Are These 2 Crypto Stocks Really Down More Than 15% This Year? Let’s Uncover the Truth!

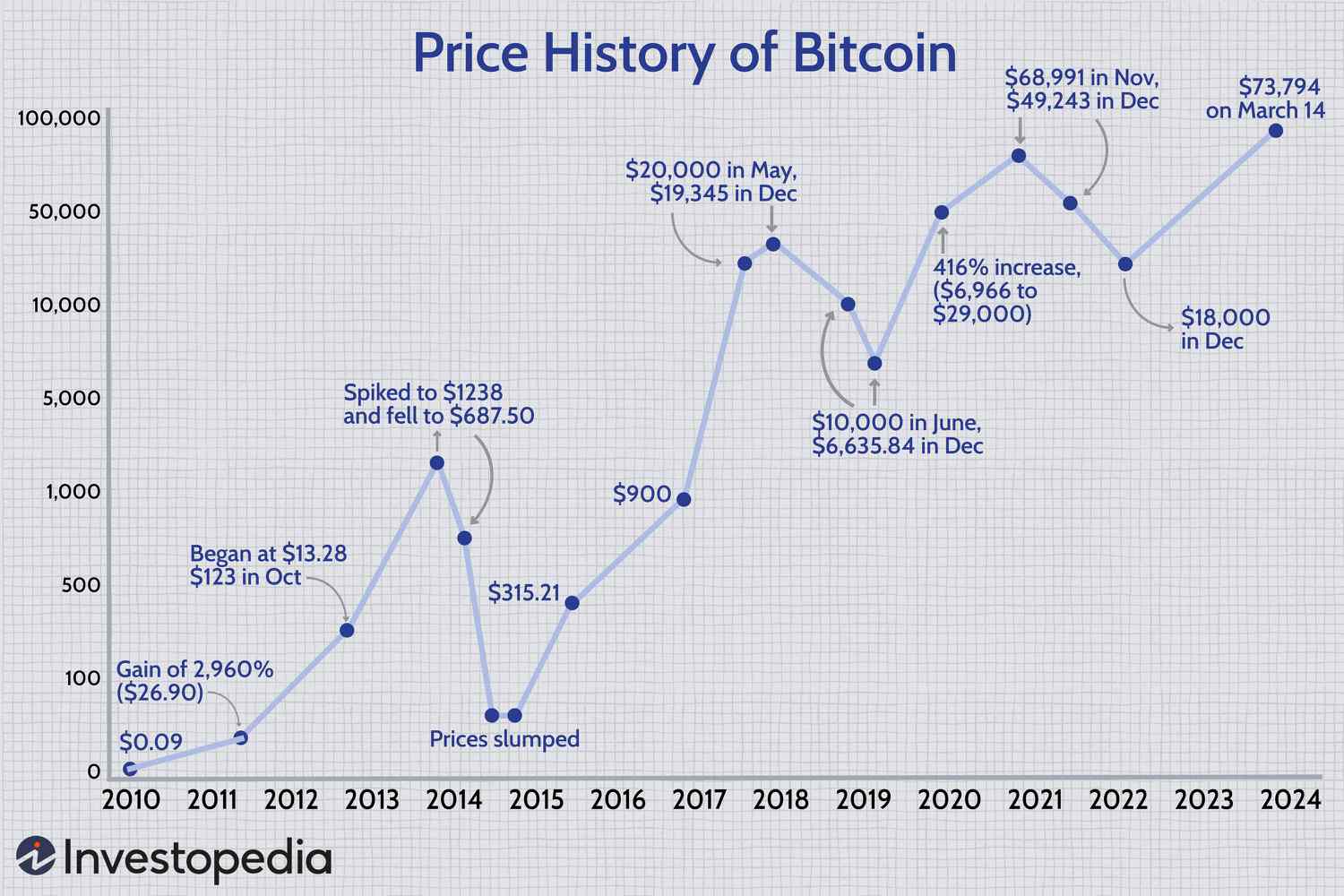

The world of Bitcoin and cryptocurrency has been a rollercoaster ride this year, with Bitcoin(CRYPTO: BTC) soaring by 50% amidst the ongoing excitement. However, not all crypto investments have shared in the success. Shares of Marathon Digital(NASDAQ: MARA) and Riot Blockchain(NASDAQ: RIOT) have taken a hit, plummeting more than 15% in 2024.

Marathon Digital: A Rocky Road

Last year was a dream run for Bitcoin miner Marathon Digital, with its shares skyrocketing by a staggering 587% fueled by the cryptocurrency’s surging value. As one of the major Bitcoin miners in North America, Marathon’s operations thrived on the back of rising prices. Fast forward to this year, and the story has taken a different turn. Marathon’s shares have dipped approximately 18% since January, despite the company’s efforts to expand its mining sites and boost overall capacity. These expansions were expected to bolster its dominance and drive substantial revenue growth in the future.

In 2023, Marathon’s revenue shot up by a whopping 229%, hitting $388 million. The company also reported an impressive net income of $261.2 million, benefiting from gains on its digital assets. Despite these positive developments, Marathon’s stock has faced a decline this year, possibly due to investors cashing out on remarkable profits. While the stock may seem reasonably priced, trading at 18 times its trailing earnings, the inherent volatility in the mining sector cannot be overlooked. In 2022, Marathon incurred a net loss of $694 million, primarily due to impairment charges impacting its financials.

Given the uncertainties surrounding Marathon’s future earnings, labeling the stock as ‘cheap’ would be a stretch. However, for those willing to embrace the high-risk nature of investing in the stock and seeking exposure to Bitcoin, Marathon could potentially be a promising growth stock to consider.

Bitcoin mining operations

Riot Platforms: Struggling in the Shadows

Another player in the crypto mining arena, Riot Platforms, has faced its own set of challenges this year, with a staggering 25% decline in its stock value. In contrast to Marathon, Riot Platforms has underperformed, registering a worse performance. Despite a successful 2023, where the stock delivered gains of 356% for its investors, the company’s fortunes have taken a hit in 2024.

Riot Platforms reported record revenue of $280.7 million in 2023, marking an 8% increase from the previous year. The company attributed this growth to higher Bitcoin production and prices. However, with a production of 6,626 bitcoins in 2023 compared to 5,554 in the previous year, representing a 19% increase, Riot Platforms still lags behind Marathon in terms of growth potential. The looming Bitcoin halving event poses a significant risk to Riot Platforms, given its smaller size and susceptibility to market fluctuations.

Despite the positive revenue figures, Riot Platforms failed to turn a profit last year, with a net loss of $49.5 million. This lack of profitability, coupled with the upcoming Bitcoin halving, raises concerns about the company’s ability to sustain itself in a challenging market environment.

While Riot Platforms’ stock may appear tempting due to its current valuation, the lack of profitability and growth prospects could deter potential investors from considering it as a viable addition to their portfolios.

Cryptocurrency market trends