Cryptocurrency in Conservative Investment Strategies: A New Approach

When it comes to investing, most people think of traditional assets like stocks and bonds. However, with the rise of cryptocurrency, investors are now considering alternative assets to diversify their portfolios. Fidelity Investments, a well-established financial institution, has taken a bold step by incorporating a spot bitcoin ETF into their Conservative All-in-One portfolio. This move has sparked interest in the potential benefits of including cryptocurrency in conservative investment strategies.

Bitcoin’s volatility can be an opportunity for diversification

Bitcoin’s volatility can be an opportunity for diversification

The key to successfully integrating cryptocurrency into a conservative investment strategy lies in understanding the difference between risk and volatility. While traditional measures of volatility may not fully capture the risk and opportunity in the crypto market, a small allocation of cryptocurrency can actually de-risk a portfolio.

Diversification is key to minimizing risk

Diversification is key to minimizing risk

Fidelity’s allocation of 1% to 3% crypto into a fund of otherwise low-cost, low-risk assets serves as a useful blueprint for personal, conservative investment strategies. This approach is far removed from the full-steam-ahead FOMO investing often seen in retail investors.

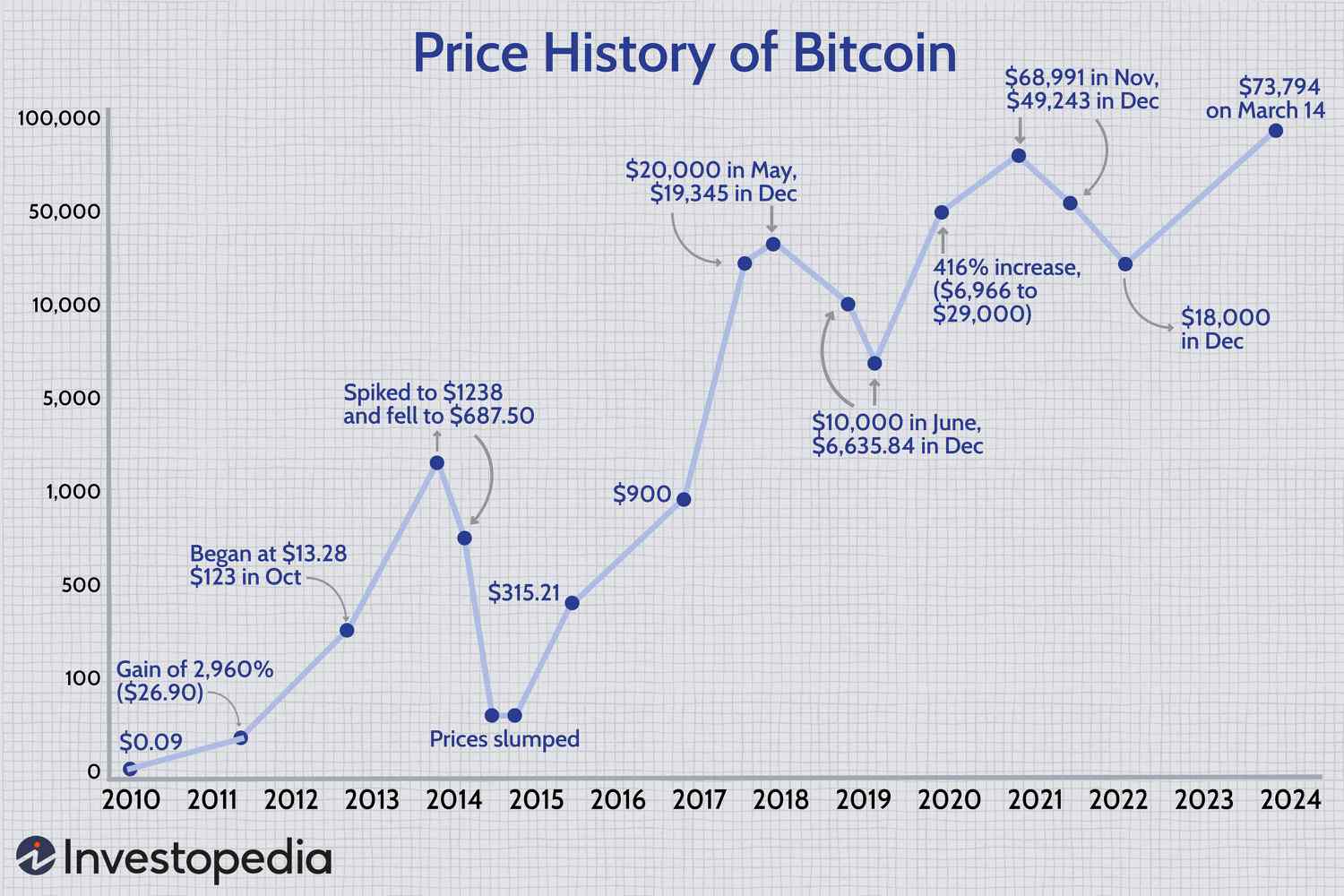

“The typical crypto hype cycle looks like this: Bitcoin or a similar fund posts rapid growth. People don’t want to miss out, so they buy in right when the asset is most expensive, only to suffer when the price oscillates downward.”

By including investments that don’t move in lockstep with the rest of the market, investors can reduce portfolio volatility. This means that when one part of the market is underperforming, the impact on the overall portfolio is mitigated.

A diversified portfolio can minimize risk

A diversified portfolio can minimize risk

In conclusion, including a small amount of cryptocurrency in a conservative investment strategy can actually de-risk a portfolio. By understanding the difference between risk and volatility, investors can make informed decisions about their investment portfolios.

Cryptocurrency can be a valuable addition to a conservative investment strategy

Cryptocurrency can be a valuable addition to a conservative investment strategy