Crypto Market Sentiment Plummets to ‘Extreme Fear’ as Bitcoin Fails to Break $60,000

The Crypto Fear & Greed Index has fallen to ’extreme fear’ for the first time since January 2023, as Bitcoin struggles to reclaim a crucial price level. The index, which tracks market sentiment toward Bitcoin and crypto, has tumbled to its lowest level in months.

Bitcoin price chart showing recent decline

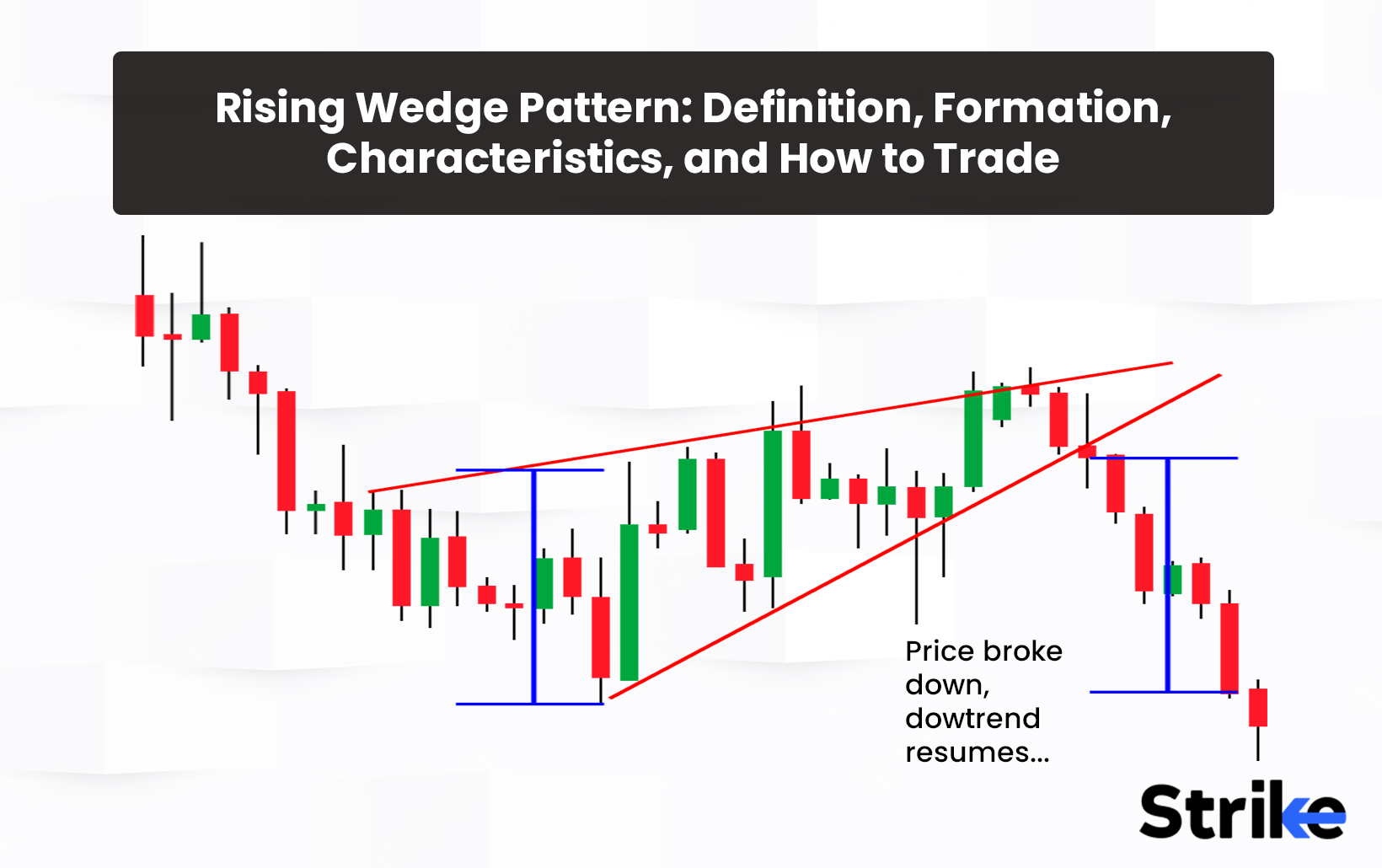

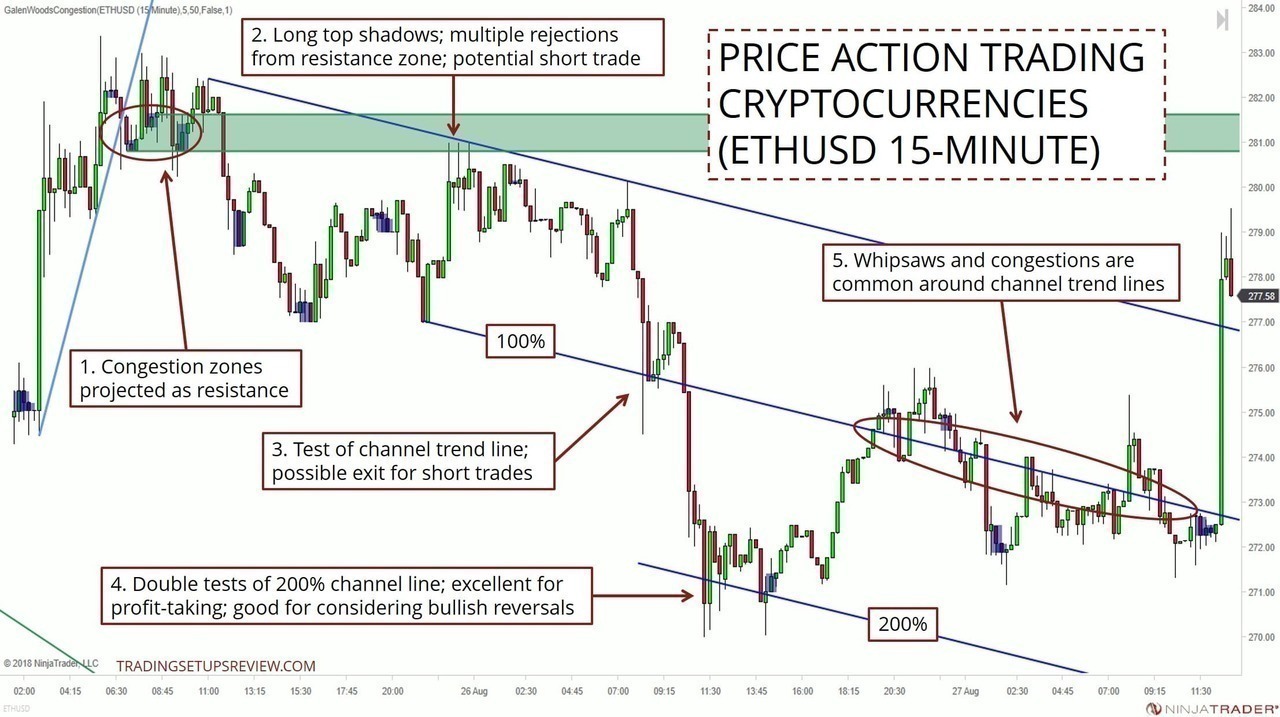

The tumbling score came as the price of Bitcoin (BTC) failed to break above the $60,000 mark for the second time in the last 48 hours. Crypto and forex trader Justin Bennett noted the formation of a potential ‘rising wedge,’ which suggests further downside in the coming days.

Rising wedge pattern on Bitcoin price chart

Rising wedge pattern on Bitcoin price chart

Bitcoin rallied as high as $59,485 on July 10 before tumbling back down to $57,000 in the following 12 hours. On July 11, BTC briefly rallied to $59,529 again but failed to hold at that level.

Bitcoin price action on July 10 and 11

Bitcoin price action on July 10 and 11

The recent negative sentiment has been linked to news that Mt. Gox has started paying back its creditors since July 5, potentially unleashing up to $8.5 billion worth of Bitcoin onto the market. Additionally, large sales from the German Government have transferred 16,254 BTC, worth $935 million at current prices, to market makers and exchanges in recent days.

Mt. Gox logo

The Crypto Fear & Greed Index factors in market volatility, trading volume, Bitcoin’s dominance, and trends. Despite the current bearish sentiment, some market analysts remain optimistic, citing the potential for Fed rate cut bets and FTX repayments to offer support.

Federal Reserve building

The prospect of some of the $16.3 billion FTX repayment over the next months translating into buying pressure, the increasingly positive stance toward crypto on both sides of the aisle, and the potential of an interest rate cut in September benefiting risk assets more generally should embolden medium- and long-term bulls.

US Government Launches New Attempt to Gather Data on Electricity Usage of Bitcoin Mining

The Energy Information Agency is starting the process to require cryptocurrency miners to submit energy consumption data after a previous attempt faced legal challenges.

Bitcoin mining operation

The fast-growing cryptocurrency industry is a major consumer of electricity, but no one, not even the U.S. government, knows exactly how much energy goes into the armada of computers used to ‘mine’ Bitcoin and other digital assets.

Energy consumption chart

The U.S. government’s new attempt to gather data on electricity usage of Bitcoin mining comes as the industry faces increasing scrutiny over its environmental impact. As the crypto market navigates its current bearish sentiment, the industry’s energy consumption is likely to remain a key area of focus for regulators and environmentalists alike.

Photo by

Photo by