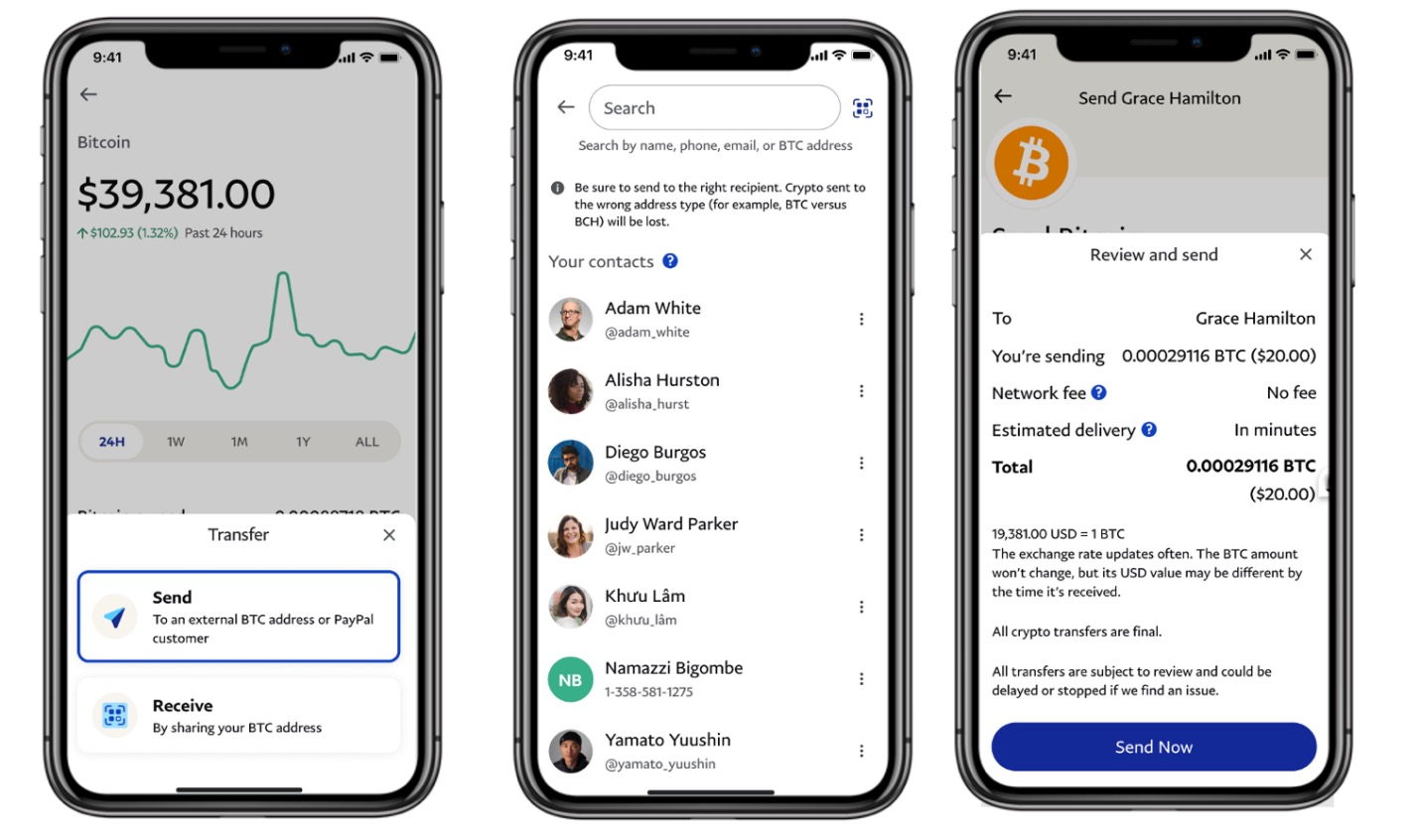

Visual representation of diverse crypto investments.

Visual representation of diverse crypto investments.

Bitcoin and Gold: The Strategic Approach of 21Shares Bytetree BOLD ETP (BOLD)

In contrast, the 21Shares Bytetree BOLD ETP uniquely blends Bitcoin and gold, creating a balanced approach to both digital and traditional investments. This innovative ETP employs a risk-adjusted weighting system, reviewed monthly, which combines the stability of gold with the expansive growth potential of Bitcoin. Following the fee reduction from 1.49% to 0.65%, the product becomes more appealing to those looking for strategic, cost-efficient exposure to these asset classes in a volatile economic environment.

“At 21Shares, our mission has always been to make cryptocurrency investments more accessible, and this fee reduction reflects our commitment to providing value for our investors,” stated Mandy Chiu, Head of Financial Product Development at 21Shares. “By lowering the fees for HODLX and BOLD, we enable more investors to participate in the future of finance at a lower cost.”

These fee reductions are a testament to 21Shares’ dedication to offering innovative and affordable investment solutions that cater to the evolving needs of the global investment community. Both ETPs ensure 100% physical backing by the underlying assets, securely stored using cold storage technology, which guarantees maximum trust for investors.

Summary of Fee Adjustments by 21Shares (As of September 24, 2024)

| Product Name | ISIN (Ticker Symbol) | Previous Fee | New Fee |

|---|---|---|---|

| 21Shares Crypto Basket 10 ETP | CH1135202179 (HODLX) | 2.5% | 0.49% |

| 21Shares Bytetree BOLD ETP | CH1146882308 (BOLD) | 1.49% | 0.65% |

About 21.co / 21Shares

21.co stands at the forefront of creating pathways into the crypto world. As the parent company of 21Shares, the largest issuer of crypto asset-based ETPs globally, 21.co is pioneering the way with its proprietary technology platform, Onyx. Founded in 2018 by Hany Rashwan and Ophelia Snyder, it operates out of Zurich with additional offices in London and New York. For further details, visit 21.co and 21shares.com.