The Crypto Market’s Sudden Surge: What’s Behind the Bull Run?

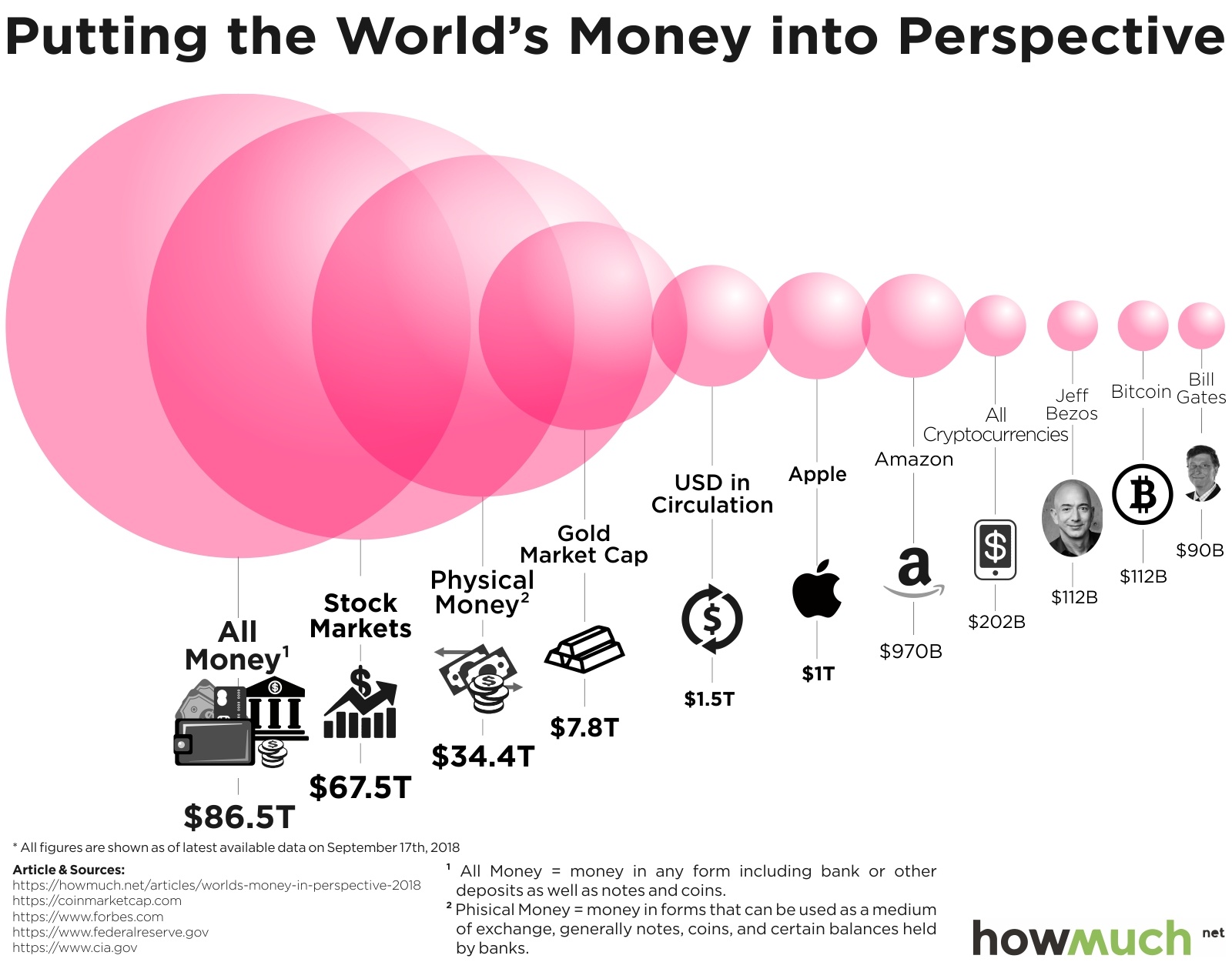

The cryptocurrency market has seen a dramatic upswing in recent days, with the total market capitalization surging over 4% in just 24 hours. Bitcoin is leading the charge, and altcoins like Chainlink are benefiting from large investors buying up significant amounts. But what’s driving this sudden surge in the crypto market?

A visual representation of the recent market upswing.

A visual representation of the recent market upswing.

One of the main reasons behind the surge is the growing demand for digital assets. According to a recent report by Coin Metrics, over $1 billion flowed into spot Bitcoin ETFs last week, highlighting the growing interest in digital assets.

On-chain data also indicates a flurry of whale activity in various altcoins. Notably, Chainlink whales have accumulated over 10 million LINK tokens, valued at more than $120 million, in the past two weeks. This increased activity is a positive sign for the market.

“The demand for cryptocurrencies has surged recently, as evidenced by over $1 billion flowing into spot Bitcoin ETFs last week.” - Source

The U.S. SEC has lost multiple cases against crypto projects and ceased investigations into others, while the European Union continues to advance the Markets in Crypto-Assets (MiCA) regulation. These developments are attracting more institutional investors to the Web3 space.

The evolving regulatory landscape is contributing to the crypto market’s growth.

The evolving regulatory landscape is contributing to the crypto market’s growth.

The Failed Assassination of Donald Trump: A Crypto-Friendly Candidate

The recent failed assassination attempt on U.S. presidential candidate Donald Trump has boosted his re-election chances. As a known advocate for cryptocurrency, Trump’s campaign has garnered significant backing from prominent figures in the crypto world, including Tron’s Justin Sun, Dogecoin’s Elon Musk, and the Gemini brothers.

Trump’s crypto-friendly stance is seen as a positive sign for the market.

Trump’s crypto-friendly stance is seen as a positive sign for the market.

The Crypto Bull Cycle Continues

The cryptocurrency market is currently experiencing a macro bull cycle, triggered by the fourth Bitcoin halving earlier this year. Until Bitcoin consistently trades above $73,000, the market is expected to consolidate. However, the anticipated approval of spot Ethereum ETFs, coupled with potential U.S. interest rate cuts later this year, could catalyze the next phase of the crypto bull run.

The fourth Bitcoin halving has triggered a macro bull cycle in the crypto market.

The fourth Bitcoin halving has triggered a macro bull cycle in the crypto market.

In conclusion, the recent surge in the crypto market is driven by a combination of factors, including growing demand for digital assets, increased whale activity, and a favorable regulatory landscape. As the market continues to consolidate, investors are eagerly anticipating the next phase of the crypto bull run.