Crypto Shorts Lose $1.9 Billion as Coinbase and MicroStrategy Outpace Bitcoin Surge

Bearish traders betting on crypto stocks falling have lost a staggering $1.9 billion in 2024. The main culprits behind this loss are crypto firms Coinbase and MicroStrategy, whose stocks have rallied this year, driving 84% of bears’ losses.

Crypto stocks on the rise

Crypto stocks on the rise

The euphoric rally has left short sellers down $1.9 billion since January, according to a report by data analytics firm S3 Partners. Despite being down billions, bearish investors are betting that the crypto stock rally will falter.

“Crypto stock short sellers have been selling into a rallying market,” said Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners.

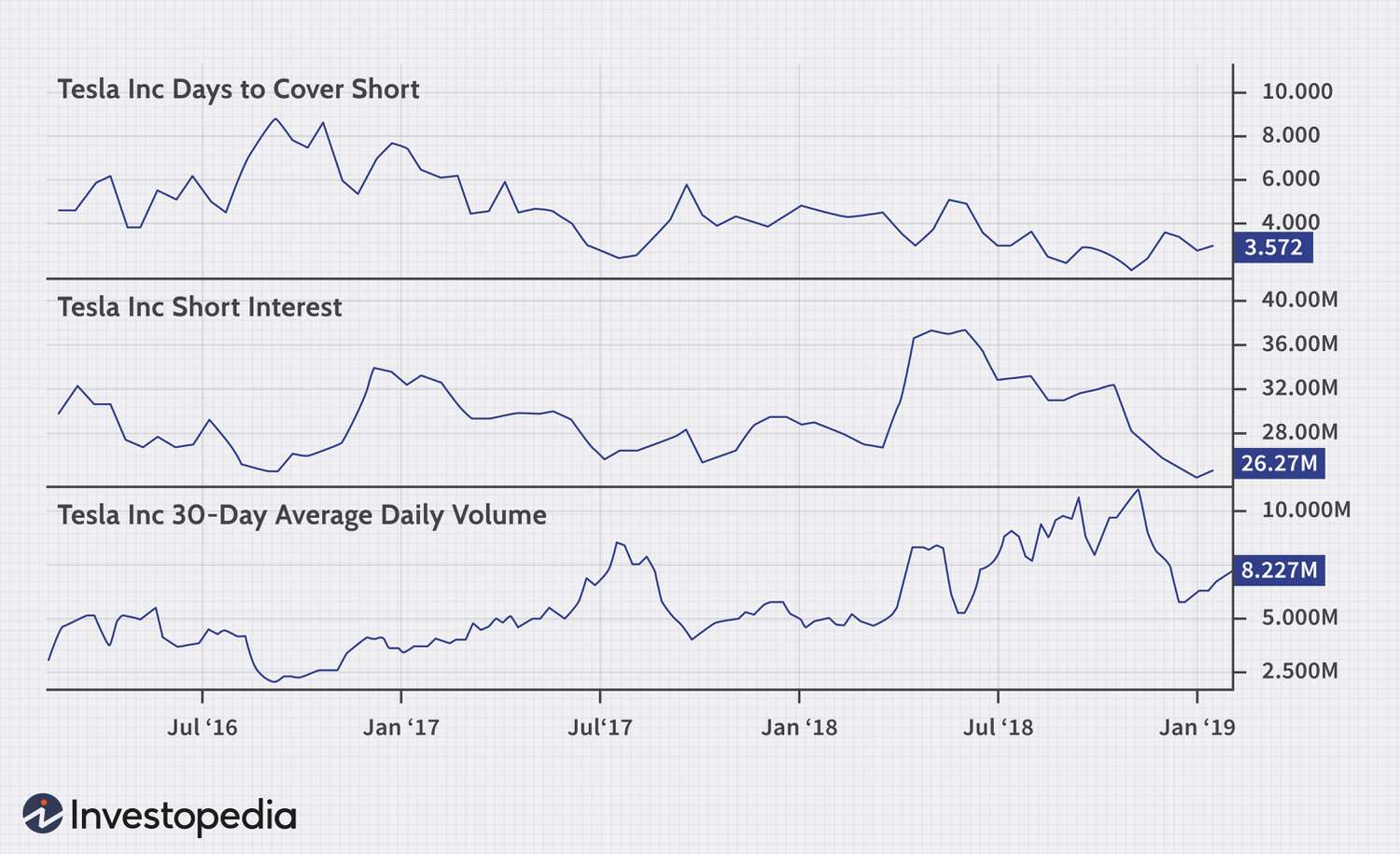

The total short interest in crypto-related stocks is at $10.7 billion, three times larger than the average in other sectors. Short interest is a measure of the number of shares being sold short, or used to bet on the stock price falling, that have not been covered or closed out.

Short interest on the rise

Short interest on the rise

Despite short sellers’ losses, short interest has risen by $4.5 billion in the last 30 days alone. S3 attributed $925 million to new bearish bets, with higher prices accounting for the rest.

“If the short exposure is a Bitcoin hedge, then short interest should remain relatively flat, regardless of the Bitcoin rally,” said Dusaniwsky.

Crypto stocks are also “extremely crowded.” MicroStrategy, Coinbase, and Bitcoin miner CleanSpark are the sector’s “most squeezable” stocks, according to S3 Partners.

Crypto stocks on the rise

Crypto stocks on the rise

As stock prices rise, short sellers are forced to buy stock, or “cover,” their bets to avoid liquidation. During a price rally, excessive covering can lead to a jump in price, called a squeeze.

MicroStrategy and Coinbase make up 84% of the short interest in the sector. With the crypto market on the rise, it’s likely that we’ll see more squeezes in the future.

The crypto market is on the rise

The crypto market is on the rise

In conclusion, the crypto market is on the rise, and short sellers are feeling the burn. With crypto stocks like Coinbase and MicroStrategy leading the charge, it’s likely that we’ll see more squeezes in the future. Will the rally continue, or will the bears finally get their revenge?

The future of crypto

The future of crypto