The Intriguing Intersection of Cryptocurrency and Economic Trends

Cryptocurrencies have captured the imagination of investors and experts alike, largely due to their potential to reshape the financial landscape. With Bitcoin leading the charge, the entire ecosystem has sparked conversations regarding its implications on economic behavior and market dynamics.

Understanding the Current Landscape

The rise of cryptocurrencies has prompted various stakeholders, including regulators and traditional financial institutions, to reevaluate their positions. Understanding this evolving landscape is crucial. Here are some important points to consider:

- Increasing Adoption: More businesses are starting to accept cryptocurrencies, which is condensing the gap between traditional currency and digital currencies.

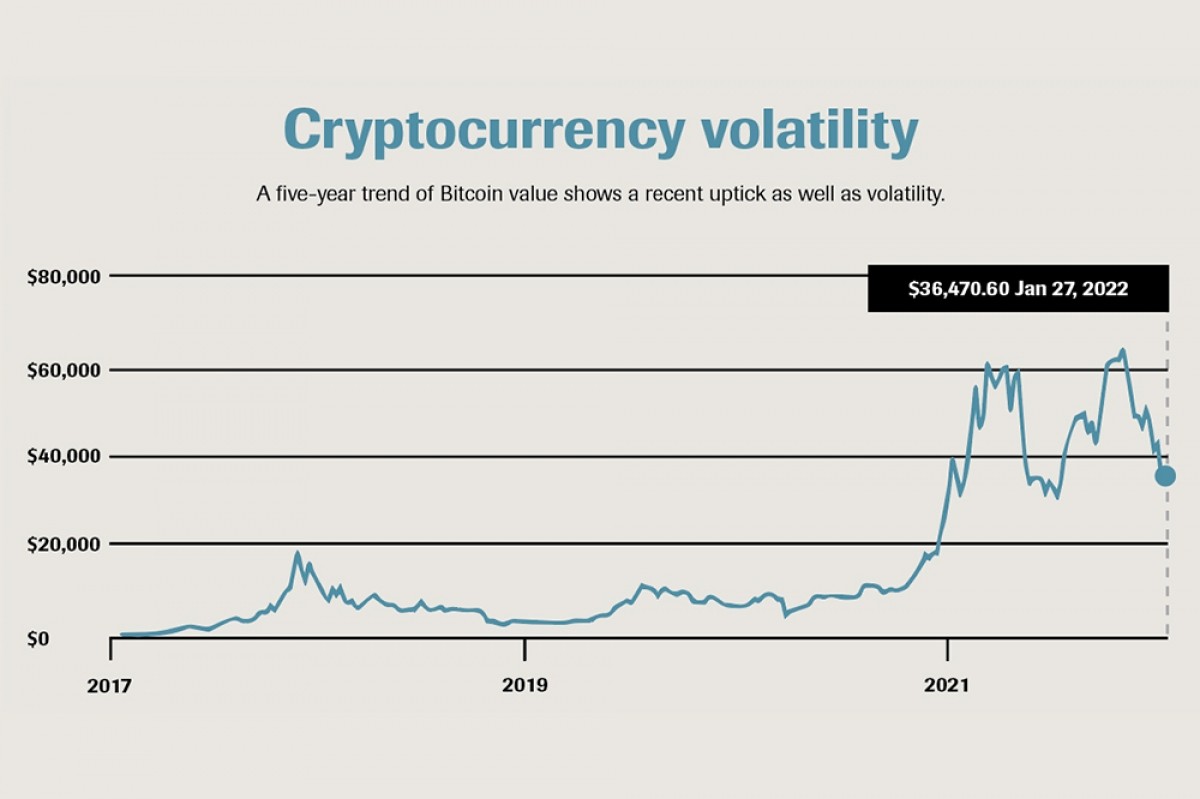

- Market Volatility: Cryptocurrencies are notoriously volatile, which can either be a deterrent or an opportunity for investors, depending on their risk appetite.

Trends in the cryptocurrency market

These factors paint a complex picture. On one hand, the opportunities for profit are enticing; on the other hand, the inherent risks serve as a warning to potential investors. Navigating this duality is part of what makes the cryptocurrency market so compelling.

Implications for Traditional Finance

As cryptocurrencies gain traction, traditional financial models and methodologies are being put to the test. Financial institutions must not only adapt but also innovate to keep pace. For example, many banks are investing in blockchain technology, viewing it as an essential part of their future infrastructures.

This is a pivotal moment. The thinking that led to the establishment of traditional financial institutions is being challenged by new, decentralized models. As someone fascinated by both finance and innovation, I find the ongoing trends in crypto exhilarating. How will these changes redefine trust in financial systems? I often reflect on how my own investment strategies have evolved due to these developments.

The Future of Cryptocurrencies

Predicting the future of cryptocurrencies is fraught with uncertainty. Will they become the backbone of an entirely new economy? Or will regulatory changes stymie their growth?

My belief is that we are still at the dawn of this evolution. More traditional companies are also dipping their toes into digital currencies, creating partnerships that blur the lines between these two worlds. The potential for integration or conflict remains palpable.

“The most successful investments will come from those who adapt not just quickly, but intelligently,” says a colleague of mine who has been in the financial sector for decades.

This statement resonates deeply with me. It acknowledges the necessity of informed decision-making amidst rapid change.

The integration of cryptocurrency into our financial future

The integration of cryptocurrency into our financial future

My daily interactions with various financial professionals—each with differing views on crypto—affirm that while skepticism exists, so does excitement about potential growth. The question remains: who will capitalize the most during this time of uncertainty?

Conclusion

In summary, the discussion surrounding cryptocurrencies serves as a lens through which we can view broader economic changes. The dynamic nature of this sector encourages continuous dialogue and reassessment of what wealth and finance mean in today’s world. Therefore, it is imperative to stay informed and remain open to new ideas and investment strategies as this saga unfolds.

I look forward to navigating this intriguing space and am excited about where we may end up in the next few years.