The Shifting Landscape of Cryptocurrency: From Digital Gold to Political Capital

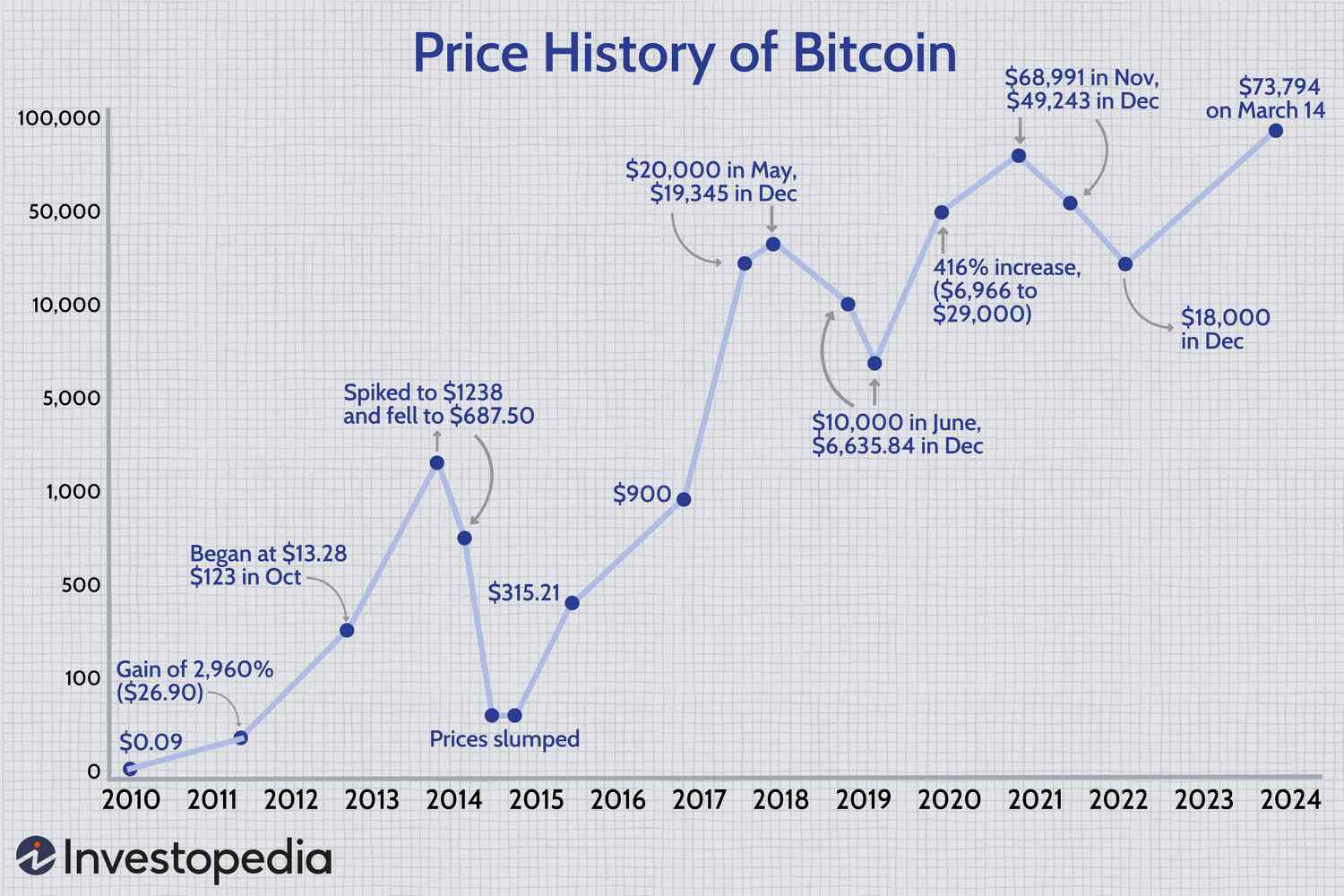

Cryptocurrency has been rapidly evolving, with diverse voices weighing in on its significance and potential. Recently, the Industrial and Commercial Bank of China (ICBC) published a detailed analysis exploring this evolution, likening Bitcoin to digital gold and describing Ethereum as “digital oil.” This comparison illustrates a growing recognition of the varied use cases and intrinsic values of different cryptocurrencies.

