Cryptocurrency Scams: Staying Safe in a High-Risk Market

As Bitcoin continues to gain mainstream acceptance, the crypto market remains plagued by scams. Even seasoned investors can fall prey to these schemes, highlighting the need for caution and vigilance.

Safeguarding Your Investments

One of the safest ways to invest in crypto is through exchange-traded funds (ETFs). These funds are regulated by the Securities and Exchange Commission (SEC), providing an added layer of security. With ETFs, you can invest in specific cryptocurrencies without having to open new accounts or learn complex trading strategies.

Investing in ETFs provides a safer way to enter the crypto market.

Investing in ETFs provides a safer way to enter the crypto market.

As new ETFs emerge for cryptocurrencies beyond Bitcoin, investors will have more opportunities to diversify their portfolios. For instance, Ethereum ETFs have recently been approved, and Solana might be next in line.

Choosing a Trusted Trading Platform

While ETFs offer a safe entry point, many investors will still need a reliable platform to buy and sell cryptocurrencies. Coinbase Global is a popular choice, regulated by the SEC and subject to strict auditing standards. Its strong security measures and rigorous listing criteria provide an added layer of protection.

Coinbase provides a secure platform for buying and selling cryptocurrencies.

However, it’s essential to do your due diligence when selecting a trading platform. The collapse of FTX in 2022 serves as a stark reminder of the risks involved. Be cautious of platforms with limited transparency and inadequate security measures.

Setting Clear Investment Rules

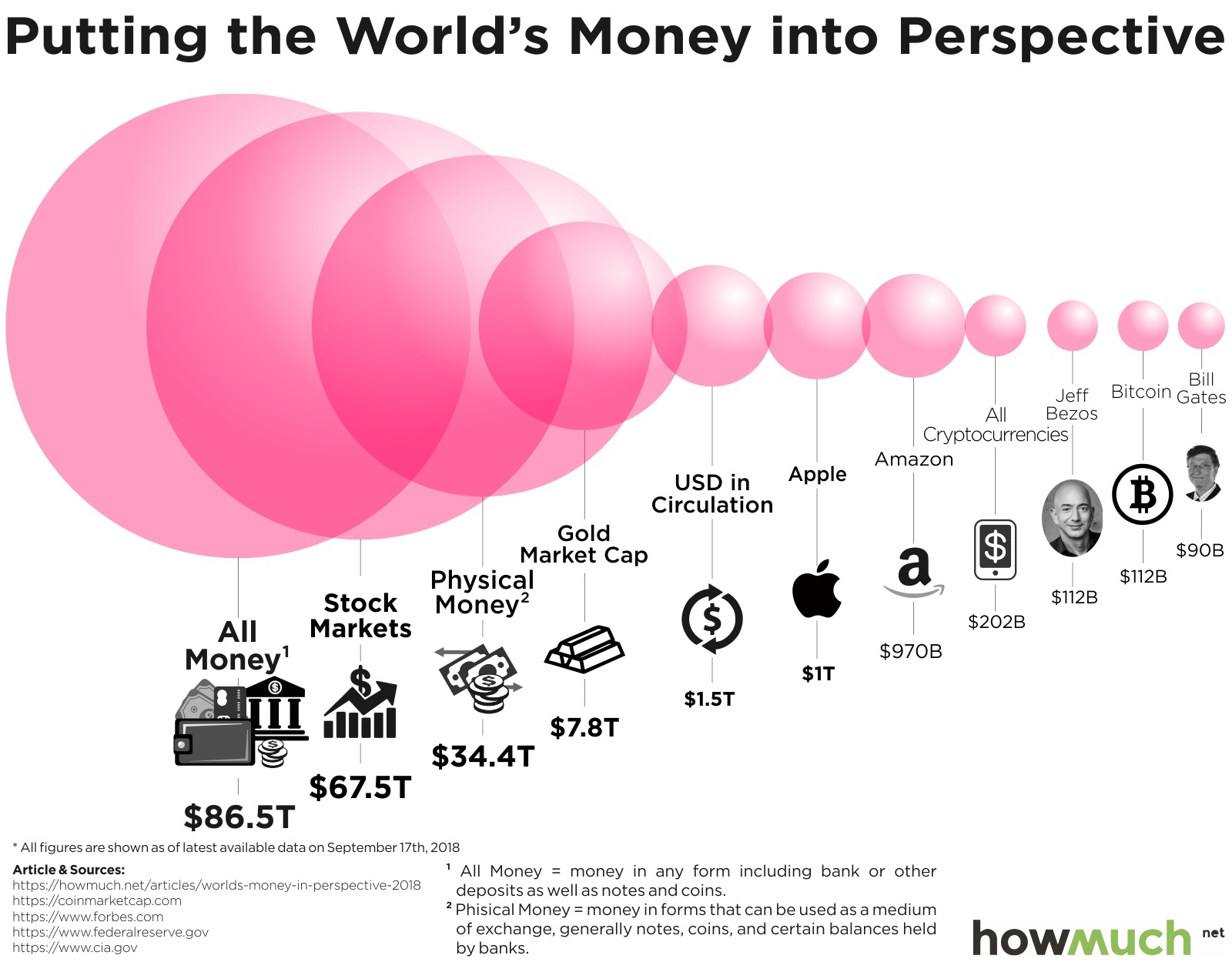

To avoid falling prey to scams, it’s crucial to set clear investment rules. Avoid investing in cryptocurrencies with tiny market caps and limited liquidity. Stick to reputable exchanges and avoid meme coins, which often have limited long-term appeal.

Set clear investment rules to avoid falling prey to scams.

Set clear investment rules to avoid falling prey to scams.

Educating yourself about the crypto market is key to avoiding scams. Familiarize yourself with blockchain wallets and the basics of cryptocurrency trading. As the market continues to evolve, staying informed will be crucial in navigating the complex world of crypto.

Conclusion

While scams remain a threat in the crypto market, there are steps you can take to safeguard your investments. By investing in ETFs, choosing a trusted trading platform, and setting clear investment rules, you can minimize your risk and maximize your returns. As the regulatory environment tightens, the risk of scams will likely decline. Until then, it’s essential to stay vigilant and informed.