The Future of Crypto ETFs: A $450 Billion Market on the Horizon

The world of cryptocurrency is on the cusp of a major breakthrough, with the bitcoin and ether ETF markets expected to grow to a staggering $450 billion in the next two years. According to a recent report by Bernstein, this surge in growth will be fueled by inflows of over $100 billion into crypto ETFs.

The rise of bitcoin ETFs is set to revolutionize the crypto market.

The rise of bitcoin ETFs is set to revolutionize the crypto market.

The report suggests that the U.S. approval of an ether spot ETF has positive implications for rival tokens like solana, which could benefit from the precedent set by ether’s classification as a commodity rather than a security. This development has significant implications for the future of cryptocurrency and could pave the way for other blockchain tokens to follow in ether’s footsteps.

Ether’s classification as a commodity has far-reaching implications for the crypto market.

Ether’s classification as a commodity has far-reaching implications for the crypto market.

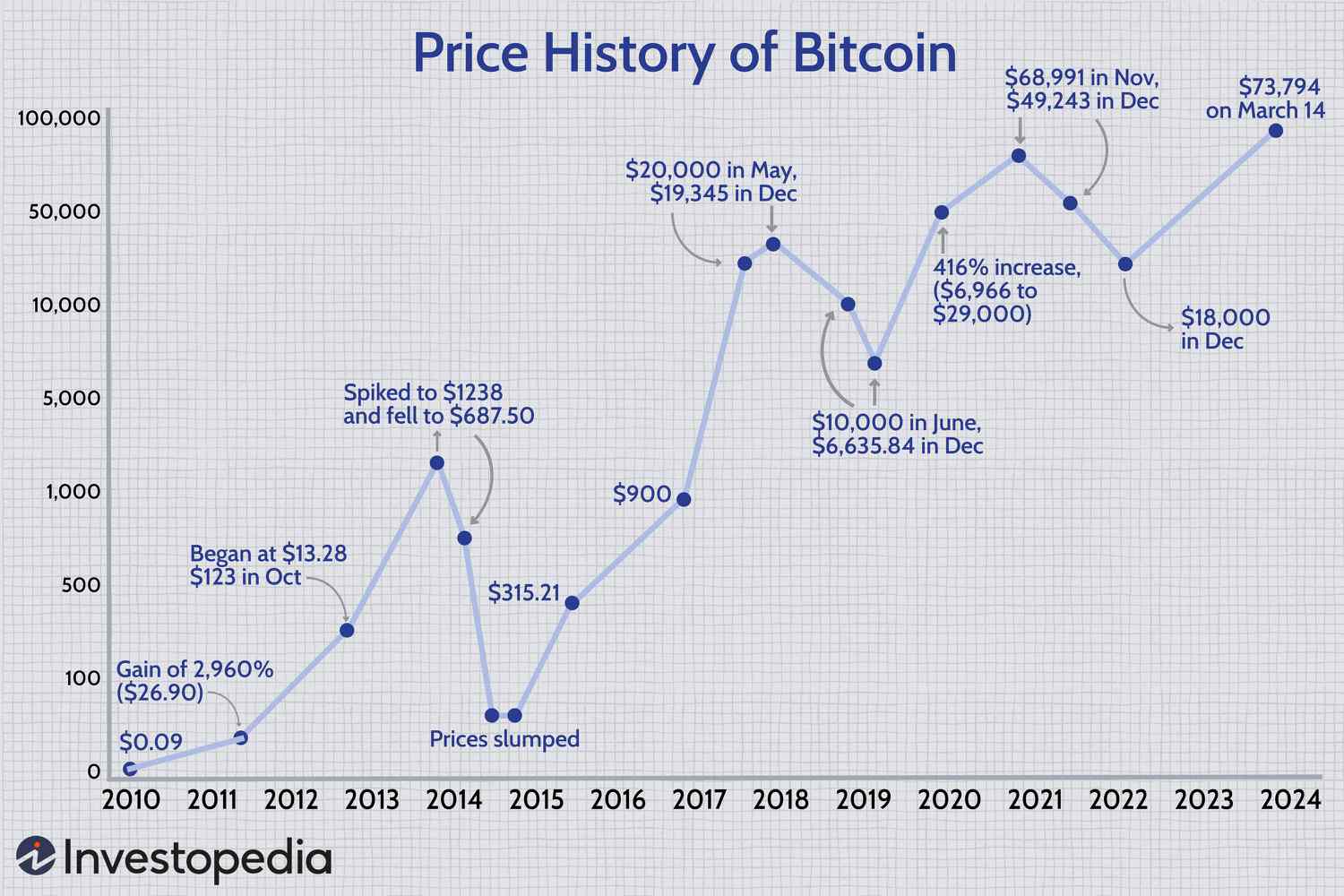

