Cryptocurrency Trading Sees a Slowdown in April

The cryptocurrency market has experienced a significant slowdown in April, with spot trading volumes declining by 32.6% to $2.01 trillion, according to data from CCData. This marks the first decline in seven months, driven by a dwindling likelihood of interest rate cuts and slower inflows into U.S.-listed spot bitcoin exchange-traded funds (ETFs).

Cryptocurrency trading volumes decline in April

Cryptocurrency trading volumes decline in April

The decline in spot market volume was accompanied by a 24.1% drop in monthly derivatives trading volume, which fell to $4.57 trillion. This marks the first decline in three months, and is attributed to unexpected macroeconomic data, an escalation in the geopolitical crisis in the Middle East, and negative net flows from U.S. spot Bitcoin ETFs.

This decline followed unexpected macroeconomic data, an escalation in the geopolitical crisis in the Middle East, and negative net flows from U.S. spot Bitcoin ETFs, leading major crypto assets to retrace the gains they made in March.

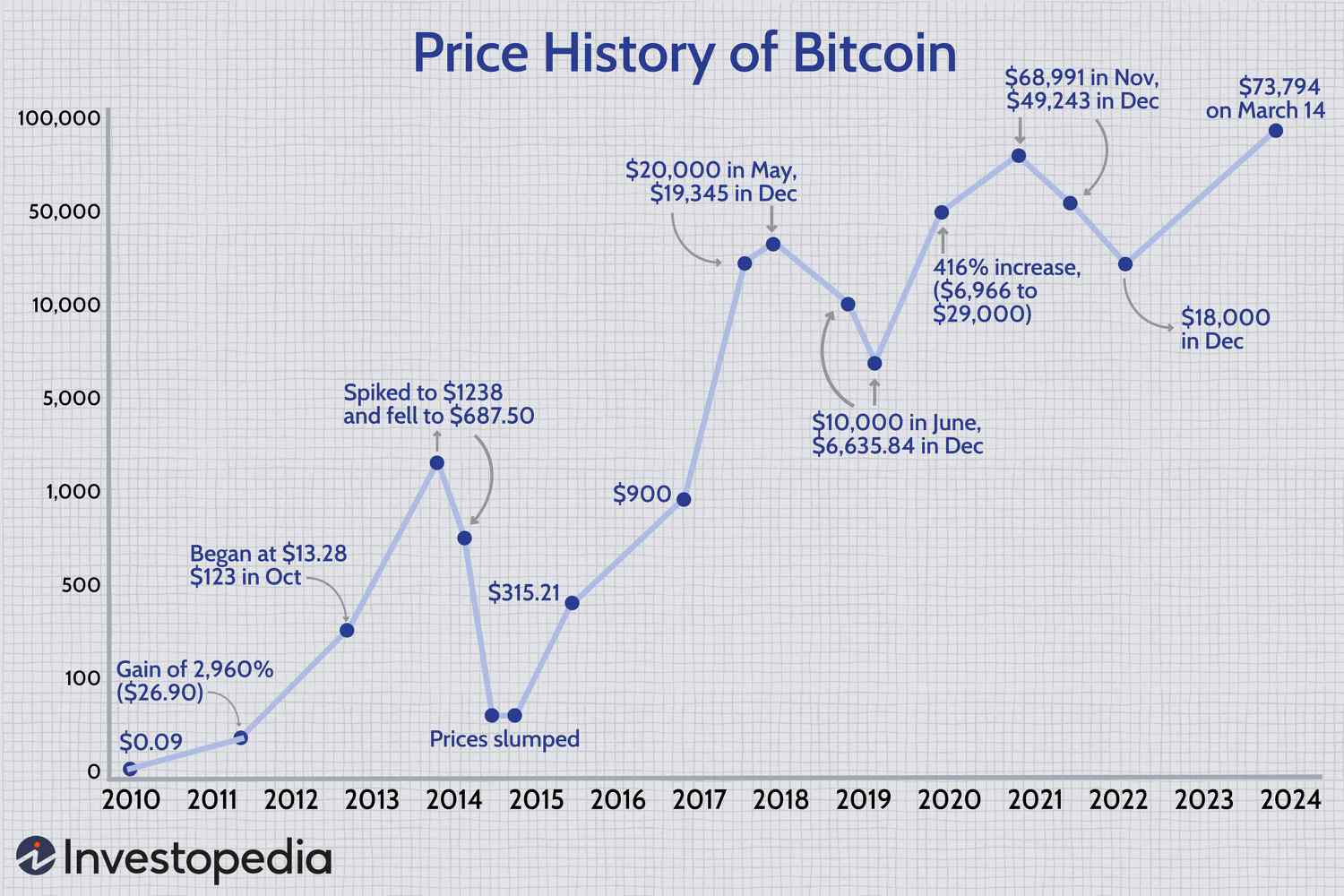

Bitcoin, in particular, suffered a significant decline, falling by almost 15% to below $60,000, breaking a seven-month hot streak that included a record high of more than $73,000 in March.

Bitcoin price decline in April

Bitcoin price decline in April

The decline in cryptocurrency trading volumes is attributed to a decrease in speculation surrounding last year’s regulatory approval of spot ETFs and the bitcoin halving event. However, according to Bakkt, a crypto custody firm, the Securities and Exchange Commission’s (SEC) approval of bitcoin ETFs will lead institutional investors to play a larger role in the cryptocurrency trading market.

As evidenced in our trading volumes in Q1, we’ve begun to see positive green shoots in the market and the overall demand environment improving, with more industry activity, higher coin prices, and overall higher retail trading volume.

Institutional investors are seeking a purpose-built crypto trading platform that will align with their needs and priorities, rather than the existing trading market that was built primarily for retail investors.

Institutional investors seek purpose-built crypto trading platforms

Institutional investors seek purpose-built crypto trading platforms

The crypto trading industry has been built primarily for everyday retail investors who use a central limit order book trading structure. However, institutional investors who are offering bitcoin ETFs are increasingly finding that the retail central limit order book structure is not meeting their large-scale needs.

The institutional investors in this market are seeking a purpose-built crypto trading platform that will align with their needs and priorities, rather than the existing trading market that was built primarily for retail investors.

The slowdown in cryptocurrency trading in April may be a temporary setback, but with institutional investors increasingly entering the market, the future of cryptocurrency trading looks promising.

The future of cryptocurrency trading

The future of cryptocurrency trading