Corporate Bitcoin Purchases: A Growing Trend in the Financial Landscape

The world of cryptocurrency is witnessing a significant shift as corporate interest in Bitcoin continues to grow, posing profound implications for the broader financial ecosystem. In this article, we explore the motivations for corporate Bitcoin acquisitions and examine the market’s reaction.

MicroStrategy’s Pioneering Move

The pivot began with MicroStrategy’s landmark purchase of 21,454 BTC for $250 million in August 2020, a move that marked a watershed moment for non-crypto enterprises. This aggressive strategy culminated in total Bitcoin holdings of 214,400 BTC by April 2023, positioning the firm at the forefront of Bitcoin adoption among corporations. MicroStrategy’s actions underscored a shifting perception of Bitcoin—it is increasingly viewed as a hedge against inflation and a reliable store of value.

Growing corporate interest in Bitcoin

Growing corporate interest in Bitcoin

The Expanding Circle of Corporate Investors

MicroStrategy’s foray into the cryptocurrency market has inspired a plethora of other companies to follow suit. Recent entrants, such as Semler Scientific, which recently disclosed its own Bitcoin purchase, reflect a growing trend wherein diverse industries, beyond technology, are acknowledging the value of digital currencies. This expanding circle of corporate investors is shaping a narrative that endorses Bitcoin as a legitimate asset class, blending blockchain technology with traditional finance.

Bitcoin’s Increasing Legitimacy

As notable corporations continue to integrate Bitcoin into their treasuries, the significance of this trend cannot be understated. It signals a broader acceptance of Bitcoin and digital assets within the established financial sphere. The implications are profound: the more corporations invest in Bitcoin, the more widespread it becomes, which could convincingly pave the way for further institutional adoption.

“As corporations increasingly add Bitcoin to their balance sheets, it augments its legitimacy and encourages smaller investors to take the plunge.”

Companies analyzing Bitcoin strategies

Companies analyzing Bitcoin strategies

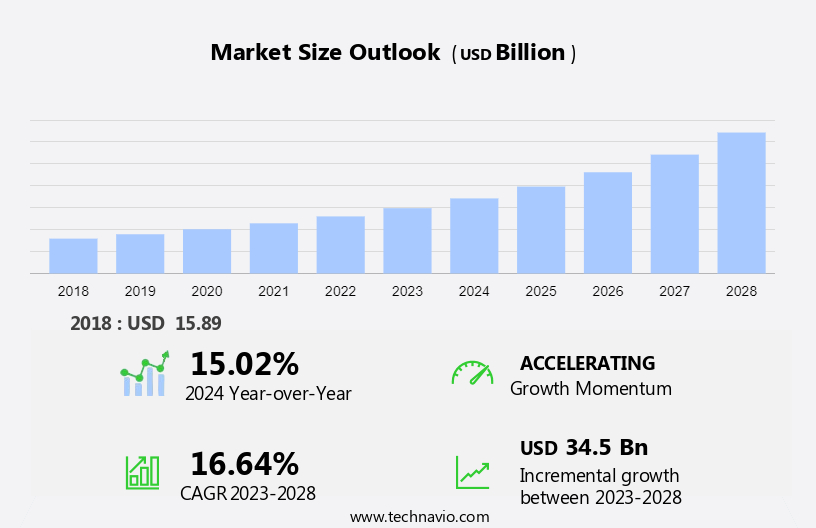

Market Reactions and Future Outlook

The market has responded vibrantly to corporate purchases, demonstrating increased volatility in Bitcoin’s trading patterns alongside surges in price following major acquisitions. This reaction has led some analysts to speculate on the potential for Bitcoin’s price appreciation, fueled by the influx of capital from corporate investors. As more large enterprises recognize Bitcoin as a viable investment, it stands to reason that overall market sentiment will evolve, further pushing Bitcoin into the mainstream financial landscape.

A New Era for Bitcoin?

The trend of corporate Bitcoin purchases transcends individual companies. It marks a momentous shift wherein Bitcoin is gradually emerging as a cornerstone of the mainstream financial infrastructure. Each transaction represents not just an investment but also an endorsement of Bitcoin’s viability in today’s economic landscape. This shift could lead to a domino effect in the eventual mainstream adoption of cryptocurrencies across various sectors.

Anticipating the future of Bitcoin in corporate finance

Anticipating the future of Bitcoin in corporate finance

Conclusion

As the momentum of corporate Bitcoin adoption builds, its long-term implications for the finance sector remain to be fully realized. With giants like MicroStrategy setting the stage, and other companies like Semler Scientific following suit, the doors for continued legitimization and adoption of Bitcoin are being opened. The journey toward acceptance within traditional finance is fraught with challenges, but the engaging narrative of corporate Bitcoin purchases compellingly demonstrates that Bitcoin is charting its course within the annals of global finance, poised for further expansion and recognition.

For updates on these developments, explore more about Bitcoin companies and their strategies on platforms like CryptoSlate.