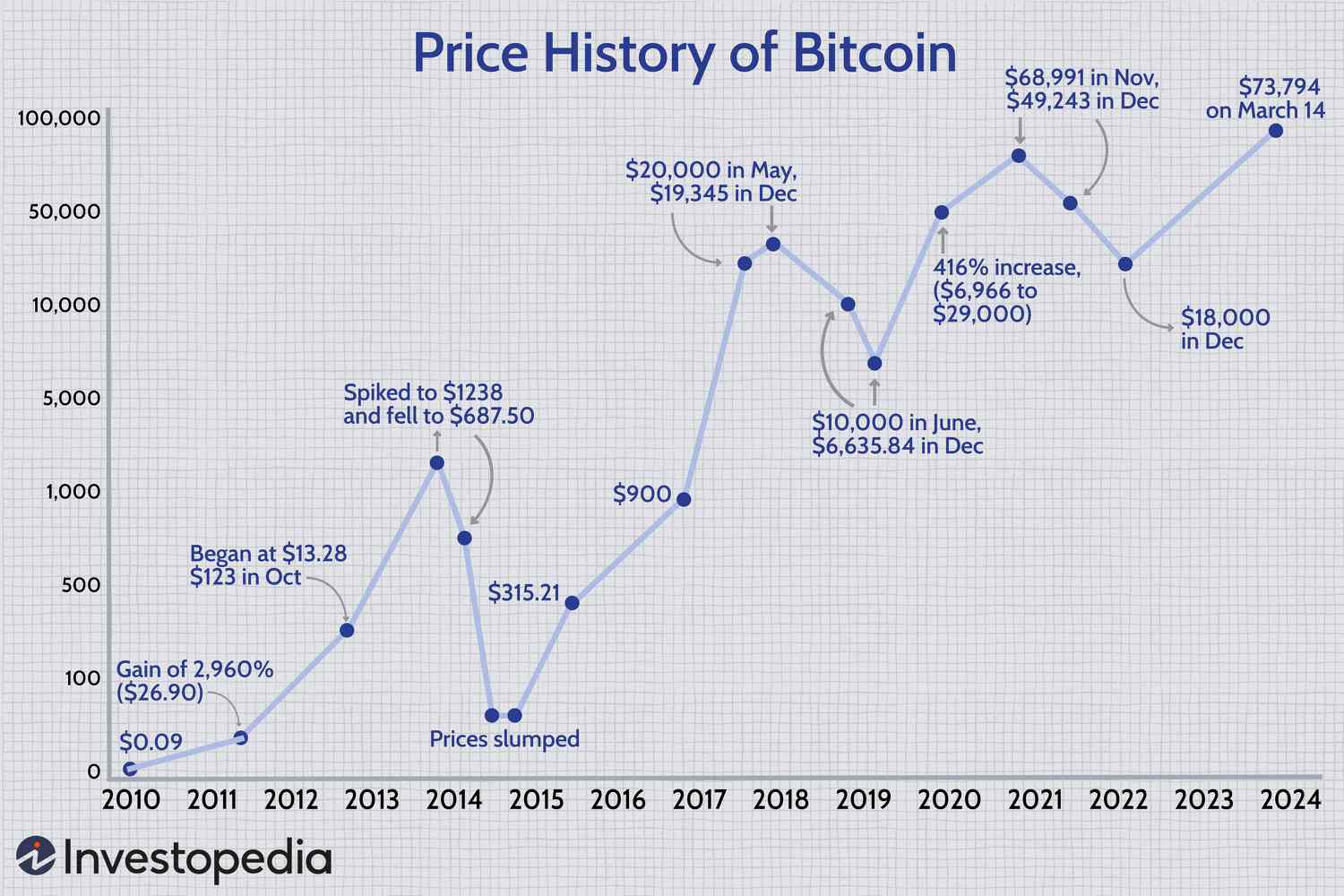

The broker predicts a bitcoin cycle high of $150,000 in 2025, with a year-end price target of $90,000. This optimistic forecast is based on the growing popularity of crypto ETFs, which are expected to attract a significant influx of investors in the coming years.

Bitcoin’s price is expected to soar in the coming years.

Bitcoin’s price is expected to soar in the coming years.

The approval of ether ETFs has also sparked a surge in interest in solana, which could benefit from the precedent set by ether. As the crypto market continues to evolve, it’s clear that ETFs will play a major role in shaping its future.

Solana could be the next big beneficiary of the crypto ETF boom.

Solana could be the next big beneficiary of the crypto ETF boom.

In conclusion, the future of crypto ETFs looks brighter than ever, with a $450 billion market on the horizon. As the market continues to grow and evolve, one thing is clear: crypto ETFs are here to stay.

The future of crypto ETFs is looking brighter than ever.

The future of crypto ETFs is looking brighter than ever.