The evolution of cryptocurrency is marked by increasing recognition and utility.

The evolution of cryptocurrency is marked by increasing recognition and utility.

As the world watches these digital assets gaining traction, the conversation around them is becoming increasingly relevant, especially in the political arena. With major political events looming, such as the upcoming debates between presidential candidates Joe Biden and Donald Trump, cryptocurrency is set to intersect with electoral discourse. The debates, slated for June 27 and September 10, will not only address pressing economic issues but are anticipated to include discussions on the future of cryptocurrencies. In fact, some estimates suggest that up to 20% of voters in key swing states consider crypto a pivotal issue in their decision-making process.

Cryptocurrency and the 2024 Elections

Significantly, Donald Trump’s recent remarks have positioned crypto as a uniquely relevant political topic. At an NFT event, he declared:

“The Democrats are very much against it [crypto]. And I say this, a lot of people are very much for it … and I’m fine with it. I want to make sure it’s good and solid … but I’m good with it.”

Trump’s support has emboldened many crypto enthusiasts to rally behind his campaign, especially considering the growing divide in public opinion regarding the regulation and future of these digital currencies. As regulatory discussions surround Ethereum ETFs and Binance lawsuits, the electorate’s awareness of these matters only deepens.

Political discussions are increasingly embracing the topic of cryptocurrency.

Political discussions are increasingly embracing the topic of cryptocurrency.

Major Players Respond: Mastercard’s Innovations

Amidst this politically charged atmosphere, financial institutions are also making significant moves to integrate cryptocurrency into everyday payment systems. Mastercard is at the forefront of these innovations, questioning whether cryptocurrency remains too complex for standard payments. The company aims to simplify this process, leveraging its scale and name recognition to bolster cryptocurrency adoption.

Mastercard’s recent initiatives, including the introduction of crypto credentials that use simple aliases instead of complex blockchain addresses, aim to ease the user experience. This approach mirrors earlier efforts by PayPal to smooth the transition for users unfamiliar with crypto transactions.

As Raj Dhamodharan, Mastercard’s executive vice president, stated:

“If you want a healthy transaction, what you want is a verified identification. We want to put standards behind that verification.”

This sentiment underscores the necessity of making cryptocurrency accessible to a broader audience, not just tech-savvy users but also the average consumer.

Mastercard’s new initiatives aim to simplify cryptocurrency transactions.

Mastercard’s new initiatives aim to simplify cryptocurrency transactions.

Challenges to Consumer Adoption

Despite the promise that cryptocurrencies hold for revolutionizing payment systems, significant hurdles remain. James Wester, a director at Javelin Strategy & Research, emphasizes that most current crypto wallets are not user-friendly. The risk of making simple mistakes—such as sending the wrong type of cryptocurrency to an incompatible wallet—can lead to loss of funds, deterring users from fully embracing crypto for everyday transactions.

As Mastercard and Visa seek to integrate more cryptocurrencies and stablecoins into their payment processes, it is clear that the industry is striving to address these challenges. By focusing on improving the user experience and ensuring regulatory compliance, they hope to unlock the true potential of cryptocurrencies as a mainstream payment method.

The Road Ahead for Cryptocurrency

Looking forward, the interplay between cryptocurrencies and traditional political discourse will likely shape the regulatory landscape in the coming years. The recognition of digital currencies by powerful entities such as ICBC and massive payment processors like Mastercard signifies a transformative moment in the financial sector.

As we move closer to the debates and into the new political climate, it will be crucial for both candidates and voters to consider the implications of cryptocurrencies on economic policy. With their potential to disrupt traditional finance and their growing significance in electoral politics, cryptocurrencies are poised to become a defining issue in the 2024 elections and beyond.

In summary, as the dialogue around cryptocurrency grows more sophisticated, both its supporters and detractors will have to navigate an increasingly complex landscape defined by innovation, regulation, and public sentiment. The future of digital currencies seems bright, but only time will tell how they will integrate into the fabric of our daily lives and the broader economy.

The future of cryptocurrency holds both challenges and immense potential.

The future of cryptocurrency holds both challenges and immense potential.