Why Bitcoin Took a Dive Today

Cryptocurrency markets experienced a sharp downturn today, with Bitcoin (BTC) and other major cryptocurrencies plummeting in value. Despite Bitcoin’s impressive 50% year-to-date increase, it has dropped over 6% in the last 24 hours.

This sudden decline has pushed Bitcoin back below $63,000 after reaching a record high above $73,000 last week. The psychological significance of this drop cannot be understated, as Bitcoin struggled to surpass the $63,000 mark during the crypto winter of 2022-23.

Ethereum (ETH), the leading altcoin, also saw a significant decrease of over 7%, bringing its price down to $3,200. Ethereum faced similar challenges in overcoming the $3,200 barrier following the crypto winter.

The impact of Bitcoin’s decline rippled across the entire cryptocurrency market. Other prominent altcoins such as Solana (SOL), BNB Coin (BNB), Cardano (ADA), and Avalanche (AVAX) all experienced notable drops in value. Surprisingly, XRP (XRP) was the only major altcoin that remained relatively stable, with less than a 1% decrease.

The Root Cause of Bitcoin’s Decline

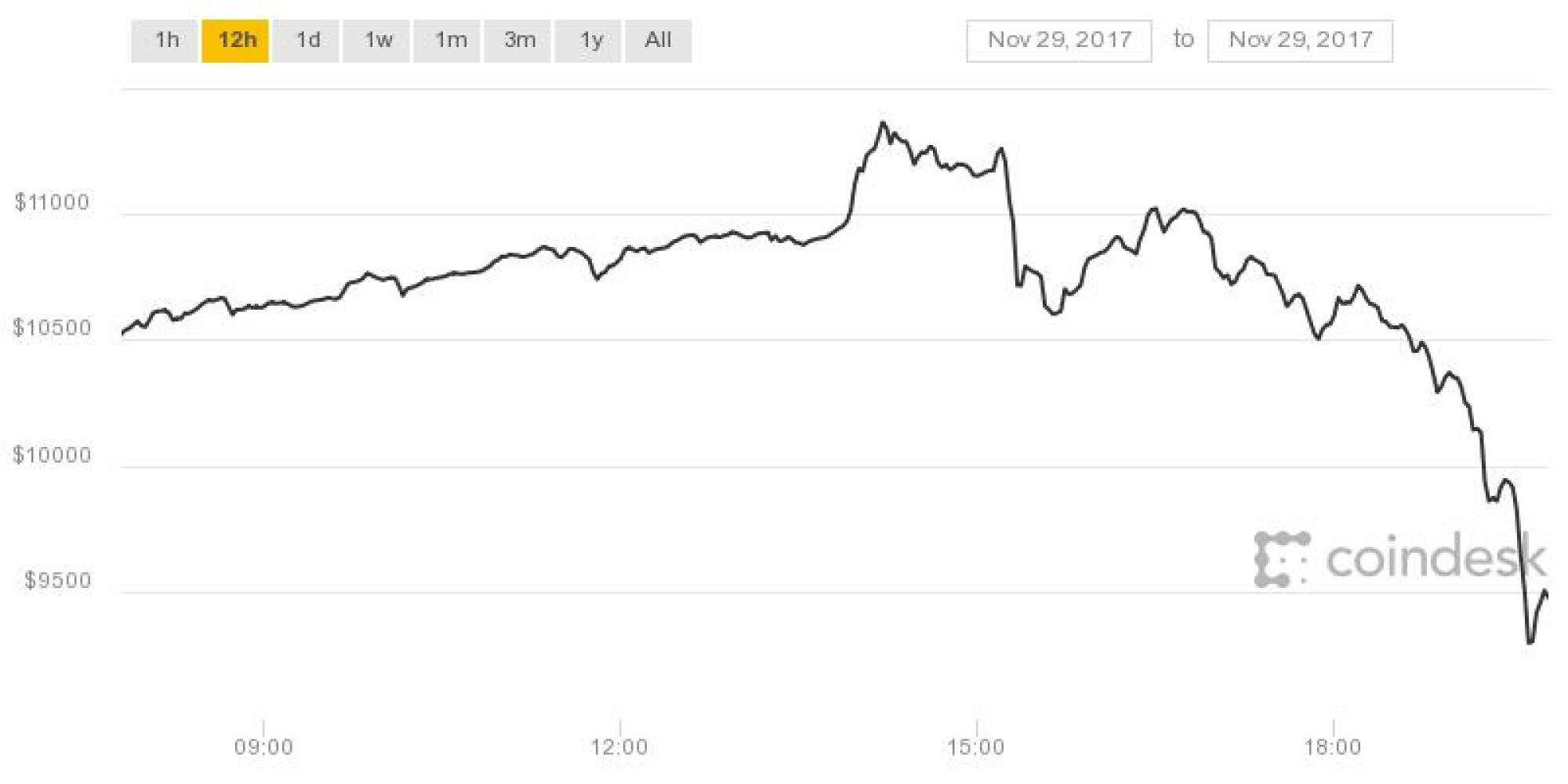

The exact reason behind Bitcoin’s recent dip remains somewhat unclear. However, reports suggest that a flash crash on the BitMEX crypto exchange triggered a massive sell-off, causing Bitcoin to briefly plummet to $8,900. Despite this, most major exchanges maintained Bitcoin prices above $60,000.

Following the initial crash, Bitcoin continued to lose value steadily, leading to an overall market cap decline of more than 8%. The broader market’s downturn is likely attributed to the fact that altcoins tend to follow Bitcoin’s lead.

Bitcoin’s recent surge began in November of the previous year, propelling its price from $34,000 to over $73,000. This surge was further fueled by the U.S. Securities and Exchange Commission’s approval of 11 new spot Bitcoin exchange-traded funds (ETFs) on January 10. Bitcoin’s price surge resulted in a more than 50% gain since the beginning of the year.

ETFs, similar to mutual funds, allow investors to trade a diversified portfolio as a single investment. However, unlike mutual funds, ETFs are traded on stock exchanges throughout the market day. It’s important to note that Bitcoin ETFs, whether spot or futures-focused, only operate during market hours.

Evaluating Cryptocurrency as an Investment

The cryptocurrency market witnessed a remarkable resurgence in 2023, with Bitcoin closing the year with a 156% increase. This recovery marked the end of the crypto winter of 2022, which was characterized by the collapse of the FTX crypto exchange in November.

In response to FTX’s collapse and other events, U.S. regulators intensified their oversight of exchanges and companies involved in cryptocurrency trading. SEC Chair Gary Gensler has asserted that most cryptocurrencies are securities subject to existing regulations. This stance was reinforced through legal actions taken against major crypto exchanges like Binance and Coinbase for allegedly engaging in unlicensed securities trading.

Despite regulatory challenges, Bitcoin’s current price of around $63,000 remains more than 15% below its recent all-time high. This price volatility underscores the inherent risks associated with cryptocurrency investments.

Conclusion

The cryptocurrency market’s recent turbulence serves as a reminder of the sector’s inherent volatility and regulatory uncertainties. While Bitcoin and other cryptocurrencies offer significant growth potential, investors must exercise caution and stay informed about market developments to navigate this rapidly evolving landscape.