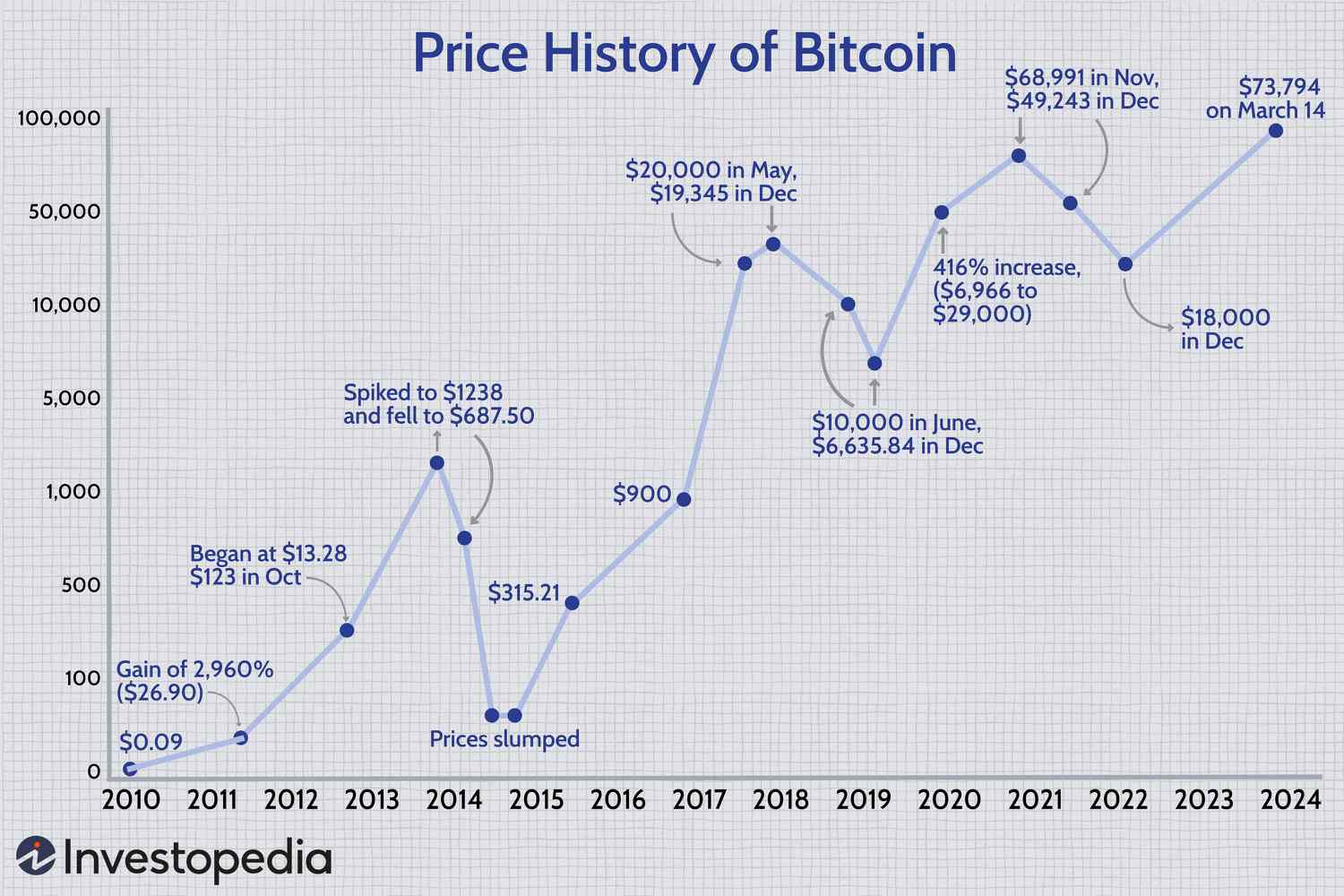

Cryptocurrency Market Sees Shifts in ETF Landscape and Meme Coin Frenzy

The cryptocurrency market has witnessed significant developments in the past week, with BlackRock’s iShares Bitcoin Trust (IBIT) surpassing Grayscale Bitcoin Trust (GBTC) as the largest spot bitcoin ETF. This shift in the ETF landscape comes amidst a backdrop of increased regulatory scrutiny, with President Joe Biden vetoing a bill that would have allowed traditional banks to more easily serve as custodians for crypto assets.

BlackRock’s IBIT Takes the Lead

IBIT, which began trading on January 11, has quickly gained traction, becoming the largest spot bitcoin ETF by assets. This development marks a significant milestone in the rapidly evolving cryptocurrency market.

Bitcoin ETFs continue to gain traction

Bitcoin ETFs continue to gain traction

President Biden Vetoes Crypto Bill

In a move that was widely anticipated, President Biden vetoed a bill aimed at overturning the SEC’s special regulations for custodians of crypto assets. This decision is likely to have significant implications for the cryptocurrency market, as it reinforces the need for stricter regulations in the industry.

Regulatory scrutiny intensifies in the cryptocurrency market

Regulatory scrutiny intensifies in the cryptocurrency market

Japanese Crypto Exchange Hacked

In a disturbing incident, Japanese crypto exchange DMM Bitcoin announced that it had been hacked, resulting in the theft of approximately $308 million worth of bitcoin. This incident serves as a stark reminder of the importance of robust security measures in the cryptocurrency space.

Security concerns in the cryptocurrency market

Security concerns in the cryptocurrency market

Meme Coins and GameStop Frenzy

In a surprising turn of events, meme coins have seen a surge in value, driven in part by the return of renowned retail trader Keith Gill, also known as RoaringKitty. This development has sparked a frenzy of activity, with many investors seeking to capitalize on the trend.

Meme coins see a surge in value

Meme coins see a surge in value

What’s Next?

As the cryptocurrency market continues to evolve, investors and enthusiasts alike will be closely watching for further developments. With the ETF landscape shifting and regulatory scrutiny intensifying, it remains to be seen how the market will respond in the coming weeks.

The cryptocurrency market continues to evolve

The cryptocurrency market continues to evolve