Crypto Markets on High Alert as $4.7B Bitcoin Options Expiry Looms

The crypto market is bracing itself for a potentially volatile day as a massive $4.7 billion in notional value Bitcoin options contracts are set to expire today. This event has the potential to shake up the market, and many are wondering how it will react.

Bitcoin options expiry event

The put/call ratio for this tranche of Bitcoin options is 0.61, indicating that there are more calls (or long contracts) expiring than puts (or shorts). The max pain point, or the point at which most losses will be made, is around $65,000, which is $3,500 lower than current spot prices.

“The total OI notional value for all outstanding BTC options contracts is a whopping $19 billion.” - Deribit

This massive expiry event comes on the heels of last week’s US Securities and Exchange Commission’s approval of spot Ethereum exchange-traded funds, which has led to a decline in crypto markets this week. However, volatility could increase significantly today.

Bitcoin price chart

In addition to today’s big batch of Bitcoin options, there are around $3.7 billion in notional value Ethereum contracts expiring. The 910,000 contracts have a put/call ratio of 0.84, with long and short sellers more evenly matched than for BTC contracts.

The crypto market has been relatively flat over the past 12 days, with total capitalization remaining steady at $2.68 trillion. Bitcoin has inched up 1.2% on the day to trade at $68,489, while Ethereum has fallen slightly to $3,751.

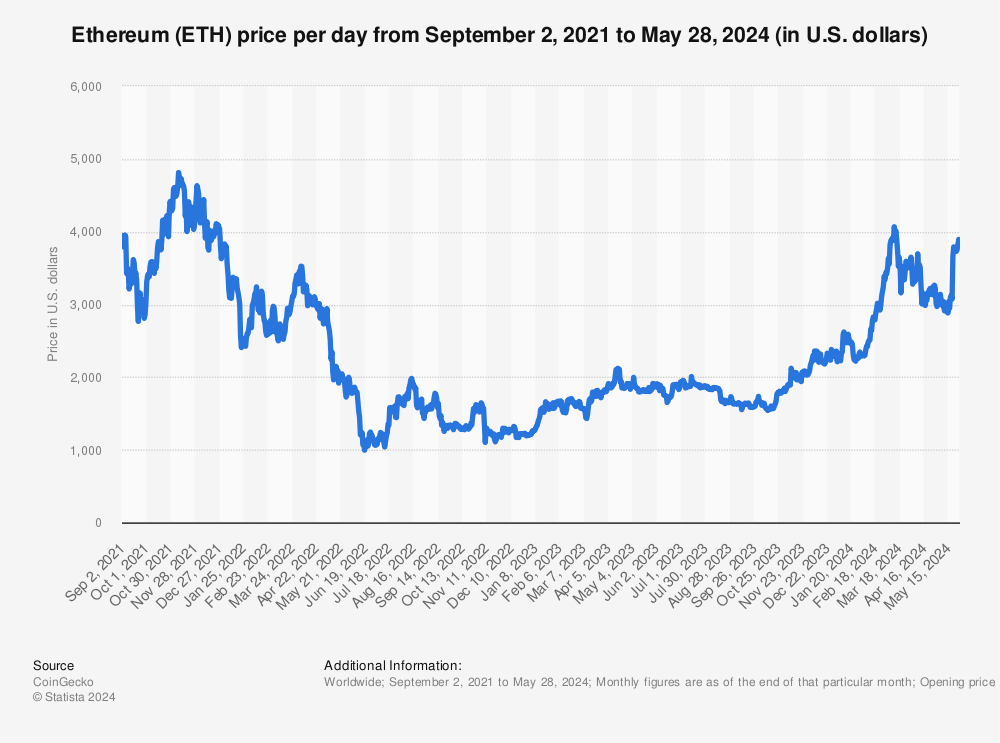

Ethereum price chart

Ethereum price chart

Altcoins have been mostly in the red, adding to their declines over the past few days, and meme coins have taken a particularly large beating.

As the crypto market navigates this massive options expiry event, one thing is certain - volatility is on the horizon. Will Bitcoin and Ethereum prices surge or plummet? Only time will tell.

Cryptocurrency market

Cryptocurrency market