Options Traders Cast a Bullish Outlook for Bitcoin in October

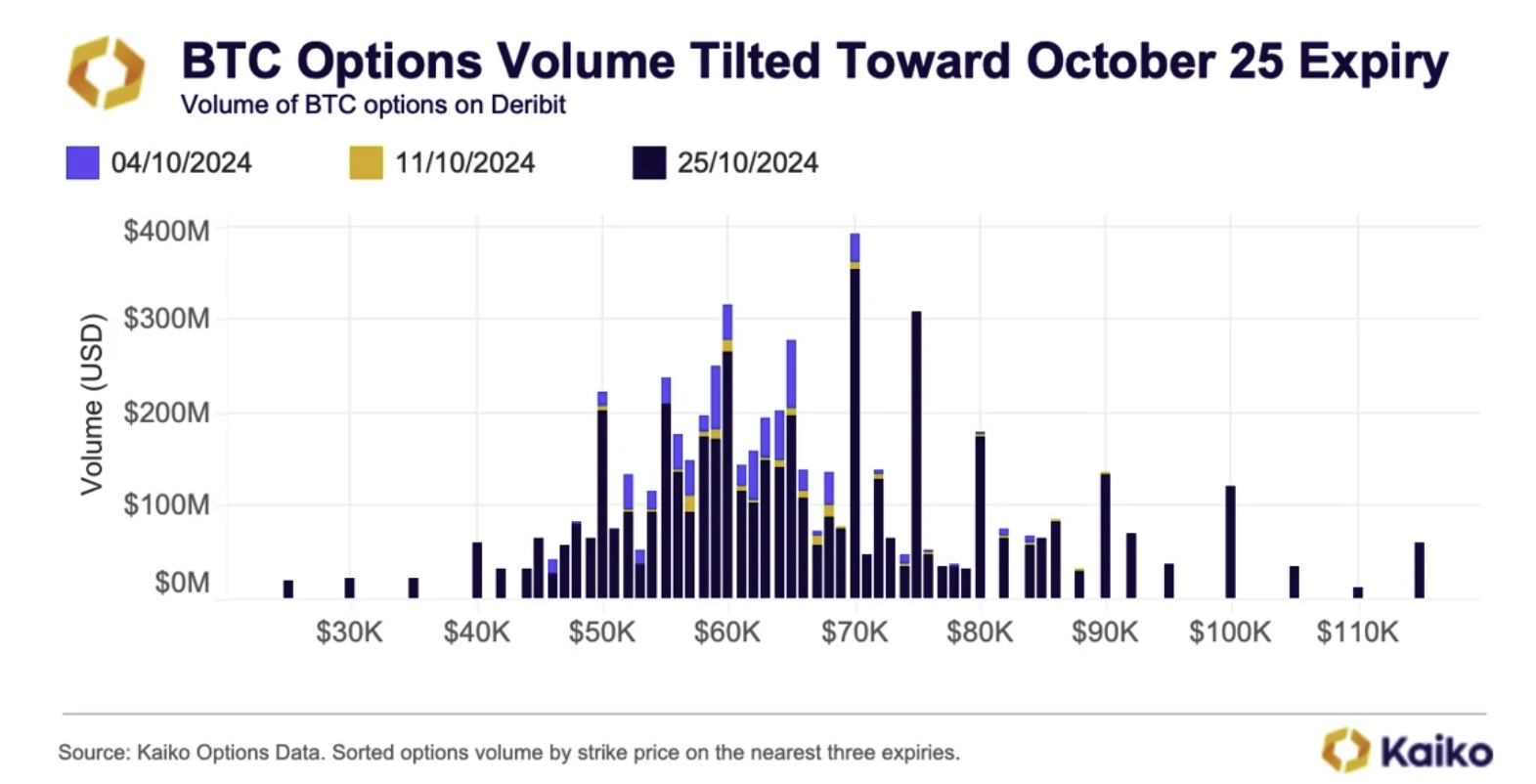

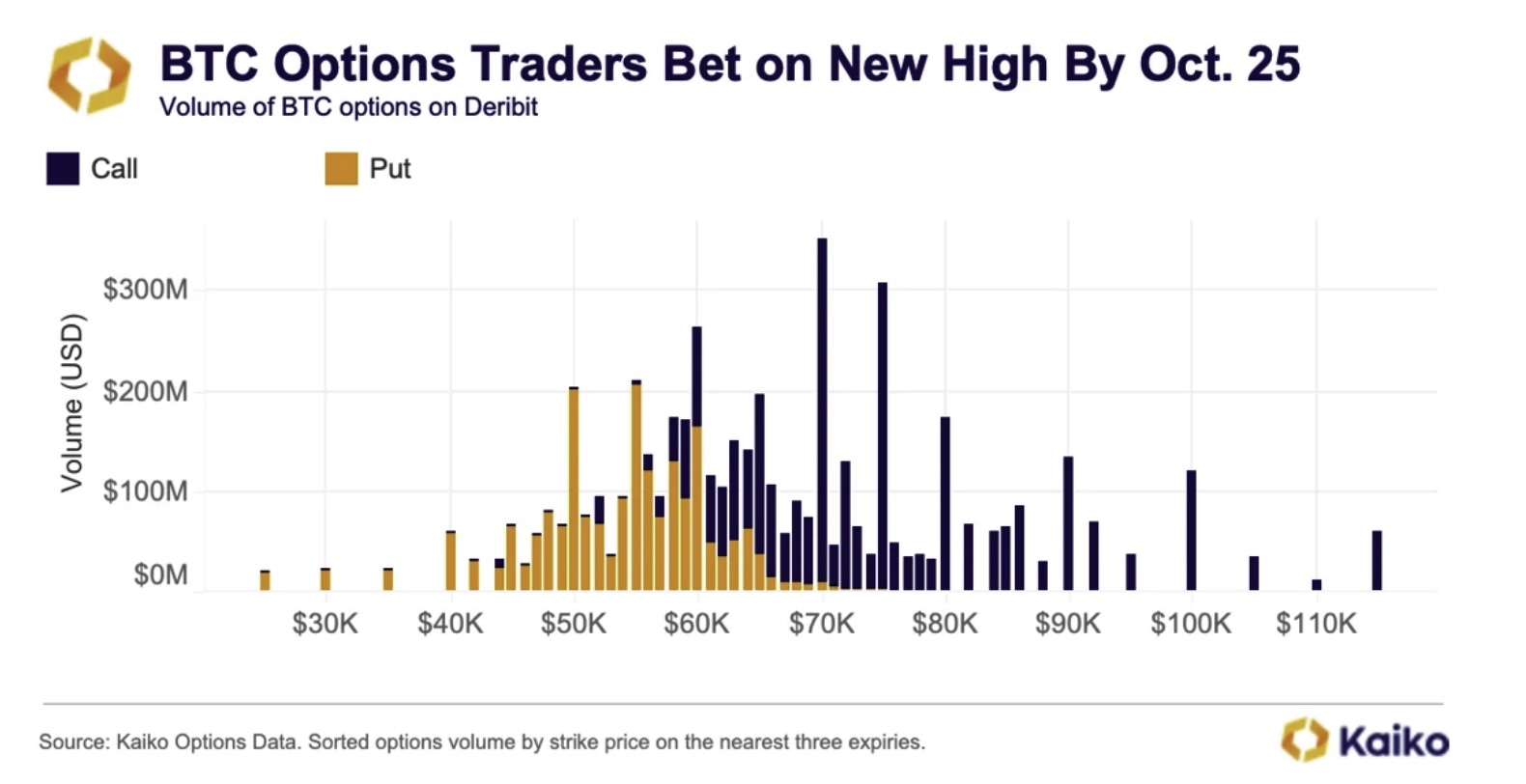

Recent analytics from Kaiko Research reveal a surge in bullish sentiments among options traders regarding Bitcoin’s performance this month. The analysis indicates a significant commitment of hundreds of millions of dollars on the Deribit platform, with many expecting Bitcoin to reclaim its previous $70,000 highs.

“Options volumes have increased over the past few weeks as markets shift to a risk-on mindset. Traders are positioning themselves to capture upside price movements ahead of what is historically BTC’s best trading month. BTC’s price has only ended October down twice since 2013.”

This optimistic sentiment is buoyed by historical data showcasing October as traditionally one of the most lucrative months for Bitcoin holders. Notably, current trading volumes are heavily concentrated on options set to expire at the end of the month, diverting attention away from the more typical front-month contracts that usually dominate trading liquidity.

Options trading has ramped up significantly as traders eagerly anticipate price movements.

Options trading has ramped up significantly as traders eagerly anticipate price movements.

New Macroeconomic Landscapes Alter Trading Decisions

Kaiko’s report highlights additional factors amplifying this bullish sentiment. The timing coincides with the U.S. Federal Reserve’s recent announcement of a rate-cutting cycle, a move that has already begun to uplift risk-on investments across financial markets. According to the analytics firm, the Fed’s aggressive monetary policy shift has sparked considerable interest in Bitcoin options, particularly with speculative trades on December contracts soaring as investors bet on Bitcoin surpassing $100,000.

“What hasn’t shown up in the markets yet is the effect of cheaper dollars and the eventual easing of the Fed’s quantitative tightening measures, which removed liquidity. Global liquidity lags the markets, so the effects of the Fed’s easing cycle will take longer to appear.”

In essence, traders are not only reacting to current market trends but are also anticipating long-term economic stability when it comes to investing in Bitcoin and other cryptocurrencies.

Current Market Dynamics

As of the latest figures, Bitcoin is priced at approximately $61,026, representing a minor decrease of 3.9% in the past 24 hours. This fluctuation underlines the unpredictable nature of the cryptocurrency market, where awareness of macroeconomic conditions plays a crucial role in traders’ strategic positioning.

Market dynamics continue to shift as traders evaluate emerging opportunities.

Market dynamics continue to shift as traders evaluate emerging opportunities.

Conclusion: A Month of High Hopes

The current buzz in the options trading space suggests that October could indeed be a critical month for Bitcoin. With the historic propensity for upward movements and favorable macroeconomic indicators, traders seem poised to take full advantage of the unfolding opportunities, reinforcing Bitcoin’s status as a resilient player in the financial markets.

For those intrigued by the evolving landscape of cryptocurrency trading, it will be essential to follow the developments closely, as the markets shift in response to these optimistic projections.

Don’t Miss a Beat – Stay updated with the latest in crypto. Subscribe for email alerts delivered directly to your inbox. Follow us on Telegram and click here for live price action.